Dollarization occurs when a country adopts a foreign currency, typically the US dollar, as its official legal tender, enhancing monetary stability and reducing exchange rate risk. Currency substitution involves the widespread use of a foreign currency alongside the domestic currency without official legal status, often driven by lack of confidence in the local economy or persistent inflation. Explore the economic implications and challenges of dollarization versus currency substitution in depth.

Why it is important

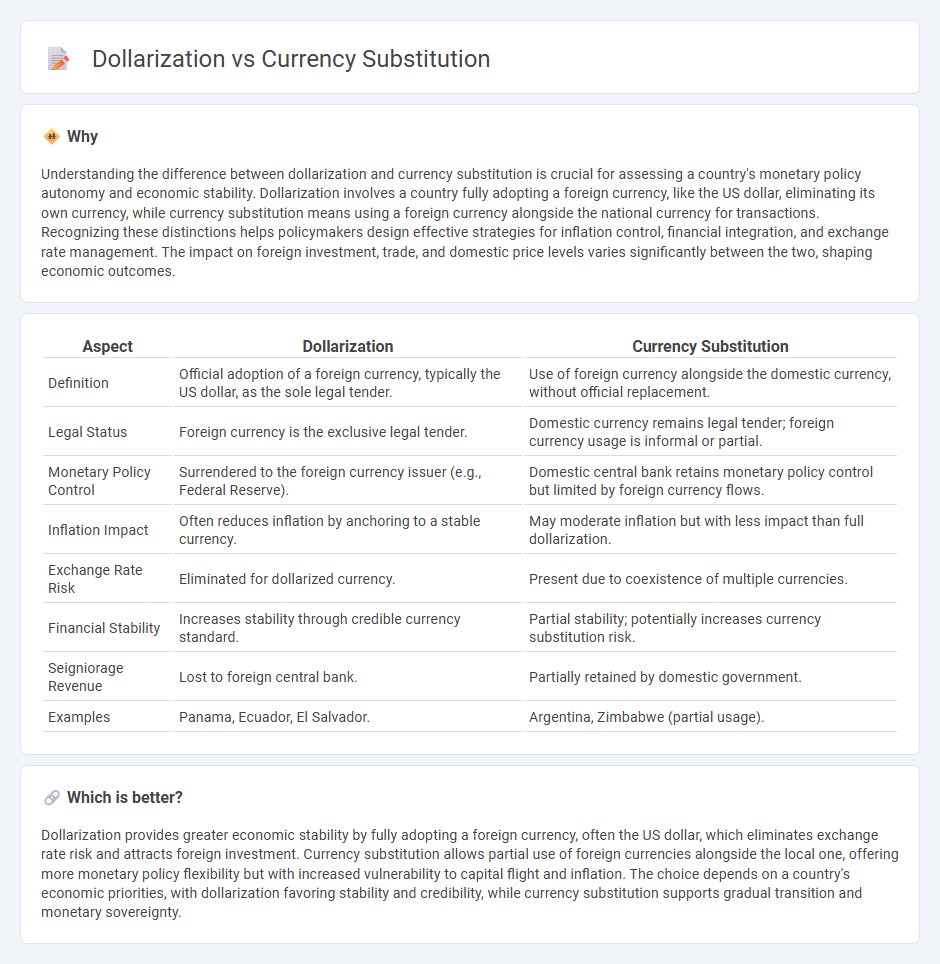

Understanding the difference between dollarization and currency substitution is crucial for assessing a country's monetary policy autonomy and economic stability. Dollarization involves a country fully adopting a foreign currency, like the US dollar, eliminating its own currency, while currency substitution means using a foreign currency alongside the national currency for transactions. Recognizing these distinctions helps policymakers design effective strategies for inflation control, financial integration, and exchange rate management. The impact on foreign investment, trade, and domestic price levels varies significantly between the two, shaping economic outcomes.

Comparison Table

| Aspect | Dollarization | Currency Substitution |

|---|---|---|

| Definition | Official adoption of a foreign currency, typically the US dollar, as the sole legal tender. | Use of foreign currency alongside the domestic currency, without official replacement. |

| Legal Status | Foreign currency is the exclusive legal tender. | Domestic currency remains legal tender; foreign currency usage is informal or partial. |

| Monetary Policy Control | Surrendered to the foreign currency issuer (e.g., Federal Reserve). | Domestic central bank retains monetary policy control but limited by foreign currency flows. |

| Inflation Impact | Often reduces inflation by anchoring to a stable currency. | May moderate inflation but with less impact than full dollarization. |

| Exchange Rate Risk | Eliminated for dollarized currency. | Present due to coexistence of multiple currencies. |

| Financial Stability | Increases stability through credible currency standard. | Partial stability; potentially increases currency substitution risk. |

| Seigniorage Revenue | Lost to foreign central bank. | Partially retained by domestic government. |

| Examples | Panama, Ecuador, El Salvador. | Argentina, Zimbabwe (partial usage). |

Which is better?

Dollarization provides greater economic stability by fully adopting a foreign currency, often the US dollar, which eliminates exchange rate risk and attracts foreign investment. Currency substitution allows partial use of foreign currencies alongside the local one, offering more monetary policy flexibility but with increased vulnerability to capital flight and inflation. The choice depends on a country's economic priorities, with dollarization favoring stability and credibility, while currency substitution supports gradual transition and monetary sovereignty.

Connection

Dollarization occurs when a country's residents use a foreign currency alongside or instead of the domestic currency, while currency substitution involves the replacement of the local currency by a more stable foreign currency for transactions and savings. Both phenomena arise from economic instability, hyperinflation, or lack of confidence in the domestic currency, leading to reduced control over monetary policy by the central bank. The interconnection lies in their common impact on financial sovereignty and the challenges they pose to effective economic management and inflation control.

Key Terms

Legal Tender

Currency substitution occurs when residents use a foreign currency alongside the domestic currency without it being officially recognized as legal tender. Dollarization refers to the full or partial adoption of the US dollar as the official legal tender by a country's government, often replacing the domestic currency altogether. Explore the distinctions in legal frameworks and economic impacts to better understand how these phenomena influence monetary sovereignty.

Exchange Rate Regime

Currency substitution occurs when residents of a country use a foreign currency alongside or instead of the domestic currency without official adoption, typically in unstable exchange rate regimes. Dollarization involves an official adoption of the US dollar as the legal tender, replacing the local currency and stabilizing exchange rate expectations. Explore the nuances and economic impacts of these exchange rate regimes to understand their role in financial stability.

Monetary Sovereignty

Currency substitution occurs when residents in a country use a foreign currency alongside or instead of the domestic currency, often limiting the central bank's control over monetary policy. Dollarization is a more extreme form, where a country officially adopts a foreign currency, typically the US dollar, fully relinquishing its own monetary sovereignty and the ability to conduct independent monetary policy. Explore the implications of these phenomena on national economic stability and policy-making to understand their impact on monetary sovereignty.

Source and External Links

Currency Substitution - Currency substitution involves using a foreign currency alongside or instead of a domestic currency, often to stabilize the economy or reduce transaction costs.

Currency Substitution - Pros and Cons - This webpage discusses the benefits and drawbacks of currency substitution, including its role in managing inflation and economic stability.

Currency Substitution in High Inflation Countries - This article explores how currency substitution can stabilize economies facing high inflation by using foreign currencies as a more reliable medium of exchange.

dowidth.com

dowidth.com