Shadow inflation occurs when prices rise unnoticed due to quality reductions or hidden fees, while demand-pull inflation results from increased consumer demand outstripping supply, driving up prices openly. Understanding the underlying causes and impacts of these inflation types is crucial for accurate economic analysis and policymaking. Explore further to grasp how these inflationary pressures shape market dynamics and consumer behavior.

Why it is important

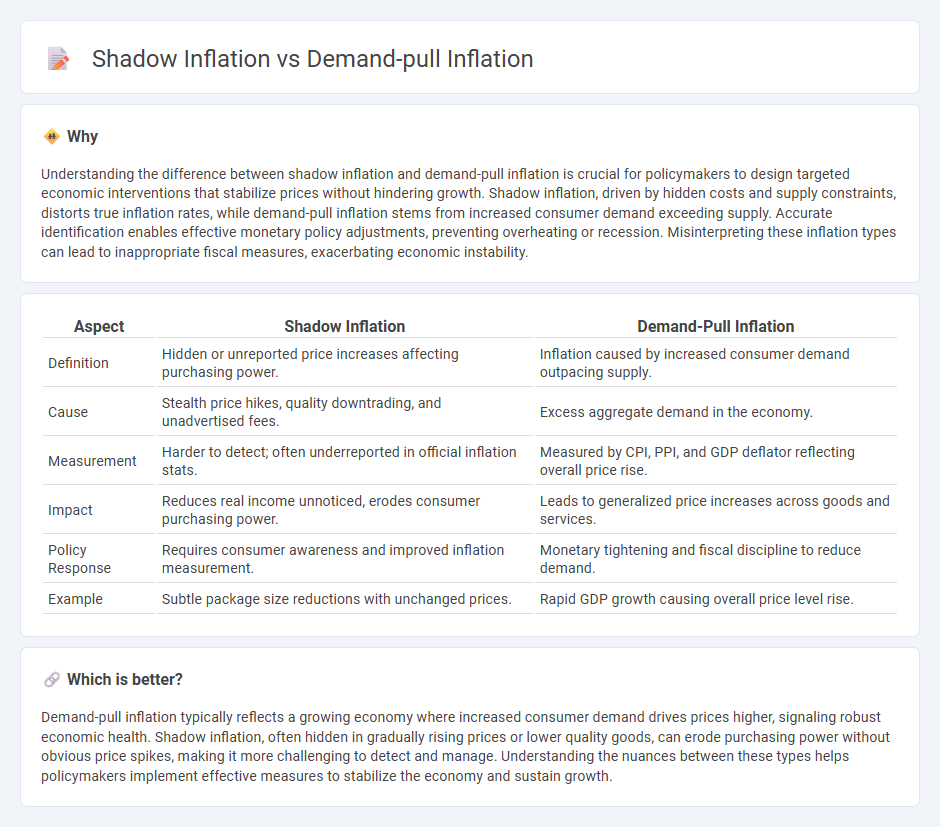

Understanding the difference between shadow inflation and demand-pull inflation is crucial for policymakers to design targeted economic interventions that stabilize prices without hindering growth. Shadow inflation, driven by hidden costs and supply constraints, distorts true inflation rates, while demand-pull inflation stems from increased consumer demand exceeding supply. Accurate identification enables effective monetary policy adjustments, preventing overheating or recession. Misinterpreting these inflation types can lead to inappropriate fiscal measures, exacerbating economic instability.

Comparison Table

| Aspect | Shadow Inflation | Demand-Pull Inflation |

|---|---|---|

| Definition | Hidden or unreported price increases affecting purchasing power. | Inflation caused by increased consumer demand outpacing supply. |

| Cause | Stealth price hikes, quality downtrading, and unadvertised fees. | Excess aggregate demand in the economy. |

| Measurement | Harder to detect; often underreported in official inflation stats. | Measured by CPI, PPI, and GDP deflator reflecting overall price rise. |

| Impact | Reduces real income unnoticed, erodes consumer purchasing power. | Leads to generalized price increases across goods and services. |

| Policy Response | Requires consumer awareness and improved inflation measurement. | Monetary tightening and fiscal discipline to reduce demand. |

| Example | Subtle package size reductions with unchanged prices. | Rapid GDP growth causing overall price level rise. |

Which is better?

Demand-pull inflation typically reflects a growing economy where increased consumer demand drives prices higher, signaling robust economic health. Shadow inflation, often hidden in gradually rising prices or lower quality goods, can erode purchasing power without obvious price spikes, making it more challenging to detect and manage. Understanding the nuances between these types helps policymakers implement effective measures to stabilize the economy and sustain growth.

Connection

Shadow inflation occurs when rising prices are underreported or hidden in official statistics, often due to measurement lags or changes in product quality, which can obscure true cost increases seen by consumers. Demand-pull inflation arises when aggregate demand exceeds supply, leading to upward pressure on prices across the economy. The connection lies in how demand-pull inflation fuels rising prices that may initially go unrecorded, contributing to shadow inflation by masking the full extent of inflationary pressures.

Key Terms

Aggregate Demand

Demand-pull inflation occurs when aggregate demand exceeds aggregate supply, driving up prices as consumers compete for limited goods and services. Shadow inflation, however, reflects hidden price increases embedded in product quality reductions or unreported cost shifts that do not immediately appear in official inflation metrics. Explore deeper insights into how these inflation types uniquely affect economic policy and market behavior.

Price Index

Demand-pull inflation occurs when rising consumer demand drives up the Price Index, reflecting an increase in the overall cost of goods and services. Shadow inflation, however, represents hidden price increases not fully captured by standard Price Index measures, often due to quality reductions or smaller package sizes. Explore how these different inflation types impact your economic understanding and financial decisions.

Hidden Costs

Demand-pull inflation occurs when increased consumer demand drives prices higher, reflecting visible market dynamics, while shadow inflation refers to hidden costs embedded in products or services, such as reduced quality or smaller quantities that are less apparent to consumers. Hidden costs in shadow inflation undermine real purchasing power without immediate price changes, making it crucial for consumers and businesses to recognize these subtle economic pressures. Explore more to understand how these inflation types impact your financial decisions.

Source and External Links

Causes of Inflation | Explainer | Education | RBA - Demand-pull inflation occurs when aggregate demand for goods and services exceeds the economy's capacity to sustainably supply them, leading to upward pressure on prices as businesses raise prices and wages to meet increased demand and spending.

Demand-Pull Inflation: How Does It Work? - SmartAsset - This type of inflation happens when consumer and business demand outpaces available supply, typically during periods of strong economic growth, resulting in a general rise in prices as more money chases fewer goods.

Demand-pull inflation - Wikipedia - Demand-pull inflation arises when aggregate demand is greater than aggregate supply, often described as "too much money spent chasing too few goods," causing prices to increase, especially when the economy is near full employment.

dowidth.com

dowidth.com