Dollarization occurs when a country adopts a foreign currency, typically the US dollar, as legal tender to stabilize its economy and reduce inflation risks. In contrast, bimonetarism involves the simultaneous circulation of both the local currency and a foreign currency, aiming to balance monetary sovereignty with economic stability. Explore the impacts and benefits of each approach to understand their roles in modern economic policy.

Why it is important

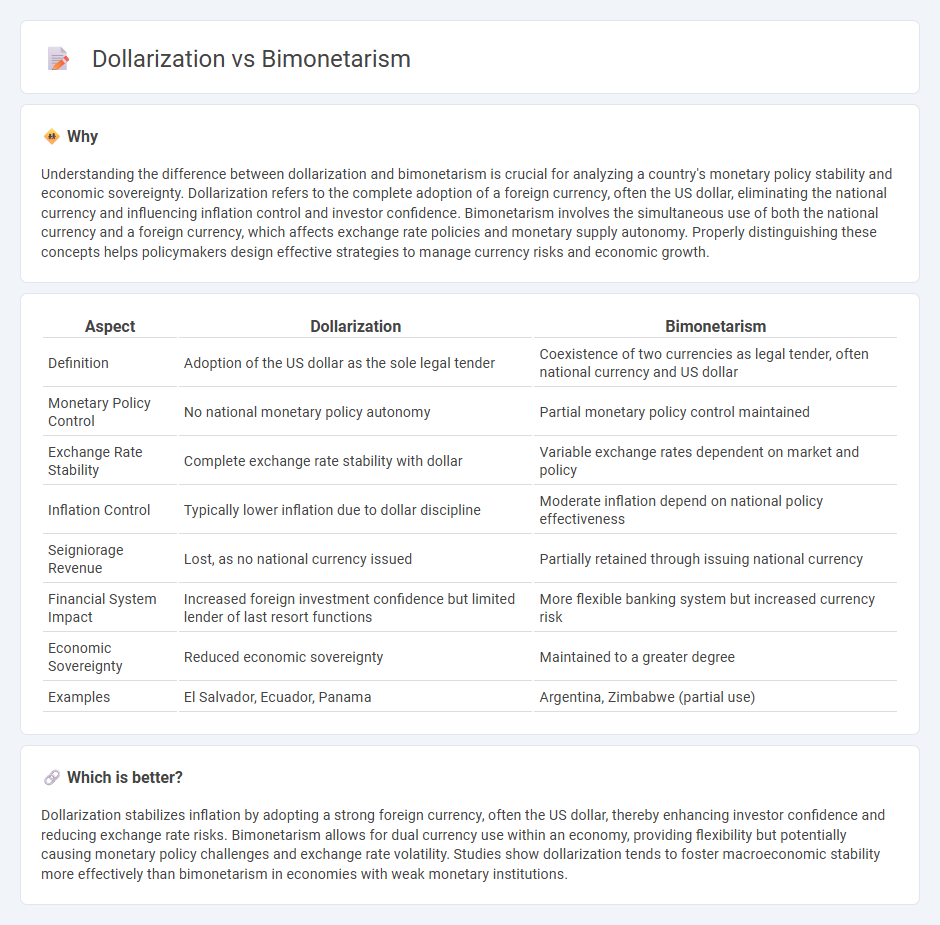

Understanding the difference between dollarization and bimonetarism is crucial for analyzing a country's monetary policy stability and economic sovereignty. Dollarization refers to the complete adoption of a foreign currency, often the US dollar, eliminating the national currency and influencing inflation control and investor confidence. Bimonetarism involves the simultaneous use of both the national currency and a foreign currency, which affects exchange rate policies and monetary supply autonomy. Properly distinguishing these concepts helps policymakers design effective strategies to manage currency risks and economic growth.

Comparison Table

| Aspect | Dollarization | Bimonetarism |

|---|---|---|

| Definition | Adoption of the US dollar as the sole legal tender | Coexistence of two currencies as legal tender, often national currency and US dollar |

| Monetary Policy Control | No national monetary policy autonomy | Partial monetary policy control maintained |

| Exchange Rate Stability | Complete exchange rate stability with dollar | Variable exchange rates dependent on market and policy |

| Inflation Control | Typically lower inflation due to dollar discipline | Moderate inflation depend on national policy effectiveness |

| Seigniorage Revenue | Lost, as no national currency issued | Partially retained through issuing national currency |

| Financial System Impact | Increased foreign investment confidence but limited lender of last resort functions | More flexible banking system but increased currency risk |

| Economic Sovereignty | Reduced economic sovereignty | Maintained to a greater degree |

| Examples | El Salvador, Ecuador, Panama | Argentina, Zimbabwe (partial use) |

Which is better?

Dollarization stabilizes inflation by adopting a strong foreign currency, often the US dollar, thereby enhancing investor confidence and reducing exchange rate risks. Bimonetarism allows for dual currency use within an economy, providing flexibility but potentially causing monetary policy challenges and exchange rate volatility. Studies show dollarization tends to foster macroeconomic stability more effectively than bimonetarism in economies with weak monetary institutions.

Connection

Dollarization occurs when a country adopts the US dollar alongside or instead of its domestic currency, often to stabilize the economy and curb inflation. Bimonetarism refers to the coexistence and use of two currencies within an economy, typically the local currency and the US dollar, influencing monetary policy and financial markets. The connection between dollarization and bimonetarism lies in the dual currency system, where dollarization can lead to or result from bimonetarism, affecting currency substitution and economic stability.

Key Terms

Dual currency system

Bimonetarism involves the coexistence of two national currencies within an economy, allowing transactions, savings, and pricing in both currencies while maintaining sovereign monetary policies. Dollarization occurs when a country fully adopts a foreign currency, typically the US dollar, as its sole legal tender, eliminating its own currency to stabilize the economy and reduce inflation risks. Explore detailed comparisons and implications of dual currency systems to understand their impact on economic stability and monetary control.

Monetary sovereignty

Bimonetarism involves the simultaneous use of a national currency and a foreign currency, allowing partial monetary sovereignty while maintaining flexibility in exchange rate policies. Dollarization refers to the complete replacement of the national currency with a foreign currency, often the US dollar, resulting in a significant loss of monetary sovereignty and policy autonomy. Explore the implications of these monetary regimes to understand their impact on economic stability and national control.

Exchange rate regime

Bimonetarism involves the coexistence of two currencies within an economy without officially adopting one as legal tender, allowing flexible exchange rate regimes influenced by both currencies. Dollarization occurs when a country officially adopts a foreign currency, typically the US dollar, replacing the national currency and effectively implementing a fixed exchange rate regime with the adopted currency. Explore deeper insights into how these monetary systems impact exchange rate stability and economic policy frameworks.

Source and External Links

Currency Competition and Bi-Monetarism: Some Important Differences - A bi-monetary regime involves two (or more) currencies circulating alongside the local currency, but they do not compete on equal terms unless one moves to a true currency competition regime where multiple currencies share legal tender status.

The Dangers of Milei's Bi-Monetarism - Bi-monetarism aims to treat two currencies--such as the peso and the U.S. dollar--as valid means of exchange, allowing them to compete freely, though often lacking the institutional conditions for stable coexistence, especially in countries with high inflation and weak currency confidence.

Yes, Virginia, Dollarization is Viable - The correct term for circulating two currencies is "bimonetariedad" (bimonetariness); in Argentina, this describes a de facto dollarization where dollars circulate widely alongside pesos, but without full legal equivalence or the elimination of monetary policy inefficiencies.

dowidth.com

dowidth.com