Micro-dosing spending involves small, frequent expenditures that cater to immediate needs, while investment flows focus on allocating larger sums toward long-term growth assets like stocks, bonds, and infrastructure. Understanding the contrasting impacts of these financial behaviors reveals how consumer habits and investment strategies drive economic stability and expansion. Explore how balancing micro-spending and investment flows shapes modern economic dynamics.

Why it is important

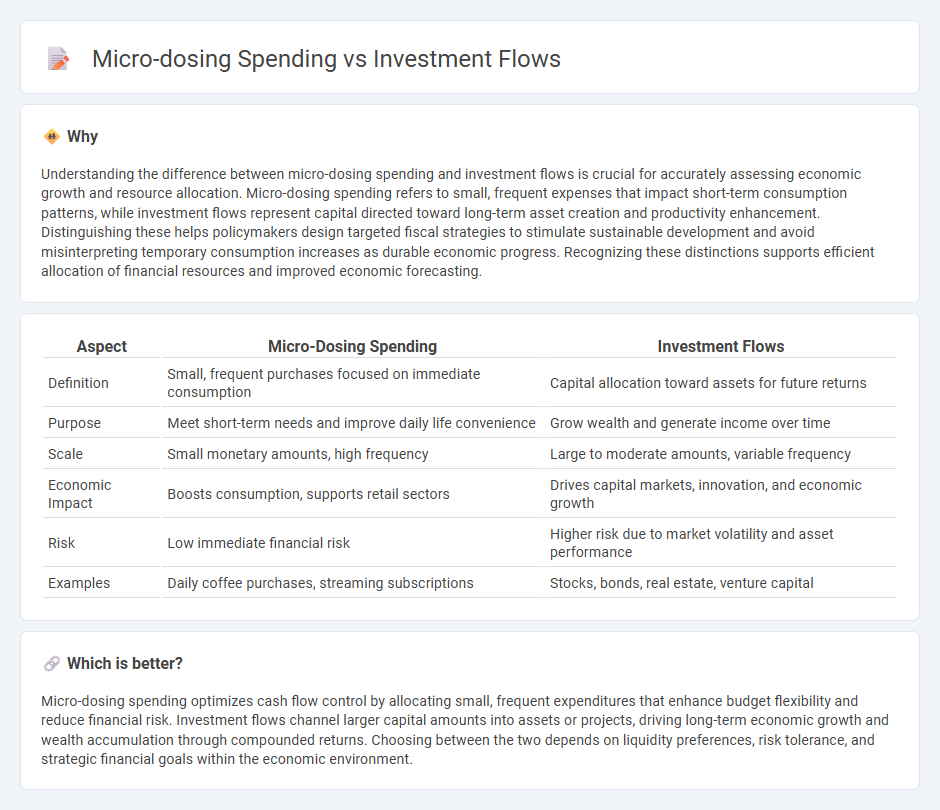

Understanding the difference between micro-dosing spending and investment flows is crucial for accurately assessing economic growth and resource allocation. Micro-dosing spending refers to small, frequent expenses that impact short-term consumption patterns, while investment flows represent capital directed toward long-term asset creation and productivity enhancement. Distinguishing these helps policymakers design targeted fiscal strategies to stimulate sustainable development and avoid misinterpreting temporary consumption increases as durable economic progress. Recognizing these distinctions supports efficient allocation of financial resources and improved economic forecasting.

Comparison Table

| Aspect | Micro-Dosing Spending | Investment Flows |

|---|---|---|

| Definition | Small, frequent purchases focused on immediate consumption | Capital allocation toward assets for future returns |

| Purpose | Meet short-term needs and improve daily life convenience | Grow wealth and generate income over time |

| Scale | Small monetary amounts, high frequency | Large to moderate amounts, variable frequency |

| Economic Impact | Boosts consumption, supports retail sectors | Drives capital markets, innovation, and economic growth |

| Risk | Low immediate financial risk | Higher risk due to market volatility and asset performance |

| Examples | Daily coffee purchases, streaming subscriptions | Stocks, bonds, real estate, venture capital |

Which is better?

Micro-dosing spending optimizes cash flow control by allocating small, frequent expenditures that enhance budget flexibility and reduce financial risk. Investment flows channel larger capital amounts into assets or projects, driving long-term economic growth and wealth accumulation through compounded returns. Choosing between the two depends on liquidity preferences, risk tolerance, and strategic financial goals within the economic environment.

Connection

Micro-dosing spending and investment flows drive incremental economic growth by enabling continuous capital deployment and consumption in smaller, manageable increments. This approach enhances liquidity and reduces market volatility by distributing resources more evenly across sectors and time periods. Data shows that economies with higher frequencies of micro-investments tend to experience more stable asset valuations and sustained consumer demand.

Key Terms

**Investment Flows:**

Investment flows represent the movement of capital into various asset classes such as equities, bonds, and real estate, driven by market trends, economic indicators, and investor sentiment. These flows significantly influence market liquidity, asset prices, and economic growth, reflecting the overall health and confidence in the financial system. Discover more about how investment flows shape global markets and impact portfolio strategies.

Capital Allocation

Investment flows in capital allocation drive significant shifts in resource distribution across sectors, emphasizing higher returns and strategic growth opportunities. Micro-dosing spending techniques, used within corporate budgets, optimize capital use by incrementally testing market responses and minimizing risk exposure. Explore deeper insights into optimizing capital allocation strategies for enhanced financial performance and strategic investment.

Portfolio Diversification

Investment flows into diversified portfolios help mitigate risks by spreading capital across various asset classes, including stocks, bonds, and alternative investments. Micro-dosing spending, often used for incremental investments or cost averaging, allows investors to gradually build exposure while managing volatility. Explore effective portfolio diversification strategies to optimize your investment returns and risk profile.

Source and External Links

FDI flows - OECD - Foreign direct investment (FDI) flows represent the value of cross-border transactions related to direct investment over time, including equity transactions, reinvestment of earnings, and intercompany debt, measured in million USD.

World Investment Report 2023 - IMF - In 2022, FDI flows increased notably in South America and Central America, while flows to structurally weak, vulnerable, and small economies, including least developed countries, declined by 4 percent.

FDI Flows to Developing Economies Drop to Lowest Level - World Bank - FDI flows into developing economies fell to the lowest level since 2005 in 2023, totaling $435 billion, due to rising trade and investment barriers that threaten global financing for development.

dowidth.com

dowidth.com