Slowbalisation reflects a deceleration in global economic integration, marked by reduced trade growth and supply chain diversification, contrasting with the rising multipolarity that sees economic power distributed among multiple influential nations such as China, the European Union, and the United States. This shift challenges traditional unipolar economic dominance and promotes regional trade agreements and localized production hubs. Explore further to understand how these trends reshape global economic stability and growth opportunities.

Why it is important

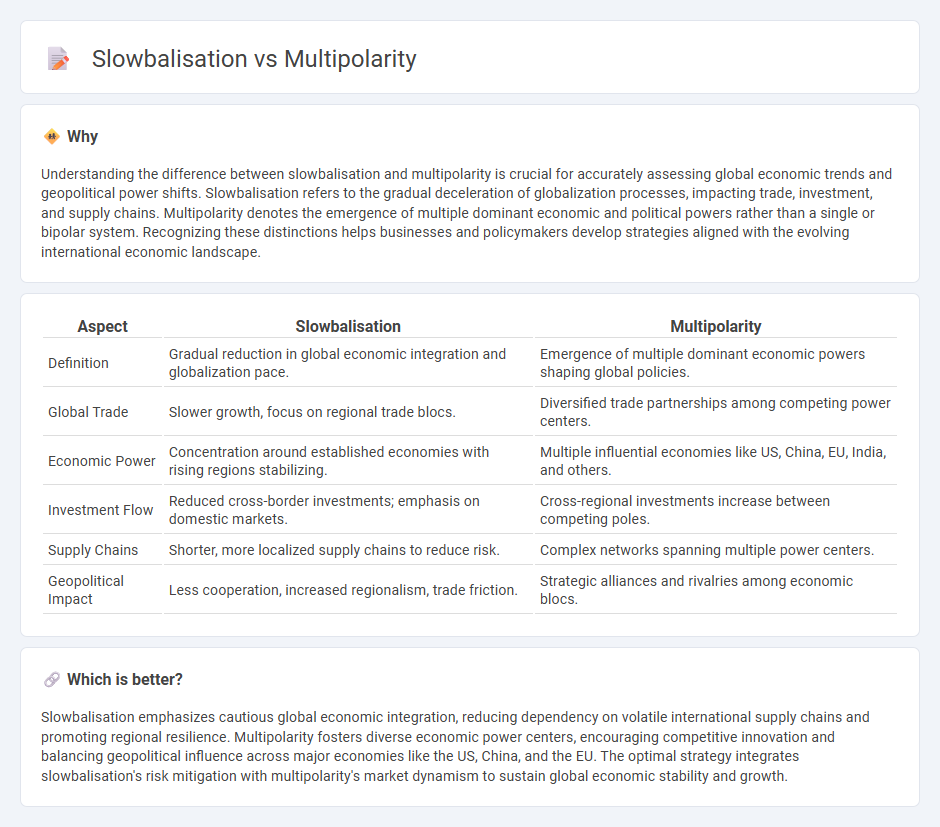

Understanding the difference between slowbalisation and multipolarity is crucial for accurately assessing global economic trends and geopolitical power shifts. Slowbalisation refers to the gradual deceleration of globalization processes, impacting trade, investment, and supply chains. Multipolarity denotes the emergence of multiple dominant economic and political powers rather than a single or bipolar system. Recognizing these distinctions helps businesses and policymakers develop strategies aligned with the evolving international economic landscape.

Comparison Table

| Aspect | Slowbalisation | Multipolarity |

|---|---|---|

| Definition | Gradual reduction in global economic integration and globalization pace. | Emergence of multiple dominant economic powers shaping global policies. |

| Global Trade | Slower growth, focus on regional trade blocs. | Diversified trade partnerships among competing power centers. |

| Economic Power | Concentration around established economies with rising regions stabilizing. | Multiple influential economies like US, China, EU, India, and others. |

| Investment Flow | Reduced cross-border investments; emphasis on domestic markets. | Cross-regional investments increase between competing poles. |

| Supply Chains | Shorter, more localized supply chains to reduce risk. | Complex networks spanning multiple power centers. |

| Geopolitical Impact | Less cooperation, increased regionalism, trade friction. | Strategic alliances and rivalries among economic blocs. |

Which is better?

Slowbalisation emphasizes cautious global economic integration, reducing dependency on volatile international supply chains and promoting regional resilience. Multipolarity fosters diverse economic power centers, encouraging competitive innovation and balancing geopolitical influence across major economies like the US, China, and the EU. The optimal strategy integrates slowbalisation's risk mitigation with multipolarity's market dynamism to sustain global economic stability and growth.

Connection

Slowbalisation reflects a deceleration in global economic integration, driven by rising protectionism and regional trade blocs. Multipolarity, characterized by the emergence of multiple influential economic powers like China, the EU, and the US, reinforces this trend by diversifying economic influence and reducing reliance on a unipolar global market. This interplay shapes a fragmented global economy where regional interests increasingly dictate trade and investment flows.

Key Terms

Global Value Chains

Multipolarity reshapes Global Value Chains (GVCs) by diversifying economic power among multiple influential countries, fostering regional supply networks and reducing reliance on a single dominant economy. Slowbalisation reflects a deceleration in global trade growth, prompting firms to prioritize resilience, reshoring, and regionalization within GVCs to mitigate risks from geopolitical tensions and disruptions. Explore how these dynamics influence strategic planning and innovation in international supply chain management.

Geopolitical Shifts

Geopolitical shifts are increasingly defined by multipolarity, where power is distributed among multiple global centers such as the US, China, the EU, and India, each asserting regional influence and strategic autonomy. This contrasts with slowbalisation, a trend characterized by the gradual deceleration of globalization due to rising protectionism, supply chain reconfiguration, and geopolitical tensions limiting cross-border economic integration. Explore how these dynamics reshape international relations and economic policies worldwide.

Trade Fragmentation

Trade fragmentation intensifies under multipolarity as emerging economic powers establish regional trade blocs, disrupting global supply chains and increasing tariff barriers. Slowbalization reflects a gradual decline in cross-border trade growth, driven by rising protectionism and shifts toward domestic production, resulting in more localized trade networks. Explore how these dynamics reshape international commerce and impact global market integration.

Source and External Links

The Politics Shed - Multipolarity - Google Sites - Multipolarity is an international system where three or more power centers exist, creating a fluid and unstable balance of power often increasing the risk of regional conflicts and global volatility according to realist theorists like John Mearsheimer.

Polarity (international relations) - Wikipedia - Multipolarity refers to a power distribution with more than two states having similar power, historically seen in periods such as the Concert of Europe, and is considered by classical realists as more stable but neorealists argue it tends to be unstable and conflict-prone due to alliance complexities.

In Defense of Multipolarity | Internationale Politik Quarterly - Multipolarity is a concept where several states or groups develop distinct rules and influence others through soft and hard power, seen as a desirable, if temporary, order given the disadvantages of bipolar bloc confrontation and challenges to a liberal rules-based global order.

dowidth.com

dowidth.com