Dollarization involves adopting a foreign currency, typically the US dollar, to stabilize the economy and attract foreign investment, often reducing inflation and exchange rate volatility. Monetary sovereignty allows a country to control its own currency policies, enabling tailored responses to economic crises but risking higher inflation and currency instability. Explore the critical balance between dollarization and monetary sovereignty to understand their impacts on national economic strategies.

Why it is important

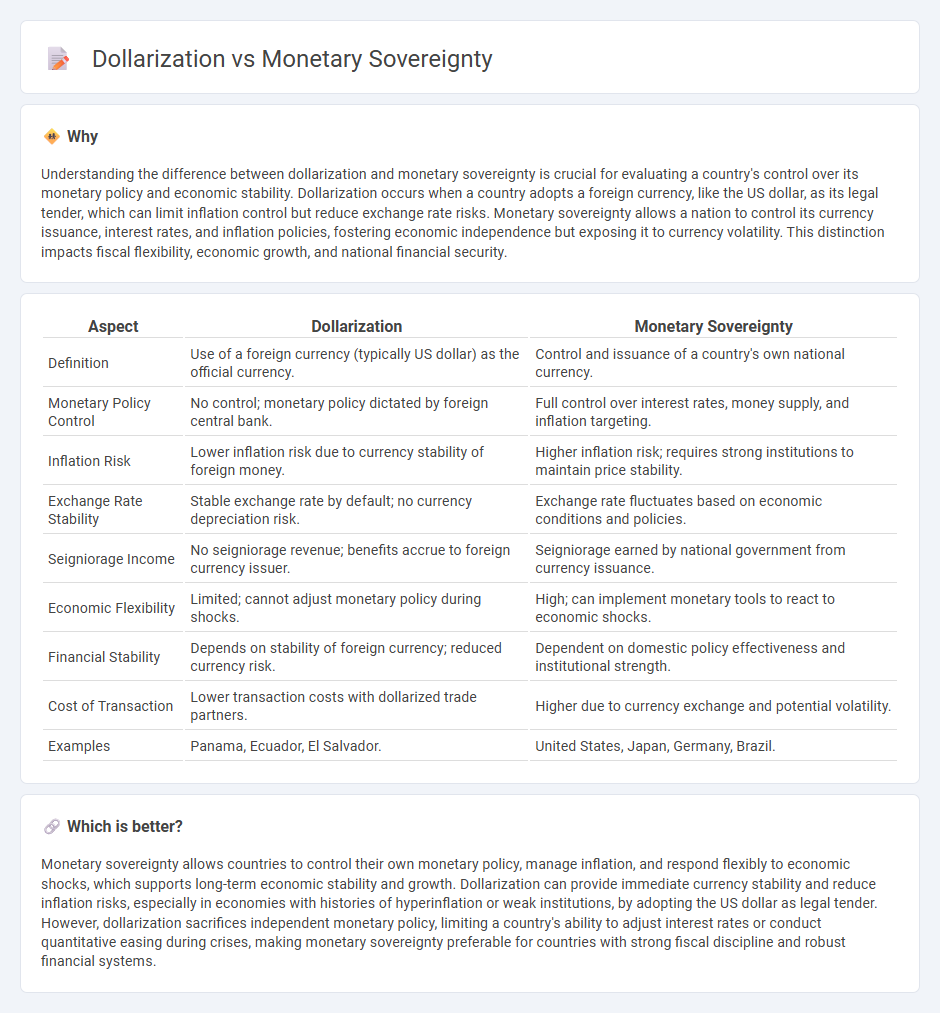

Understanding the difference between dollarization and monetary sovereignty is crucial for evaluating a country's control over its monetary policy and economic stability. Dollarization occurs when a country adopts a foreign currency, like the US dollar, as its legal tender, which can limit inflation control but reduce exchange rate risks. Monetary sovereignty allows a nation to control its currency issuance, interest rates, and inflation policies, fostering economic independence but exposing it to currency volatility. This distinction impacts fiscal flexibility, economic growth, and national financial security.

