Doom spending describes impulsive, emotionally driven purchases often triggered by stress or uncertainty, leading to financial strain and reduced savings. Conscious spending emphasizes mindful budgeting, prioritizing essential needs, and long-term financial goals to enhance economic stability and personal well-being. Explore strategies to balance immediate desires with sustainable financial health.

Why it is important

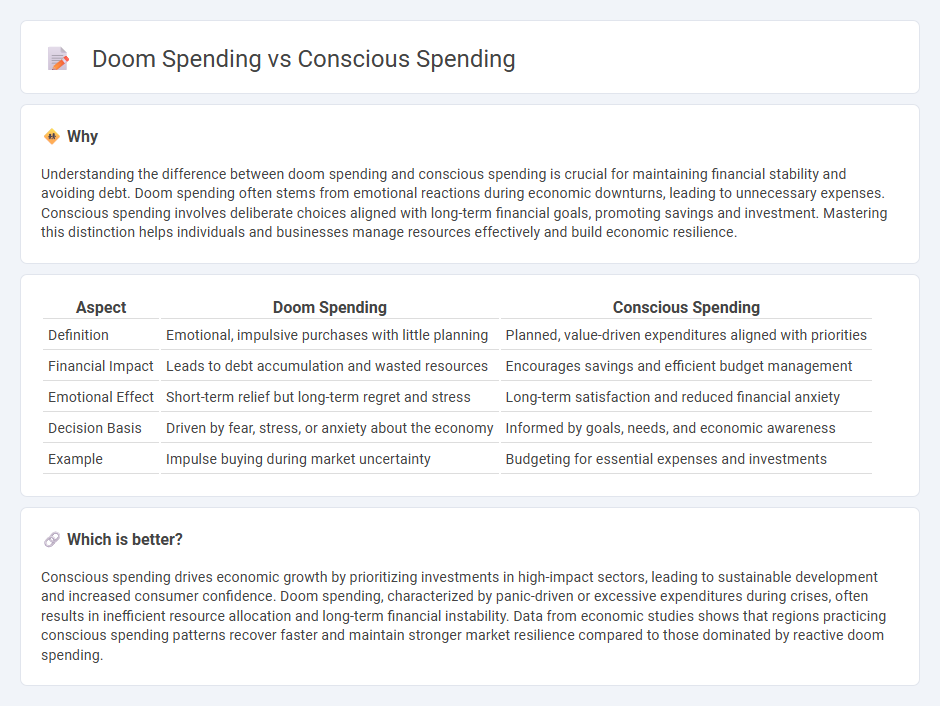

Understanding the difference between doom spending and conscious spending is crucial for maintaining financial stability and avoiding debt. Doom spending often stems from emotional reactions during economic downturns, leading to unnecessary expenses. Conscious spending involves deliberate choices aligned with long-term financial goals, promoting savings and investment. Mastering this distinction helps individuals and businesses manage resources effectively and build economic resilience.

Comparison Table

| Aspect | Doom Spending | Conscious Spending |

|---|---|---|

| Definition | Emotional, impulsive purchases with little planning | Planned, value-driven expenditures aligned with priorities |

| Financial Impact | Leads to debt accumulation and wasted resources | Encourages savings and efficient budget management |

| Emotional Effect | Short-term relief but long-term regret and stress | Long-term satisfaction and reduced financial anxiety |

| Decision Basis | Driven by fear, stress, or anxiety about the economy | Informed by goals, needs, and economic awareness |

| Example | Impulse buying during market uncertainty | Budgeting for essential expenses and investments |

Which is better?

Conscious spending drives economic growth by prioritizing investments in high-impact sectors, leading to sustainable development and increased consumer confidence. Doom spending, characterized by panic-driven or excessive expenditures during crises, often results in inefficient resource allocation and long-term financial instability. Data from economic studies shows that regions practicing conscious spending patterns recover faster and maintain stronger market resilience compared to those dominated by reactive doom spending.

Connection

Doom spending and conscious spending represent contrasting financial behaviors influenced by economic stress and financial awareness. Doom spending emerges from anxiety and uncertainty during economic downturns, leading to impulsive purchases as emotional coping mechanisms. Conscious spending involves deliberate budgeting and prioritization, promoting financial resilience and long-term economic stability.

Key Terms

Budgeting

Conscious spending involves deliberate allocation of funds aligned with personal values and long-term financial goals, optimizing budget efficiency. Doom spending, often driven by anxiety or stress, leads to impulsive purchases that disrupt financial stability and budget plans. Explore detailed strategies to master budgeting and shift from doom spending to conscious financial management.

Financial Psychology

Conscious spending involves intentional financial decisions aligned with personal values and long-term goals, while doom spending arises from emotional stress or crisis-driven impulses, often exacerbated by anxiety and fear. Financial psychology examines these behaviors by analyzing cognitive biases, emotional triggers, and the impact of mindset on money management habits. Explore deeper insights into how understanding these psychological patterns can transform your financial wellbeing.

Discretionary Income

Discretionary income, the portion of income left after essential expenses, plays a critical role in distinguishing conscious spending from doom spending. Conscious spending strategically allocates discretionary income towards fulfilling long-term goals and personal values, enhancing financial well-being. Explore effective ways to manage your discretionary income to master the art of conscious spending.

Source and External Links

Conscious Spending Basics (a guide to achieving your Rich Life) - Conscious spending is a personal and flexible money management approach that breaks spending into fixed costs, investments, savings, and guilt-free spending, focusing on what matters most rather than restricting purchases like traditional budgets do.

Conscious Spending Vs. Budgeting - DataDrivenInvestor - Conscious spending is a mindset to purposefully spend money aligned with your values, contrasting with traditional budgeting by emphasizing intentional choices over strict allocation or restriction.

Get your Conscious Spending Plan - The Conscious Spending Plan advocates saving and investing enough each month while allowing guilt-free spending on things that bring joy, shifting the focus from restriction to building a Rich Life today.

dowidth.com

dowidth.com