Zombie companies, characterized by their inability to cover debt costs and relying on continuous borrowing, contrast sharply with blue chip companies known for their strong balance sheets, stable earnings, and reliable dividends. The persistence of zombie firms can distort economic growth and allocation of capital, while blue chip companies typically drive market stability and investor confidence. Explore how these two types of companies impact economic resilience and investment strategies.

Why it is important

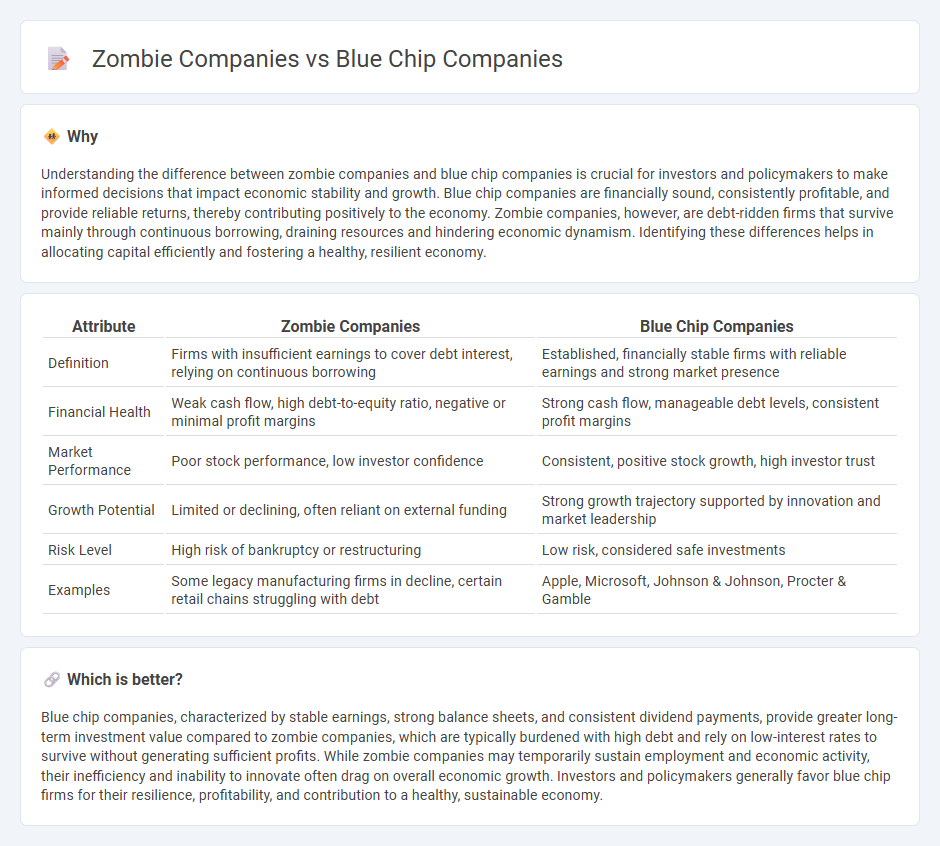

Understanding the difference between zombie companies and blue chip companies is crucial for investors and policymakers to make informed decisions that impact economic stability and growth. Blue chip companies are financially sound, consistently profitable, and provide reliable returns, thereby contributing positively to the economy. Zombie companies, however, are debt-ridden firms that survive mainly through continuous borrowing, draining resources and hindering economic dynamism. Identifying these differences helps in allocating capital efficiently and fostering a healthy, resilient economy.

Comparison Table

| Attribute | Zombie Companies | Blue Chip Companies |

|---|---|---|

| Definition | Firms with insufficient earnings to cover debt interest, relying on continuous borrowing | Established, financially stable firms with reliable earnings and strong market presence |

| Financial Health | Weak cash flow, high debt-to-equity ratio, negative or minimal profit margins | Strong cash flow, manageable debt levels, consistent profit margins |

| Market Performance | Poor stock performance, low investor confidence | Consistent, positive stock growth, high investor trust |

| Growth Potential | Limited or declining, often reliant on external funding | Strong growth trajectory supported by innovation and market leadership |

| Risk Level | High risk of bankruptcy or restructuring | Low risk, considered safe investments |

| Examples | Some legacy manufacturing firms in decline, certain retail chains struggling with debt | Apple, Microsoft, Johnson & Johnson, Procter & Gamble |

Which is better?

Blue chip companies, characterized by stable earnings, strong balance sheets, and consistent dividend payments, provide greater long-term investment value compared to zombie companies, which are typically burdened with high debt and rely on low-interest rates to survive without generating sufficient profits. While zombie companies may temporarily sustain employment and economic activity, their inefficiency and inability to innovate often drag on overall economic growth. Investors and policymakers generally favor blue chip firms for their resilience, profitability, and contribution to a healthy, sustainable economy.

Connection

Zombie companies, defined as firms unable to cover debt servicing costs with current earnings, drain economic resources and impede market dynamism. Blue chip companies, characterized by robust financial health and stable earnings, often absorb market opportunities left vacant by failing zombie firms. The coexistence of these two entities influences capital allocation efficiency, impacting overall economic growth and investment climate.

Key Terms

Financial Stability

Blue chip companies demonstrate strong financial stability characterized by consistent earnings, robust cash flow, and low debt levels, making them reliable investment options with long-term growth potential. In contrast, zombie companies struggle to generate sufficient revenue to cover debt interest, often relying on continuous borrowing, which threatens their survival and market confidence. Explore the key indicators differentiating financial stability in blue chip firms versus zombie companies to make informed investment decisions.

Creditworthiness

Blue chip companies demonstrate strong creditworthiness through stable cash flows, low default risk, and high credit ratings issued by agencies such as Moody's and S&P. In contrast, zombie companies struggle to meet debt obligations, relying on continuous refinancing and often showing poor credit metrics and high default probabilities. Explore the critical differences in credit profiles and financial health between blue chip and zombie companies to make informed investment decisions.

Profitability

Blue chip companies consistently demonstrate strong profitability through stable earnings, robust cash flows, and resilient market positions, making them attractive to investors seeking long-term growth. Zombie companies, by contrast, barely generate enough profit to cover debt interest, relying heavily on external financing and showing poor operational efficiency. Discover how profitability metrics distinctly separate blue chip firms from zombie companies and influence investment decisions.

Source and External Links

Blue Chip - Learn How to Pick and Invest in Blue-Chip Stocks - Blue chip stocks are shares of well-established corporations known for reliability, quality, financial stability, steady earnings, and often paying consistent dividends, serving as market leaders in their sectors.

7 Best-Performing Blue-Chip Stocks for July 2025 - NerdWallet - Blue-chip stocks represent big, stable, and established companies with large market capitalizations, strong growth histories, often paying dividends, and usually included in major indexes like the S&P 500 and Dow Jones.

10 Best Blue-Chip Stocks to Buy for the Long Term - Morningstar - Examples of blue-chip companies include Pfizer, Amazon, and Bristol-Myers Squibb, noted for their large market caps, strong financials, and competitive advantages in their industries.

dowidth.com

dowidth.com