Rentvesting offers an accessible path to property ownership by allowing individuals to rent where they want to live while investing in real estate in more affordable locations. Real estate syndication involves pooling funds with other investors to acquire larger, income-generating properties that might be unattainable individually. Explore the differences and benefits of rentvesting and syndication to determine the best investment strategy for your financial goals.

Why it is important

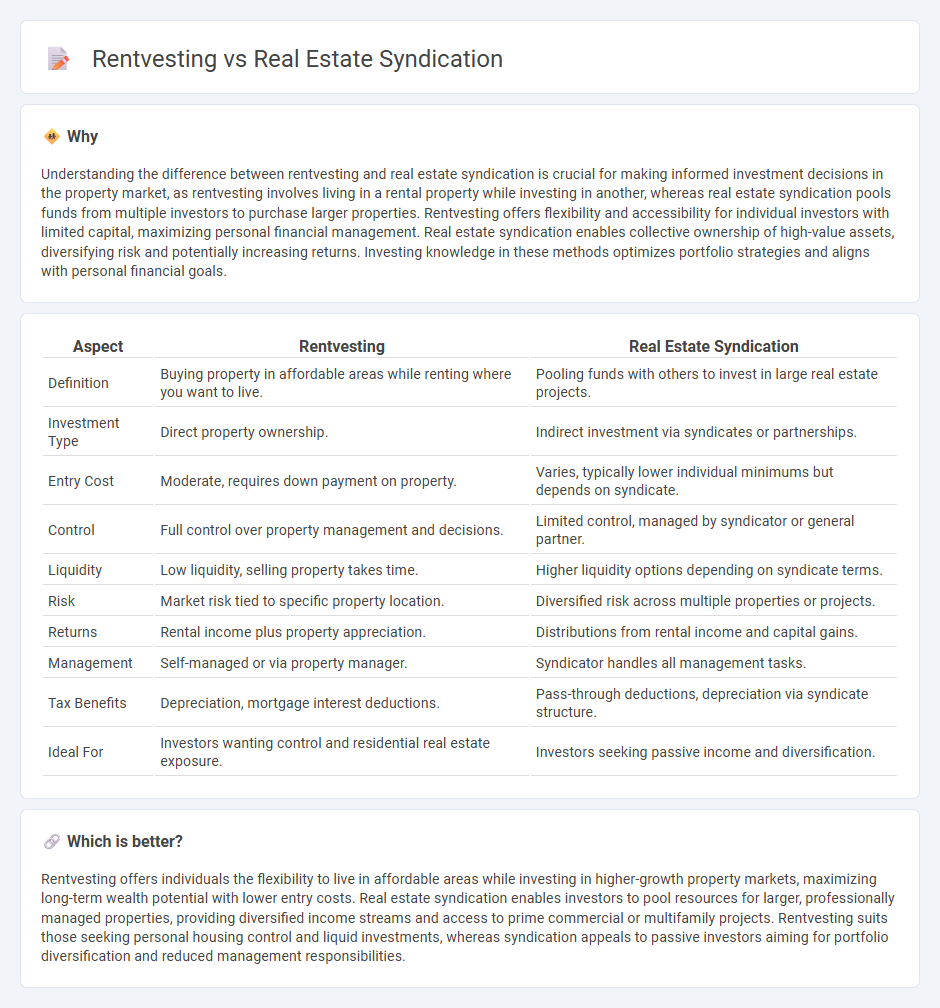

Understanding the difference between rentvesting and real estate syndication is crucial for making informed investment decisions in the property market, as rentvesting involves living in a rental property while investing in another, whereas real estate syndication pools funds from multiple investors to purchase larger properties. Rentvesting offers flexibility and accessibility for individual investors with limited capital, maximizing personal financial management. Real estate syndication enables collective ownership of high-value assets, diversifying risk and potentially increasing returns. Investing knowledge in these methods optimizes portfolio strategies and aligns with personal financial goals.

Comparison Table

| Aspect | Rentvesting | Real Estate Syndication |

|---|---|---|

| Definition | Buying property in affordable areas while renting where you want to live. | Pooling funds with others to invest in large real estate projects. |

| Investment Type | Direct property ownership. | Indirect investment via syndicates or partnerships. |

| Entry Cost | Moderate, requires down payment on property. | Varies, typically lower individual minimums but depends on syndicate. |

| Control | Full control over property management and decisions. | Limited control, managed by syndicator or general partner. |

| Liquidity | Low liquidity, selling property takes time. | Higher liquidity options depending on syndicate terms. |

| Risk | Market risk tied to specific property location. | Diversified risk across multiple properties or projects. |

| Returns | Rental income plus property appreciation. | Distributions from rental income and capital gains. |

| Management | Self-managed or via property manager. | Syndicator handles all management tasks. |

| Tax Benefits | Depreciation, mortgage interest deductions. | Pass-through deductions, depreciation via syndicate structure. |

| Ideal For | Investors wanting control and residential real estate exposure. | Investors seeking passive income and diversification. |

Which is better?

Rentvesting offers individuals the flexibility to live in affordable areas while investing in higher-growth property markets, maximizing long-term wealth potential with lower entry costs. Real estate syndication enables investors to pool resources for larger, professionally managed properties, providing diversified income streams and access to prime commercial or multifamily projects. Rentvesting suits those seeking personal housing control and liquid investments, whereas syndication appeals to passive investors aiming for portfolio diversification and reduced management responsibilities.

Connection

Rentvesting allows individuals to live in affordable rental properties while investing in real estate elsewhere, often through syndication to access larger, diversified projects. Real estate syndication pools funds from multiple investors, enabling rentvestors to enter markets with higher returns without full property ownership responsibilities. This connection enhances portfolio diversification and capital growth opportunities within the economy.

Key Terms

Capital Pooling

Real estate syndication involves multiple investors pooling capital to acquire large properties, leveraging combined resources for greater purchasing power and shared risk. Rentvesting differs by allowing individuals to rent where they live while investing in more affordable markets, focusing on personal cash flow management rather than collective capital pooling. Explore how capital pooling in syndication can amplify your investment potential and diversify risks effectively.

Rental Income

Real estate syndication pools investor capital to acquire large rental properties, enabling access to high-value assets and passive income streams with professional management. Rentvesting involves buying a property in an affordable area to rent out while living elsewhere, maximizing rental income and personal housing flexibility. Explore these strategies in-depth to optimize your rental income and investment portfolio.

Ownership Structure

Real estate syndication involves multiple investors pooling funds to collectively own larger property assets, with ownership typically structured through limited partnerships or LLCs. Rentvesting allows individuals to rent where they want to live while owning investment properties elsewhere, maintaining direct individual ownership of these real estate assets. Explore further to understand which ownership structure aligns with your investment goals and lifestyle preferences.

Source and External Links

14. Real Estate Syndicates and Investment Trusts - Real estate syndication is an investment structure where individual investors pool their capital under the management of a sponsor to collectively purchase, operate, and profit from real estate properties that would be beyond the reach of a single investor.

An Introduction to Real Estate Syndication - Real estate syndication allows multiple investors to combine their money for a specific real estate opportunity, managed by a sponsor, enabling investment in larger and potentially more profitable properties than they could afford or manage alone.

Real Estate Syndications vs. REITs for Investors - In a real estate syndication, investors become direct owners of a property or property group by pooling funds together, with the sponsor handling all management and operational duties and the investors providing capital but remaining hands-off.

dowidth.com

dowidth.com