Comparison Table

| Aspect | Dollarization | Monetary Sovereignty |

|---|---|---|

| Definition | Use of a foreign currency (typically US dollar) as the official currency. | Control and issuance of a country's own national currency. |

| Monetary Policy Control | No control; monetary policy dictated by foreign central bank. | Full control over interest rates, money supply, and inflation targeting. |

| Inflation Risk | Lower inflation risk due to currency stability of foreign money. | Higher inflation risk; requires strong institutions to maintain price stability. |

| Exchange Rate Stability | Stable exchange rate by default; no currency depreciation risk. | Exchange rate fluctuates based on economic conditions and policies. |

| Seigniorage Income | No seigniorage revenue; benefits accrue to foreign currency issuer. | Seigniorage earned by national government from currency issuance. |

| Economic Flexibility | Limited; cannot adjust monetary policy during shocks. | High; can implement monetary tools to react to economic shocks. |

| Financial Stability | Depends on stability of foreign currency; reduced currency risk. | Dependent on domestic policy effectiveness and institutional strength. |

| Cost of Transaction | Lower transaction costs with dollarized trade partners. | Higher due to currency exchange and potential volatility. |

| Examples | Panama, Ecuador, El Salvador. | United States, Japan, Germany, Brazil. |

Which is better?

Monetary sovereignty allows countries to control their own monetary policy, manage inflation, and respond flexibly to economic shocks, which supports long-term economic stability and growth. Dollarization can provide immediate currency stability and reduce inflation risks, especially in economies with histories of hyperinflation or weak institutions, by adopting the US dollar as legal tender. However, dollarization sacrifices independent monetary policy, limiting a country's ability to adjust interest rates or conduct quantitative easing during crises, making monetary sovereignty preferable for countries with strong fiscal discipline and robust financial systems.

Connection

Dollarization influences monetary sovereignty by limiting a nation's control over its monetary policy and exchange rates when relying on a foreign currency like the US dollar. High levels of dollarization reduce a country's ability to independently regulate inflation, interest rates, and currency valuation, impacting economic stability and fiscal flexibility. Countries with strong monetary sovereignty maintain their own currency, enabling tailored policy responses to domestic economic conditions and external shocks.

Key Terms

Currency Issuance

Monetary sovereignty allows a nation to issue its own currency, controlling supply and interest rates to influence economic stability and respond to local financial conditions. Dollarization, in contrast, relinquishes this control by adopting a foreign currency, typically the U.S. dollar, limiting monetary policy flexibility and dependence on another country's economic decisions. Explore the trade-offs between monetary sovereignty and dollarization for deeper insights into currency issuance impacts.

Exchange Rate Regime

Maintaining monetary sovereignty allows a country to control its exchange rate regime, adapting policies to stabilize currency, manage inflation, and respond to economic shocks. Dollarization, by contrast, involves adopting the U.S. dollar as legal tender, eliminating independent exchange rate policies and often leading to reduced monetary policy flexibility but increased currency stability. Explore the impacts of these exchange rate choices on economic growth and financial autonomy to understand their long-term implications.

Seigniorage

Monetary sovereignty allows a country to control its currency issuance and capture seigniorage, the profit made from issuing currency above the face value. In contrast, dollarization cedes this power to the foreign currency issuer, eliminating local seigniorage revenue and potentially increasing vulnerability to external monetary policies. Explore further to understand how seigniorage impacts economic stability and fiscal policy under different monetary regimes.

Source and External Links

Monetary Sovereignty - This concept refers to a state's power to exercise exclusive legal control over its currency and monetary policy, including the authority to designate legal tender and control its issuance and retirement.

From Territorial to Monetary Sovereignty - This article explores the shift from territorial to monetary sovereignty, emphasizing the importance of control over monetary affairs in the era of credit-based financial systems.

What's Monetary Sovereignty Worth? - This study examines the implications of monetary sovereignty for a state's autonomy and independence, particularly in the context of financial liberalization and integration with global systems.

dowidth.com

dowidth.com