Dollarization occurs when a country adopts a foreign currency, typically the US dollar, to stabilize its economy, control inflation, and attract investment. De-dollarization involves efforts to reduce reliance on foreign currency, promote the national currency, and regain monetary policy autonomy. Explore the impacts and strategies behind dollarization and de-dollarization to understand their roles in economic stability.

Why it is important

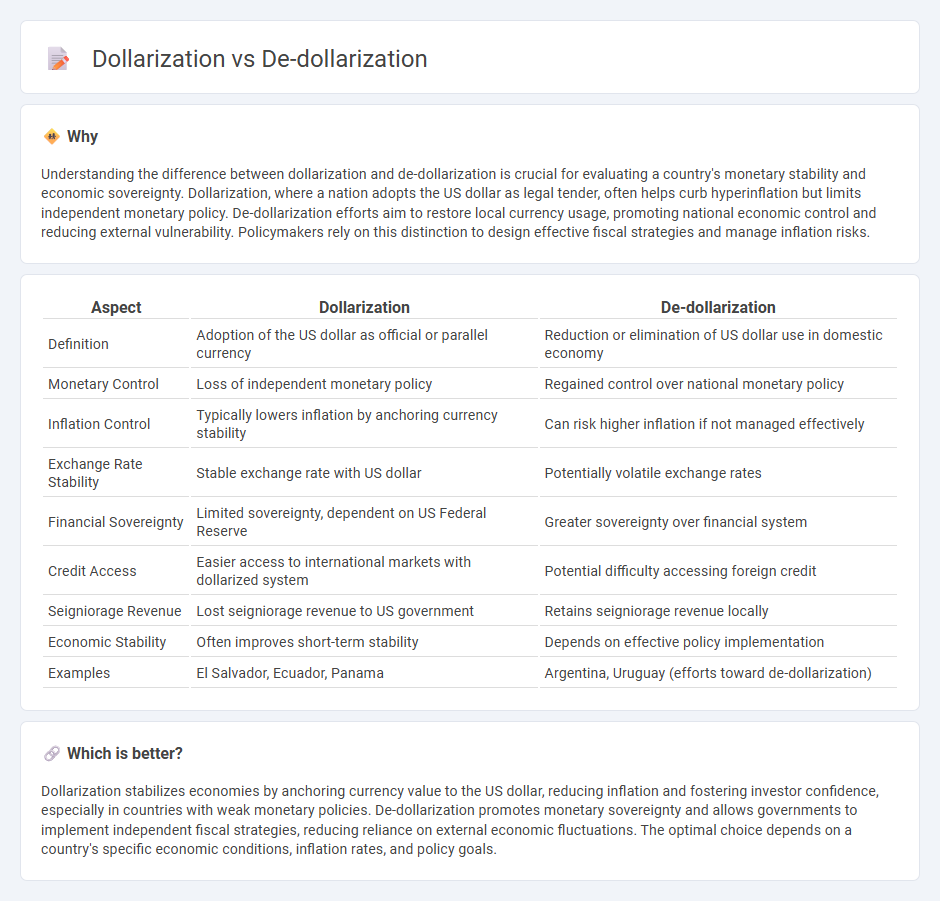

Understanding the difference between dollarization and de-dollarization is crucial for evaluating a country's monetary stability and economic sovereignty. Dollarization, where a nation adopts the US dollar as legal tender, often helps curb hyperinflation but limits independent monetary policy. De-dollarization efforts aim to restore local currency usage, promoting national economic control and reducing external vulnerability. Policymakers rely on this distinction to design effective fiscal strategies and manage inflation risks.

Comparison Table

| Aspect | Dollarization | De-dollarization |

|---|---|---|

| Definition | Adoption of the US dollar as official or parallel currency | Reduction or elimination of US dollar use in domestic economy |

| Monetary Control | Loss of independent monetary policy | Regained control over national monetary policy |

| Inflation Control | Typically lowers inflation by anchoring currency stability | Can risk higher inflation if not managed effectively |

| Exchange Rate Stability | Stable exchange rate with US dollar | Potentially volatile exchange rates |

| Financial Sovereignty | Limited sovereignty, dependent on US Federal Reserve | Greater sovereignty over financial system |

| Credit Access | Easier access to international markets with dollarized system | Potential difficulty accessing foreign credit |

| Seigniorage Revenue | Lost seigniorage revenue to US government | Retains seigniorage revenue locally |

| Economic Stability | Often improves short-term stability | Depends on effective policy implementation |

| Examples | El Salvador, Ecuador, Panama | Argentina, Uruguay (efforts toward de-dollarization) |

Which is better?

Dollarization stabilizes economies by anchoring currency value to the US dollar, reducing inflation and fostering investor confidence, especially in countries with weak monetary policies. De-dollarization promotes monetary sovereignty and allows governments to implement independent fiscal strategies, reducing reliance on external economic fluctuations. The optimal choice depends on a country's specific economic conditions, inflation rates, and policy goals.

Connection

Dollarization increases economic stability by allowing countries to adopt the US dollar, reducing currency risk and inflation, but it limits monetary policy autonomy. De-dollarization efforts aim to restore control over national currencies and monetary policies, seeking to boost economic sovereignty and address vulnerabilities linked to reliance on a foreign currency. The connection between dollarization and de-dollarization lies in balancing economic stability with monetary independence to manage inflation, exchange rates, and economic growth effectively.

Key Terms

Reserve Currency

De-dollarization involves countries reducing reliance on the US dollar as their reserve currency to diversify risks and enhance monetary sovereignty, while dollarization refers to adopting the US dollar officially or unofficially to stabilize the economy and attract foreign investment. Key drivers of de-dollarization include geopolitical tensions, sanctions, and the pursuit of alternative reserve assets like the euro, yuan, or gold. Explore in-depth analysis and latest trends on how shifting reserve currency dynamics reshape global financial stability.

Exchange Rate Regime

De-dollarization involves shifting economies away from reliance on the US dollar, promoting local currencies to stabilize the exchange rate regime and reduce vulnerability to external shocks. In contrast, dollarization occurs when countries adopt the US dollar officially or unofficially, often to combat hyperinflation and stabilize volatile exchange rates. Explore detailed comparisons on how these strategies impact exchange rate regimes and economic stability in various countries.

Capital Flows

Capital flows under de-dollarization typically shift towards domestic currencies, reducing reliance on the US dollar and limiting exposure to dollar-induced volatility in emerging markets. Dollarization encourages foreign investment by offering stability and liquidity through the US dollar, facilitating cross-border capital movement but increasing vulnerability to US monetary policy changes. Explore the dynamics of capital flows in these contrasting monetary regimes to understand their impact on financial stability and economic growth.

Source and External Links

Navigating the Tides of De-dollarization: Impact on Global Economy - De-dollarization is a strategic move by countries to reduce reliance on the US dollar by diversifying reserves, promoting alternative currencies like the yuan and euro, and developing new payment systems to decrease vulnerability to US monetary and political decisions.

Dedollarisation - Wikipedia - Dedollarization refers to nations decreasing their use of the US dollar as a reserve currency, medium of exchange, or unit of account, often seeking to create alternative financial systems to gain economic independence from Western-dominated infrastructure like SWIFT.

De-dollarization: The end of dollar dominance? - J.P. Morgan - De-dollarization involves a structural reduction in the global use of the US dollar for trade and finance, reflecting broader geopolitical shifts and raising questions about the future of dollar hegemony in international markets.

dowidth.com

dowidth.com