Revenge spending refers to the surge in consumer purchases driven by pent-up demand after periods of restricted spending, often seen following economic downturns or lockdowns. Discretionary spending involves non-essential purchases that consumers make based on personal preferences and available income, influencing overall economic growth and market trends. Explore how these spending behaviors impact the economy and consumer markets to understand their significance.

Why it is important

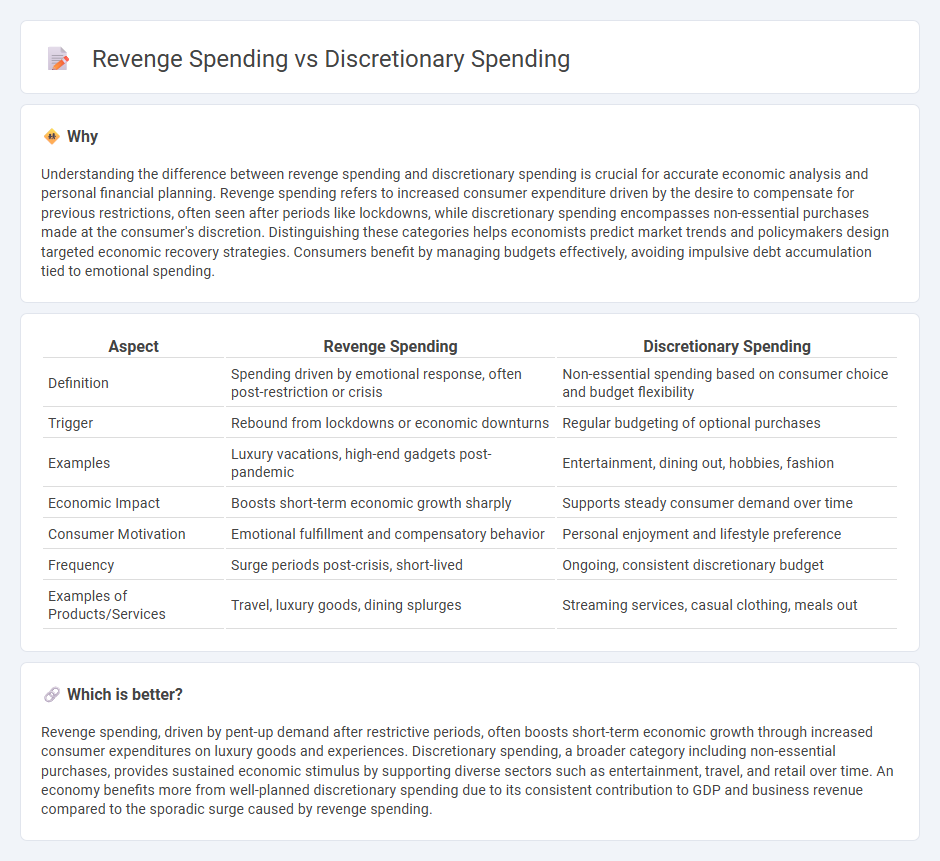

Understanding the difference between revenge spending and discretionary spending is crucial for accurate economic analysis and personal financial planning. Revenge spending refers to increased consumer expenditure driven by the desire to compensate for previous restrictions, often seen after periods like lockdowns, while discretionary spending encompasses non-essential purchases made at the consumer's discretion. Distinguishing these categories helps economists predict market trends and policymakers design targeted economic recovery strategies. Consumers benefit by managing budgets effectively, avoiding impulsive debt accumulation tied to emotional spending.

Comparison Table

| Aspect | Revenge Spending | Discretionary Spending |

|---|---|---|

| Definition | Spending driven by emotional response, often post-restriction or crisis | Non-essential spending based on consumer choice and budget flexibility |

| Trigger | Rebound from lockdowns or economic downturns | Regular budgeting of optional purchases |

| Examples | Luxury vacations, high-end gadgets post-pandemic | Entertainment, dining out, hobbies, fashion |

| Economic Impact | Boosts short-term economic growth sharply | Supports steady consumer demand over time |

| Consumer Motivation | Emotional fulfillment and compensatory behavior | Personal enjoyment and lifestyle preference |

| Frequency | Surge periods post-crisis, short-lived | Ongoing, consistent discretionary budget |

| Examples of Products/Services | Travel, luxury goods, dining splurges | Streaming services, casual clothing, meals out |

Which is better?

Revenge spending, driven by pent-up demand after restrictive periods, often boosts short-term economic growth through increased consumer expenditures on luxury goods and experiences. Discretionary spending, a broader category including non-essential purchases, provides sustained economic stimulus by supporting diverse sectors such as entertainment, travel, and retail over time. An economy benefits more from well-planned discretionary spending due to its consistent contribution to GDP and business revenue compared to the sporadic surge caused by revenge spending.

Connection

Revenge spending, a surge in consumer purchases following periods of restricted economic activity, significantly boosts discretionary spending on non-essential goods and services. This behavior impacts sectors such as travel, dining, and luxury retail, driving short-term economic growth and shifting consumer confidence metrics. Businesses capitalize on this trend by tailoring marketing strategies to capitalize on pent-up demand, thereby influencing broader economic recovery patterns.

Key Terms

Consumer Behavior

Discretionary spending reflects consumer behavior driven by non-essential purchases made for pleasure or luxury, influenced by factors such as income level and economic confidence. Revenge spending emerges as a specific form of discretionary spending where consumers indulge in costly or impulsive purchases to compensate for previous periods of restricted spending, often seen after crises like a pandemic. Explore the nuanced differences between these spending patterns to better understand evolving consumer motivations.

Disposable Income

Discretionary spending refers to purchases made with disposable income after essential expenses, while revenge spending arises from a psychological response to restrictions, prompting increased expenditure as a form of indulgence. Both behaviors significantly impact the allocation of disposable income, influencing broader economic patterns. Explore more to understand how disposable income drives these distinct consumer spending trends.

Economic Stimulus

Discretionary spending refers to consumer expenditures on non-essential goods and services, often influenced by confidence and economic conditions, while revenge spending describes the surge in purchases driven by pent-up demand after prolonged restrictions, especially evident post-pandemic. Economic stimulus measures, such as direct cash payments and tax relief, aim to boost discretionary spending by increasing household disposable income, thereby stimulating economic recovery. Explore how strategic economic policies can balance and maximize the impact of both spending behaviors to fuel sustainable growth.

Source and External Links

Discretionary vs. Mandatory Spending: What Are They? - Discretionary spending refers to nonessential costs that are not required to maintain your household or business, such as dining out, entertainment, travel, and gifts.

What is mandatory and discretionary spending? - Discretionary spending is set by annual appropriations acts and includes federal programs like defense, education, transportation, and environmental protection, which Congress must approve each year.

Discretionary spending - In U.S. public finance, discretionary spending is government spending authorized through appropriations bills, making it optional and subject to annual legislative review, unlike mandatory spending.

dowidth.com

dowidth.com