Biodiversity credits quantify specific ecosystem services to incentivize conservation efforts through market mechanisms, while natural capital encompasses the broader economic value of all ecological assets and their contributions to human well-being. Understanding the distinctions between these concepts is essential for integrating environmental sustainability into economic planning and investment strategies. Explore these frameworks further to discover how they drive innovative solutions for preserving biodiversity and enhancing natural resource management.

Why it is important

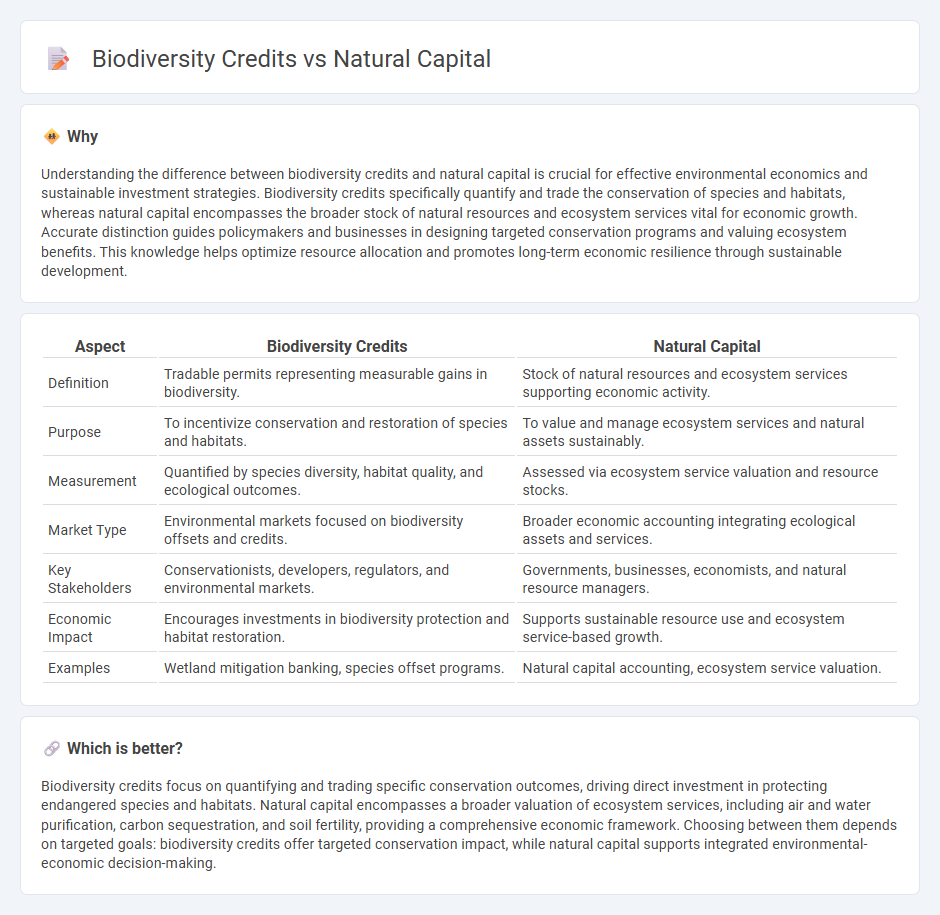

Understanding the difference between biodiversity credits and natural capital is crucial for effective environmental economics and sustainable investment strategies. Biodiversity credits specifically quantify and trade the conservation of species and habitats, whereas natural capital encompasses the broader stock of natural resources and ecosystem services vital for economic growth. Accurate distinction guides policymakers and businesses in designing targeted conservation programs and valuing ecosystem benefits. This knowledge helps optimize resource allocation and promotes long-term economic resilience through sustainable development.

Comparison Table

| Aspect | Biodiversity Credits | Natural Capital |

|---|---|---|

| Definition | Tradable permits representing measurable gains in biodiversity. | Stock of natural resources and ecosystem services supporting economic activity. |

| Purpose | To incentivize conservation and restoration of species and habitats. | To value and manage ecosystem services and natural assets sustainably. |

| Measurement | Quantified by species diversity, habitat quality, and ecological outcomes. | Assessed via ecosystem service valuation and resource stocks. |

| Market Type | Environmental markets focused on biodiversity offsets and credits. | Broader economic accounting integrating ecological assets and services. |

| Key Stakeholders | Conservationists, developers, regulators, and environmental markets. | Governments, businesses, economists, and natural resource managers. |

| Economic Impact | Encourages investments in biodiversity protection and habitat restoration. | Supports sustainable resource use and ecosystem service-based growth. |

| Examples | Wetland mitigation banking, species offset programs. | Natural capital accounting, ecosystem service valuation. |

Which is better?

Biodiversity credits focus on quantifying and trading specific conservation outcomes, driving direct investment in protecting endangered species and habitats. Natural capital encompasses a broader valuation of ecosystem services, including air and water purification, carbon sequestration, and soil fertility, providing a comprehensive economic framework. Choosing between them depends on targeted goals: biodiversity credits offer targeted conservation impact, while natural capital supports integrated environmental-economic decision-making.

Connection

Biodiversity credits represent tradable assets linked to the conservation and restoration of ecosystems, directly quantifying the value of natural capital, which encompasses the stock of natural resources and ecosystem services. By assigning economic value to biodiversity, these credits incentivize sustainable practices and integrate ecological health into financial markets. This mechanism enhances the recognition of biodiversity as a vital component of natural capital, driving investment toward environmental preservation and economic resilience.

Key Terms

Ecosystem Services

Natural capital credits quantify the economic value of ecosystem services such as carbon sequestration, water filtration, and soil fertility, enabling investment in sustainable resource management. Biodiversity credits specifically target the preservation and restoration of species and habitats, promoting genetic diversity and ecosystem resilience. Explore in-depth how these credit systems drive environmental conservation and sustainable development.

Valuation

Natural capital valuation quantifies the economic benefits derived from ecosystems, including air and water purification, carbon sequestration, and recreational opportunities. Biodiversity credits specifically assign monetary value to conserving species diversity and habitat preservation, often linked to regulatory frameworks and market mechanisms. Explore how integrating both valuation approaches can enhance sustainable environmental investments.

Tradable Instruments

Natural capital credits represent tradable instruments tied to the value of ecosystems and the services they provide, enabling businesses to invest in conservation and sustainable resource management. Biodiversity credits specifically quantify measurable units of biodiversity conservation, allowing companies to offset environmental impacts through regulated or voluntary markets. Explore how these tradable instruments are shaping ecosystem finance and corporate sustainability strategies.

Source and External Links

Natural capital - Wikipedia - Natural capital is the world's stock of natural resources including geology, soils, air, water, and all living organisms, which provide ecosystem services essential for human life and underpin the economy and society by enabling the production of goods and services.

What's Natural Capital and Why Does It Matter to Investors? - Natural capital includes assets like freshwater, oceans, land, biodiversity, and climate that support ecosystem services, which are crucial inputs for economic value creation and assessing business risks related to nature loss.

What is natural capital? A guide to natural capital | IFAW - Natural capital refers to the world's supply of invaluable natural assets such as water, soil, air, and trees, which provide goods and biological processes benefiting society, and its preservation is key for environmental sustainability and economic prosperity.

dowidth.com

dowidth.com