Soft saving focuses on preserving wealth through low-risk assets that maintain purchasing power over time, while soft currency refers to a nation's money that experiences high inflation and depreciation, reducing its value in international markets. Countries with soft currencies often face challenges such as capital flight and reduced investor confidence, impacting economic stability. Explore further to understand how these concepts influence global financial strategies and economic policies.

Why it is important

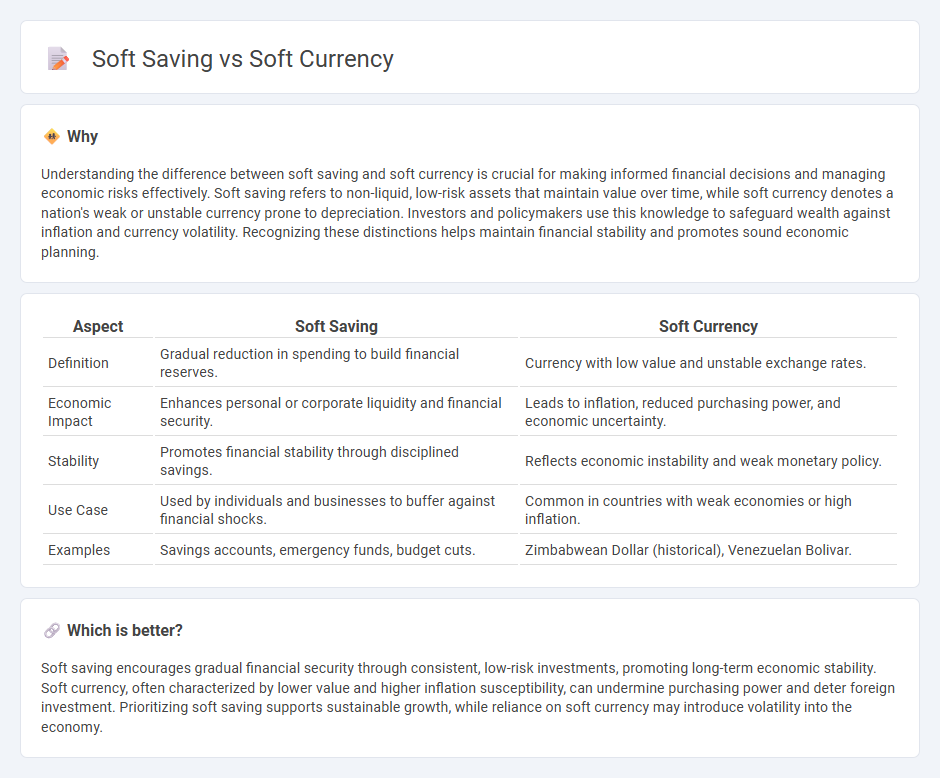

Understanding the difference between soft saving and soft currency is crucial for making informed financial decisions and managing economic risks effectively. Soft saving refers to non-liquid, low-risk assets that maintain value over time, while soft currency denotes a nation's weak or unstable currency prone to depreciation. Investors and policymakers use this knowledge to safeguard wealth against inflation and currency volatility. Recognizing these distinctions helps maintain financial stability and promotes sound economic planning.

Comparison Table

| Aspect | Soft Saving | Soft Currency |

|---|---|---|

| Definition | Gradual reduction in spending to build financial reserves. | Currency with low value and unstable exchange rates. |

| Economic Impact | Enhances personal or corporate liquidity and financial security. | Leads to inflation, reduced purchasing power, and economic uncertainty. |

| Stability | Promotes financial stability through disciplined savings. | Reflects economic instability and weak monetary policy. |

| Use Case | Used by individuals and businesses to buffer against financial shocks. | Common in countries with weak economies or high inflation. |

| Examples | Savings accounts, emergency funds, budget cuts. | Zimbabwean Dollar (historical), Venezuelan Bolivar. |

Which is better?

Soft saving encourages gradual financial security through consistent, low-risk investments, promoting long-term economic stability. Soft currency, often characterized by lower value and higher inflation susceptibility, can undermine purchasing power and deter foreign investment. Prioritizing soft saving supports sustainable growth, while reliance on soft currency may introduce volatility into the economy.

Connection

Soft saving refers to accumulating wealth through assets with lower volatility and risk, often denominated in soft currencies such as the US dollar or Euro. Soft currencies are prone to inflation and depreciation, affecting the real value of savings and influencing individuals' preference for converting soft savings into more stable or hard assets. The dynamic between soft saving and soft currency highlights the impact of currency stability on economic decisions and wealth preservation strategies.

Key Terms

Exchange Rate

Soft currency typically refers to a nation's money that is expected to depreciate or fluctuate significantly in the foreign exchange market, often due to economic instability or low demand. Soft saving emphasizes holding funds in assets or currencies that may not provide strong protection against exchange rate volatility, potentially eroding purchasing power over time. Explore further to understand how exchange rate dynamics impact financial strategies involving soft currency and soft saving.

Inflation

Soft currency refers to a nation's money that is prone to depreciation and lacks stability in foreign exchange markets, often losing value rapidly during inflationary periods. Soft saving involves holding assets with lower purchasing power preservation, making them vulnerable to erosion from inflation's impact on real returns. Explore how inflation influences the value of soft currencies and the effectiveness of soft savings strategies for better financial planning.

Purchasing Power

Soft currency refers to a national currency that lacks strong international demand and depreciates frequently, leading to diminished purchasing power domestically and abroad. Soft saving implies storing wealth in assets or currencies prone to value erosion, diminishing future purchasing power due to inflation or market volatility. Explore how managing soft currency and soft saving impacts purchasing power stability for financial security.

Source and External Links

What is soft currency? Simple Definition & Meaning - LSD.Law - A soft currency is a type of money not backed by reserves, making its value prone to rapid and unpredictable changes, exemplified by unstable currencies like the Zimbabwean dollar and Venezuelan bolivar.

What Is Soft Money? - Bitcoin Magazine - Soft currency (or soft money) refers to government-regulated money not backed by tangible commodities, often associated with weak economies, inflation, or political instability, contrasting with hard money which is physically scarce or hard coded.

Hard Currency - Overview, Factors, Examples, Comparison - Soft currency is described as unstable, often unconvertible, highly fluctuating, and depreciating due to factors like inflation, war, and political turmoil, unlike hard currency which is stable and globally accepted.

dowidth.com

dowidth.com