Shadow bailouts involve unofficial financial support to failing institutions, often bypassing formal regulation to prevent systemic collapse. The lender of last resort is a central bank function providing emergency liquidity directly to solvent banks facing temporary liquidity shortages. Explore the distinctions and implications of these mechanisms to understand their roles in economic stability.

Why it is important

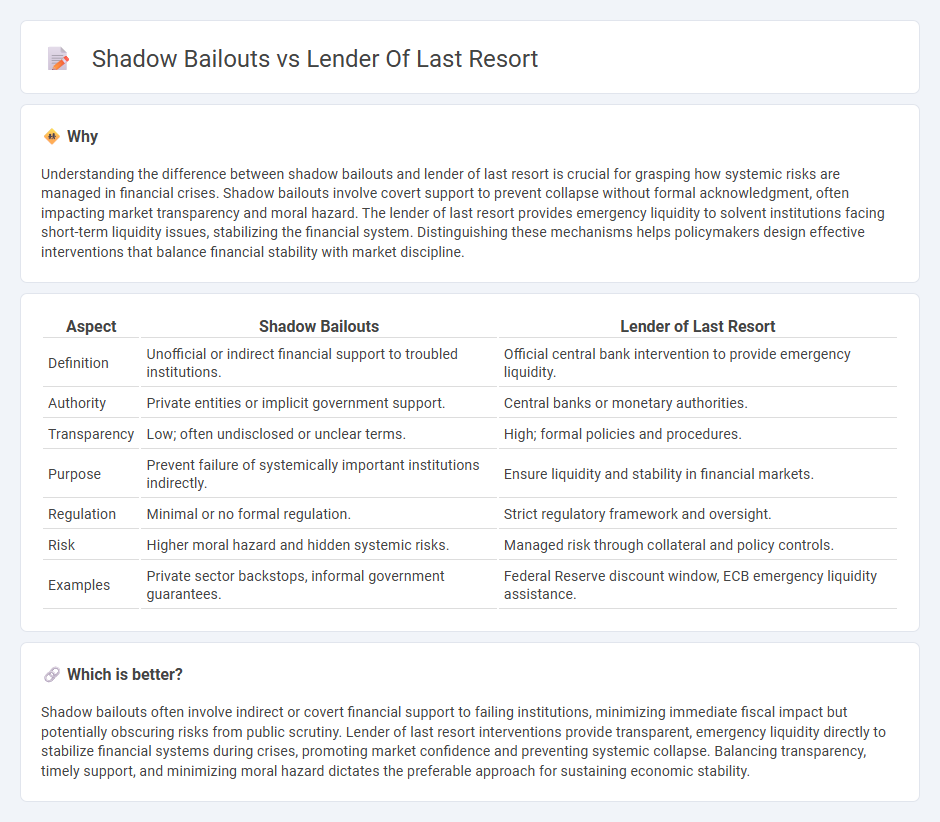

Understanding the difference between shadow bailouts and lender of last resort is crucial for grasping how systemic risks are managed in financial crises. Shadow bailouts involve covert support to prevent collapse without formal acknowledgment, often impacting market transparency and moral hazard. The lender of last resort provides emergency liquidity to solvent institutions facing short-term liquidity issues, stabilizing the financial system. Distinguishing these mechanisms helps policymakers design effective interventions that balance financial stability with market discipline.

Comparison Table

| Aspect | Shadow Bailouts | Lender of Last Resort |

|---|---|---|

| Definition | Unofficial or indirect financial support to troubled institutions. | Official central bank intervention to provide emergency liquidity. |

| Authority | Private entities or implicit government support. | Central banks or monetary authorities. |

| Transparency | Low; often undisclosed or unclear terms. | High; formal policies and procedures. |

| Purpose | Prevent failure of systemically important institutions indirectly. | Ensure liquidity and stability in financial markets. |

| Regulation | Minimal or no formal regulation. | Strict regulatory framework and oversight. |

| Risk | Higher moral hazard and hidden systemic risks. | Managed risk through collateral and policy controls. |

| Examples | Private sector backstops, informal government guarantees. | Federal Reserve discount window, ECB emergency liquidity assistance. |

Which is better?

Shadow bailouts often involve indirect or covert financial support to failing institutions, minimizing immediate fiscal impact but potentially obscuring risks from public scrutiny. Lender of last resort interventions provide transparent, emergency liquidity directly to stabilize financial systems during crises, promoting market confidence and preventing systemic collapse. Balancing transparency, timely support, and minimizing moral hazard dictates the preferable approach for sustaining economic stability.

Connection

Shadow bailouts occur when governments or central banks secretly support failing financial institutions to prevent systemic collapse, often bypassing formal legislative approval. The lender of last resort function is a central bank's role to provide emergency liquidity to solvent but illiquid banks, thereby stabilizing the financial system during crises. Both mechanisms aim to mitigate severe economic disruptions by ensuring liquidity and confidence in the banking sector, although shadow bailouts operate covertly while lender of last resort actions are officially mandated.

Key Terms

Central Bank

Central Banks act as lenders of last resort by providing emergency liquidity to stabilize financial institutions during crises, preventing systemic collapse through transparent and regulated mechanisms. Shadow bailouts occur when central banks indirectly support failing entities via unconventional measures, such as purchasing toxic assets or facilitating private sector rescues, often lacking clarity and accountability. Explore the nuanced roles and implications of central bank interventions in financial stability for deeper insights.

Liquidity Support

Lender of last resort refers to central banks providing emergency liquidity support to financial institutions facing short-term funding crises, ensuring market stability and preventing systemic collapse. Shadow bailouts involve covert financial assistance from governments or private entities to distressed firms outside formal regulatory frameworks, often lacking transparency and accountability. Explore further to understand the critical differences and implications of these liquidity support mechanisms.

Off-balance-sheet Intervention

Lender of last resort involves central banks providing emergency liquidity to solvent banks facing temporary liquidity crises, typically recorded on the balance sheet, whereas shadow bailouts often involve off-balance-sheet interventions such as special purpose vehicles (SPVs) or guarantees to support non-bank financial institutions without direct asset purchases. Off-balance-sheet mechanisms can obscure the extent of financial support, potentially masking government exposure and complicating risk assessment in the shadow banking system. Explore the detailed distinctions and implications of these interventions for a deeper understanding of financial stability mechanisms.

Source and External Links

What is a lender of last resort? - European Central Bank - A lender of last resort is typically a central bank that provides urgent liquidity to banks that cannot otherwise secure funding, especially during financial turmoil, to maintain financial system stability and prevent widespread bank runs, with the ECB and national central banks sharing this role in the euro area.

Lender of Last Resort - Corporate Finance Institute - The lender of last resort, usually the central bank, supplies liquidity to financial institutions facing crises to prevent panics and contagion, following classical theories that emphasize protecting the overall money supply rather than individual insolvent banks.

Lender of last resort - Wikipedia - A lender of last resort is a financial entity, generally a central bank, that provides liquidity to institutions unable to secure funds in the market, aiming to prevent economic disruption from bank runs and financial panics; historically, the Bank of England is a prime example of this role.

dowidth.com

dowidth.com