Zombie companies, often characterized by low productivity and heavy debt burdens, struggle to generate sufficient profits to cover interest payments, thereby stifling economic growth. In contrast, gazelle companies exhibit rapid revenue growth and innovation, driving job creation and contributing significantly to GDP expansion. Explore how the dynamics between these company types impact economic resilience and development.

Why it is important

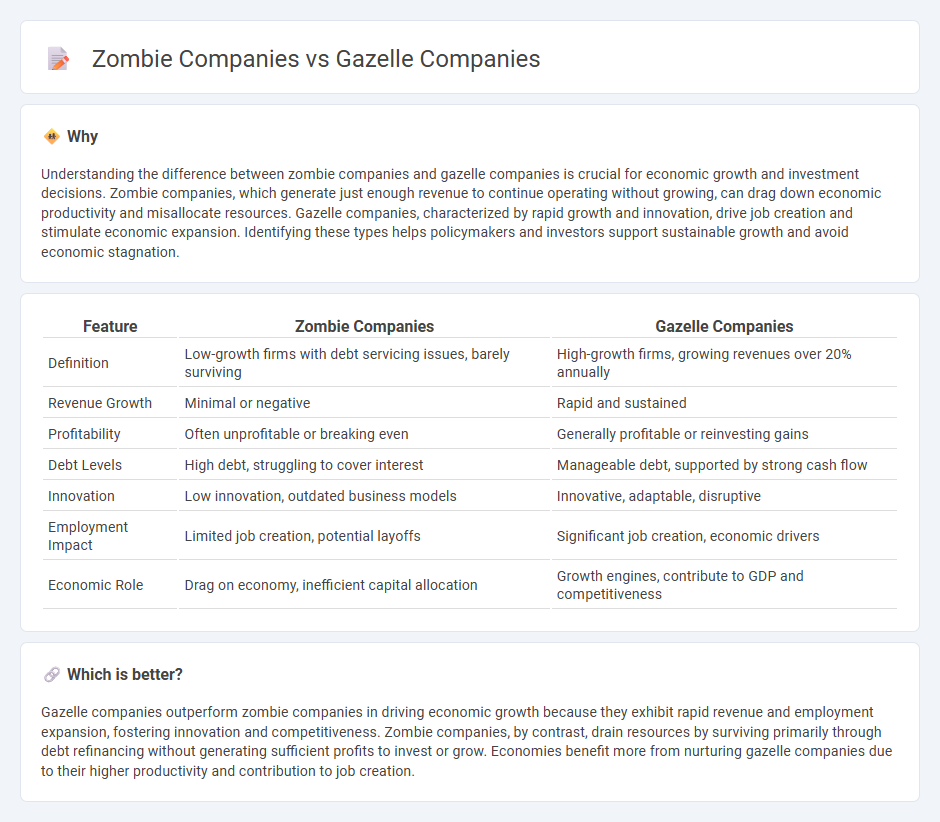

Understanding the difference between zombie companies and gazelle companies is crucial for economic growth and investment decisions. Zombie companies, which generate just enough revenue to continue operating without growing, can drag down economic productivity and misallocate resources. Gazelle companies, characterized by rapid growth and innovation, drive job creation and stimulate economic expansion. Identifying these types helps policymakers and investors support sustainable growth and avoid economic stagnation.

Comparison Table

| Feature | Zombie Companies | Gazelle Companies |

|---|---|---|

| Definition | Low-growth firms with debt servicing issues, barely surviving | High-growth firms, growing revenues over 20% annually |

| Revenue Growth | Minimal or negative | Rapid and sustained |

| Profitability | Often unprofitable or breaking even | Generally profitable or reinvesting gains |

| Debt Levels | High debt, struggling to cover interest | Manageable debt, supported by strong cash flow |

| Innovation | Low innovation, outdated business models | Innovative, adaptable, disruptive |

| Employment Impact | Limited job creation, potential layoffs | Significant job creation, economic drivers |

| Economic Role | Drag on economy, inefficient capital allocation | Growth engines, contribute to GDP and competitiveness |

Which is better?

Gazelle companies outperform zombie companies in driving economic growth because they exhibit rapid revenue and employment expansion, fostering innovation and competitiveness. Zombie companies, by contrast, drain resources by surviving primarily through debt refinancing without generating sufficient profits to invest or grow. Economies benefit more from nurturing gazelle companies due to their higher productivity and contribution to job creation.

Connection

Zombie companies, characterized by their inability to cover debt servicing with current earnings, drain resources and limit economic growth, while gazelle companies, known for rapid scaling and high job creation, drive innovation and productivity. The persistence of zombie companies can distort market dynamics by hogging capital and credit, which otherwise could fuel growth in gazelle companies. Efficient reallocation of resources from zombified firms to high-potential gazelles strengthens economic dynamism and labor markets.

Key Terms

Growth Rate

Gazelle companies exhibit rapid revenue growth, typically exceeding 20% annually, driving innovation and job creation in dynamic markets. In contrast, zombie companies maintain low or stagnant growth rates, often relying on debt to sustain operations despite poor financial health. Discover how growth rate disparities impact economic resilience and investment strategies.

Profitability

Gazelle companies exhibit high profitability with rapid revenue growth often exceeding 20% annually, driven by innovation and efficient business models. Zombie companies struggle with profitability, often barely covering interest expenses and lacking the financial health to invest in growth or innovation. Explore deeper insights into how profitability metrics distinguish these dynamic gazelles from struggling zombies.

Debt Sustainability

Gazelle companies demonstrate robust debt sustainability by maintaining strong cash flow and growth metrics that support manageable leverage levels, in contrast to zombie companies, which struggle to cover interest payments and rely heavily on debt rollovers. Gazelles typically exhibit high revenue growth rates exceeding 20% annually, enabling them to reduce debt ratios and invest in expansion, whereas zombies show stagnant revenue and deteriorating debt-to-equity ratios, increasing financial risk. Explore detailed analyses of debt sustainability frameworks and sector-specific impacts to better understand these divergent business models.

Source and External Links

Gazelles: an endangered yet essential species of company - Gazelle companies are firms that achieve at least 20% annual sales growth over several years, representing a rare but vital driver of employment and economic growth, often concentrated in sectors like wholesale, retail, education, and real estate rather than just high-tech industries.

Decoding Company Growth with Gazelle | Blog - Lightcast - Gazelle is a platform that uses advanced algorithms and AI to index and predict the growth potential of companies, providing valuable data for investors, economic developers, and workforce strategists who need to identify fast-expanding businesses amidst vast, often opaque datasets.

What Is A Gazelle Company? - Dominic Monkhouse - In the US, gazelle companies make up only about 4% of all firms but are responsible for 70% of new job creation, typically defined by rapid revenue growth (often doubling revenue) and a minimum revenue threshold (e.g., $1 million).

dowidth.com

dowidth.com