Shadow bailouts refer to indirect government interventions that support failing financial institutions or industries without explicit public announcements, often through regulatory forbearance or hidden guarantees. Fiscal stimulus involves direct government spending or tax cuts aimed at boosting economic activity and consumer demand during downturns. Explore the key differences and implications of shadow bailouts versus fiscal stimulus to understand their roles in economic recovery.

Why it is important

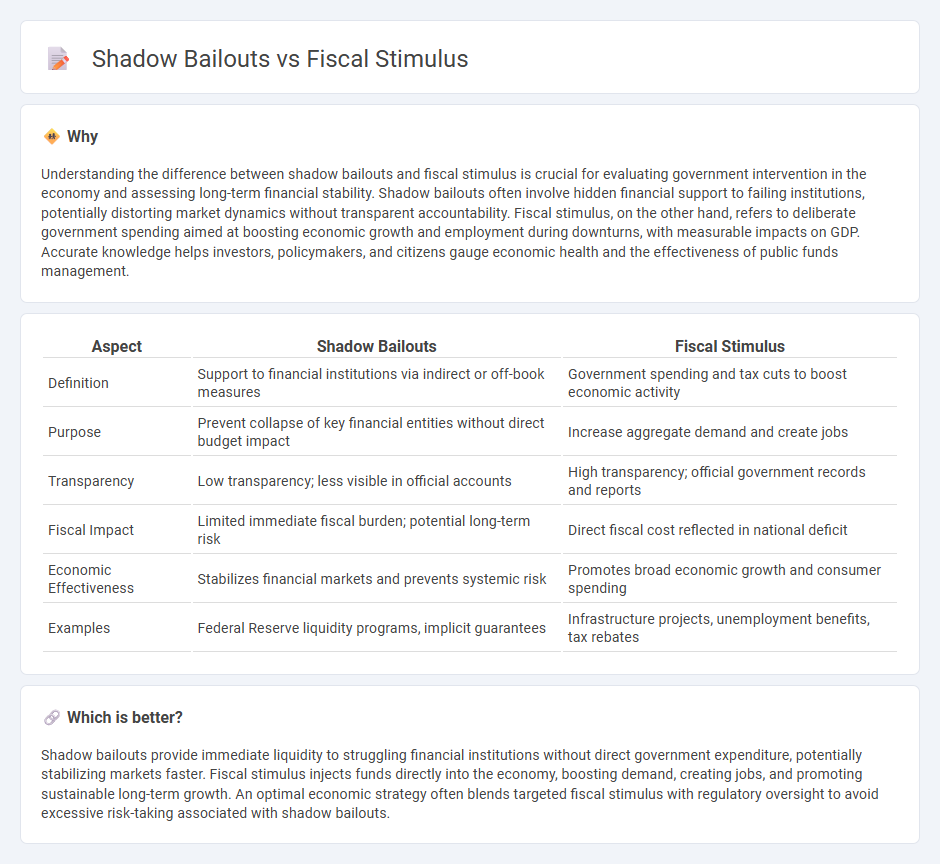

Understanding the difference between shadow bailouts and fiscal stimulus is crucial for evaluating government intervention in the economy and assessing long-term financial stability. Shadow bailouts often involve hidden financial support to failing institutions, potentially distorting market dynamics without transparent accountability. Fiscal stimulus, on the other hand, refers to deliberate government spending aimed at boosting economic growth and employment during downturns, with measurable impacts on GDP. Accurate knowledge helps investors, policymakers, and citizens gauge economic health and the effectiveness of public funds management.

Comparison Table

| Aspect | Shadow Bailouts | Fiscal Stimulus |

|---|---|---|

| Definition | Support to financial institutions via indirect or off-book measures | Government spending and tax cuts to boost economic activity |

| Purpose | Prevent collapse of key financial entities without direct budget impact | Increase aggregate demand and create jobs |

| Transparency | Low transparency; less visible in official accounts | High transparency; official government records and reports |

| Fiscal Impact | Limited immediate fiscal burden; potential long-term risk | Direct fiscal cost reflected in national deficit |

| Economic Effectiveness | Stabilizes financial markets and prevents systemic risk | Promotes broad economic growth and consumer spending |

| Examples | Federal Reserve liquidity programs, implicit guarantees | Infrastructure projects, unemployment benefits, tax rebates |

Which is better?

Shadow bailouts provide immediate liquidity to struggling financial institutions without direct government expenditure, potentially stabilizing markets faster. Fiscal stimulus injects funds directly into the economy, boosting demand, creating jobs, and promoting sustainable long-term growth. An optimal economic strategy often blends targeted fiscal stimulus with regulatory oversight to avoid excessive risk-taking associated with shadow bailouts.

Connection

Shadow bailouts and fiscal stimulus are interconnected through their roles in stabilizing economies during financial crises by channeling government resources to support struggling sectors. Shadow bailouts often involve indirect or less transparent financial support mechanisms, complementing fiscal stimulus measures such as increased public spending and tax relief to boost aggregate demand. Both tools aim to mitigate economic downturns, maintain liquidity, and restore market confidence by preventing systemic collapse and encouraging investment.

Key Terms

Government Spending

Government spending plays a crucial role in fiscal stimulus efforts by directly injecting funds into the economy to boost demand, create jobs, and support public services. In contrast, shadow bailouts involve indirect government interventions through financial systems, such as guarantees and off-balance-sheet liabilities, which may obscure true fiscal risks. Explore more about the economic impacts and policy implications of government spending in fiscal stimulus versus shadow bailouts.

Off-Balance-Sheet Support

Fiscal stimulus injects liquidity directly into the economy through government spending and tax relief, boosting demand and economic activity. Shadow bailouts involve off-balance-sheet support where governments provide indirect financial assistance to struggling firms via guarantees, loans, or asset purchases that do not appear immediately in official budgets. Explore the complexities and economic implications of these support mechanisms to understand their long-term fiscal impact.

Moral Hazard

Fiscal stimulus aims to boost economic activity by injecting government funds into the economy, whereas shadow bailouts involve indirect financial support to distressed institutions, often without public transparency. Both approaches can heighten moral hazard by encouraging risky behavior if entities expect future rescues without bearing full consequences. Explore the implications of these mechanisms on economic stability and risk management to understand their long-term effects.

Source and External Links

What characteristics make fiscal stimulus most effective? - Fiscal stimulus, such as tax cuts or spending increases, raises output and incomes short-term by boosting demand, and is most effective when timely, temporary, and targeted to those likely to spend the funds quickly rather than save them.

Glossary:Fiscal stimulus - Statistics Explained - Eurostat - Fiscal stimulus involves government actions like increased public spending or tax reductions aimed at economic growth by creating jobs or increasing purchasing power.

Fiscal Policy: Taking and Giving Away - The effectiveness of fiscal stimulus depends on size, timing, composition, and duration, with spending measures generally having larger multipliers than tax cuts and best outcomes when fiscal position is sustainable and monetary policy accommodative.

dowidth.com

dowidth.com