Greedflation occurs when rising prices are driven by companies increasing profit margins rather than just higher costs, contrasting with supply shocks that cause price hikes due to sudden shortages or disruptions in production. Understanding the interplay between greedflation and supply shocks is essential for analyzing inflation dynamics and formulating effective economic policies. Discover more about how these factors impact global markets and consumer prices.

Why it is important

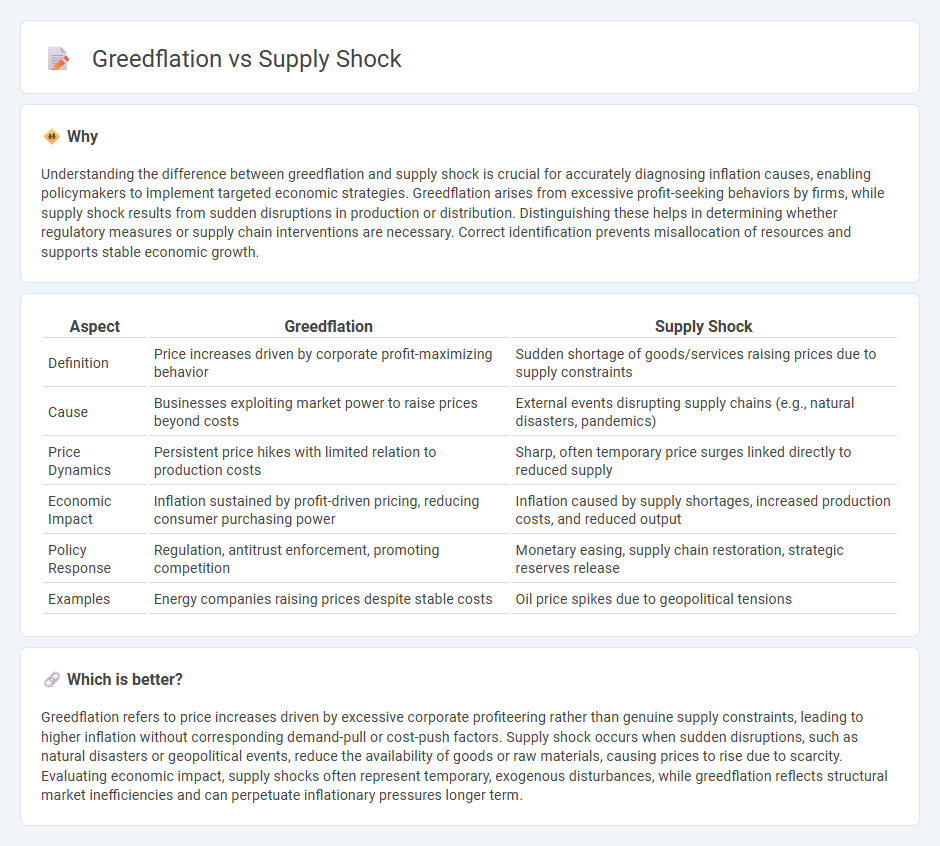

Understanding the difference between greedflation and supply shock is crucial for accurately diagnosing inflation causes, enabling policymakers to implement targeted economic strategies. Greedflation arises from excessive profit-seeking behaviors by firms, while supply shock results from sudden disruptions in production or distribution. Distinguishing these helps in determining whether regulatory measures or supply chain interventions are necessary. Correct identification prevents misallocation of resources and supports stable economic growth.

Comparison Table

| Aspect | Greedflation | Supply Shock |

|---|---|---|

| Definition | Price increases driven by corporate profit-maximizing behavior | Sudden shortage of goods/services raising prices due to supply constraints |

| Cause | Businesses exploiting market power to raise prices beyond costs | External events disrupting supply chains (e.g., natural disasters, pandemics) |

| Price Dynamics | Persistent price hikes with limited relation to production costs | Sharp, often temporary price surges linked directly to reduced supply |

| Economic Impact | Inflation sustained by profit-driven pricing, reducing consumer purchasing power | Inflation caused by supply shortages, increased production costs, and reduced output |

| Policy Response | Regulation, antitrust enforcement, promoting competition | Monetary easing, supply chain restoration, strategic reserves release |

| Examples | Energy companies raising prices despite stable costs | Oil price spikes due to geopolitical tensions |

Which is better?

Greedflation refers to price increases driven by excessive corporate profiteering rather than genuine supply constraints, leading to higher inflation without corresponding demand-pull or cost-push factors. Supply shock occurs when sudden disruptions, such as natural disasters or geopolitical events, reduce the availability of goods or raw materials, causing prices to rise due to scarcity. Evaluating economic impact, supply shocks often represent temporary, exogenous disturbances, while greedflation reflects structural market inefficiencies and can perpetuate inflationary pressures longer term.

Connection

Greedflation and supply shocks are interconnected as supply disruptions lead to scarcity, allowing producers to raise prices disproportionately, fueling greedflation. Supply shocks reduce the availability of goods, increasing production costs and enabling firms to capitalize on limited supply by charging higher profits. This dynamic intensifies inflationary pressures beyond what traditional demand-pull factors would cause, complicating economic stability.

Key Terms

Aggregate Supply

Supply shocks disrupt aggregate supply by causing sudden reductions in production capacity or input availability, leading to increased prices and lower output. Greedflation occurs when firms exploit market power to raise prices above cost increases, impacting aggregate supply less directly but distorting price signals and output incentives. Explore how these distinct mechanisms influence inflation dynamics and economic policy responses.

Price Levels

Supply shocks directly impact price levels by causing sudden shortages or surpluses of goods, leading to rapid inflation or deflation based on availability disruptions. Greedflation refers to price increases driven primarily by companies exploiting market power to raise markups beyond cost changes, sustaining elevated price levels even without supply constraints. Explore how these distinct drivers influence inflation dynamics and affect overall economic stability by learning more about their mechanisms and effects.

Market Power

Supply shock occurs when sudden disruptions in production or logistics reduce the availability of goods, causing prices to spike due to scarcity. Greedflation stems from firms with significant market power exploiting supply constraints to increase prices beyond cost-driven levels. Explore how market power influences inflation dynamics to understand the interplay between supply shocks and greedflation.

Source and External Links

Positive vs. Negative Supply Shocks | Definition & Examples - A supply shock is a drastic change in the availability of a product in the marketplace, shifting the supply curve either positively (increasing supply, lowering prices, raising output) or negatively (decreasing supply, raising prices, lowering output and employment).

Supply shock - A supply shock is an event that suddenly changes the supply of a commodity or service, affecting prices and output; negative shocks can cause stagflation by raising prices and lowering production, while positive shocks increase output and reduce prices.

Supply Shocks | Microeconomics - Negative supply shocks reduce supply (shifting supply curve left), causing excess demand and price increases, whereas positive shocks increase supply and lower prices.

dowidth.com

dowidth.com