Polycrisis refers to a convergence of multiple, interconnected crises that amplify economic instability, whereas a black swan event signifies an unpredictable, rare occurrence with severe economic consequences. Understanding the distinctions between these phenomena is essential for risk management and economic forecasting. Explore further to deepen your insight into their impacts on global markets.

Why it is important

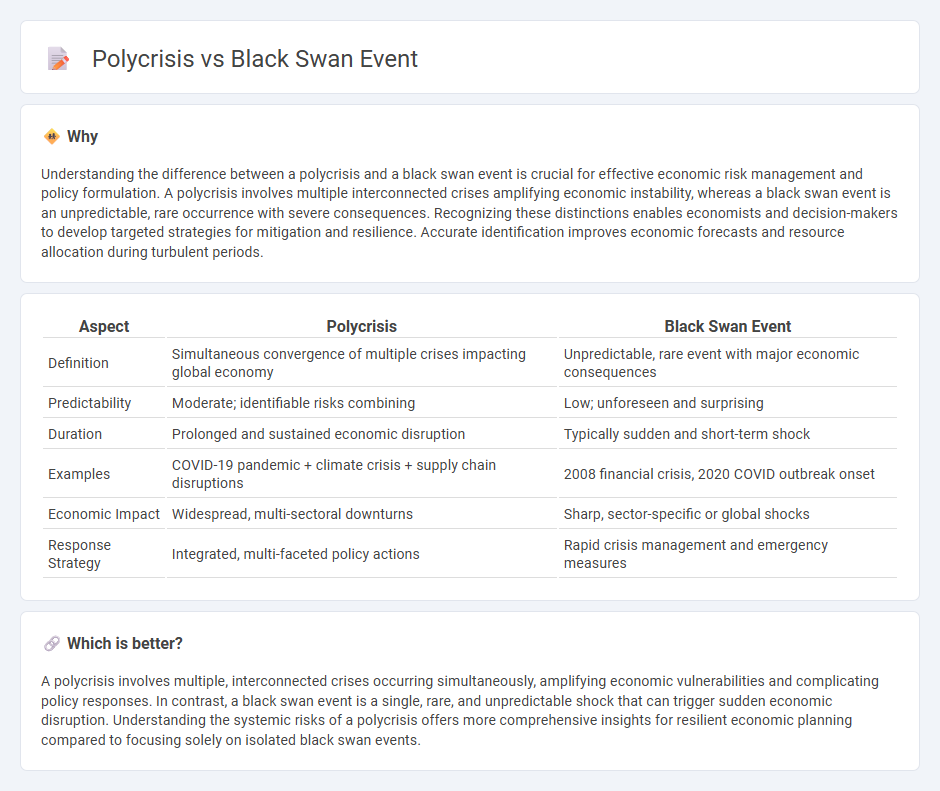

Understanding the difference between a polycrisis and a black swan event is crucial for effective economic risk management and policy formulation. A polycrisis involves multiple interconnected crises amplifying economic instability, whereas a black swan event is an unpredictable, rare occurrence with severe consequences. Recognizing these distinctions enables economists and decision-makers to develop targeted strategies for mitigation and resilience. Accurate identification improves economic forecasts and resource allocation during turbulent periods.

Comparison Table

| Aspect | Polycrisis | Black Swan Event |

|---|---|---|

| Definition | Simultaneous convergence of multiple crises impacting global economy | Unpredictable, rare event with major economic consequences |

| Predictability | Moderate; identifiable risks combining | Low; unforeseen and surprising |

| Duration | Prolonged and sustained economic disruption | Typically sudden and short-term shock |

| Examples | COVID-19 pandemic + climate crisis + supply chain disruptions | 2008 financial crisis, 2020 COVID outbreak onset |

| Economic Impact | Widespread, multi-sectoral downturns | Sharp, sector-specific or global shocks |

| Response Strategy | Integrated, multi-faceted policy actions | Rapid crisis management and emergency measures |

Which is better?

A polycrisis involves multiple, interconnected crises occurring simultaneously, amplifying economic vulnerabilities and complicating policy responses. In contrast, a black swan event is a single, rare, and unpredictable shock that can trigger sudden economic disruption. Understanding the systemic risks of a polycrisis offers more comprehensive insights for resilient economic planning compared to focusing solely on isolated black swan events.

Connection

Polycrisis and black swan events are connected through their profound impact on economic stability, where multiple simultaneous crises amplify vulnerabilities in global markets. Black swan events, characterized by their unpredictability and severe consequences, often trigger or exacerbate a polycrisis by disrupting supply chains, financial systems, and investor confidence. This interplay intensifies economic fluctuations, leading to accelerated recessions or prolonged recovery periods.

Key Terms

**Black Swan Event:**

A Black Swan event is an unpredictable and rare occurrence with severe impact, often reshaping markets, industries, or societies due to its unprecedented nature. These events defy standard risk models and statistical expectations, resulting in significant economic, political, or environmental consequences. Explore how understanding Black Swan events can enhance strategic risk management and resilience planning.

Unpredictability

A Black Swan event is characterized by extreme unpredictability and a rare, high-impact occurrence that defies conventional expectations, making it nearly impossible to foresee or prepare for. A polycrisis involves multiple, interconnected crises unfolding simultaneously, creating compounded unpredictability through complex systemic interactions rather than a single unforeseeable event. Explore how understanding these distinct concepts can enhance strategic risk management and resilience planning.

Extreme Impact

A black swan event is an unpredictable incident with extreme impact, often reshaping industries or societies overnight, such as the 2008 financial crisis or the COVID-19 pandemic. A polycrisis involves multiple interconnected crises occurring simultaneously, amplifying their overall impact and complexity, as seen in the combination of climate change, geopolitical tensions, and economic instability today. Explore further to understand how these phenomena influence risk management and strategic planning.

Source and External Links

Black Swan Event - A black swan event is an unexpected occurrence with significant, wide-ranging consequences that, after happening, people often claim was predictable; typically used to describe negative events like financial crashes or natural disasters, as popularized by Nassim Taleb.

Black Swan Event - Definition, Examples, Attributes - The term describes extremely rare and unpredictable negative events with profound impacts, originating from the false belief that all swans were white until black swans were discovered in the 1600s, illustrating how a single observation can challenge long-held assumptions.

Black Swan Event: What It Is, Meaning, & Examples - In financial markets, a black swan event is a rare, unpredictable event with widespread impact that causes major market losses and economic harm, accompanied by hindsight bias making it seem predictable after the fact, a concept emphasized by Nassim Nicholas Taleb.

dowidth.com

dowidth.com