The economy experiences shifts influenced by consumer behavior changes, known as vibe shifts, and traditional business cycle turning points marked by fluctuations in GDP, employment, and inflation. Vibe shifts often signal long-term transformations in market sentiment and spending patterns, while business cycles reflect short-term economic expansions and contractions driven by macroeconomic factors. Explore deeper insights into how these forces shape financial markets and business strategies.

Why it is important

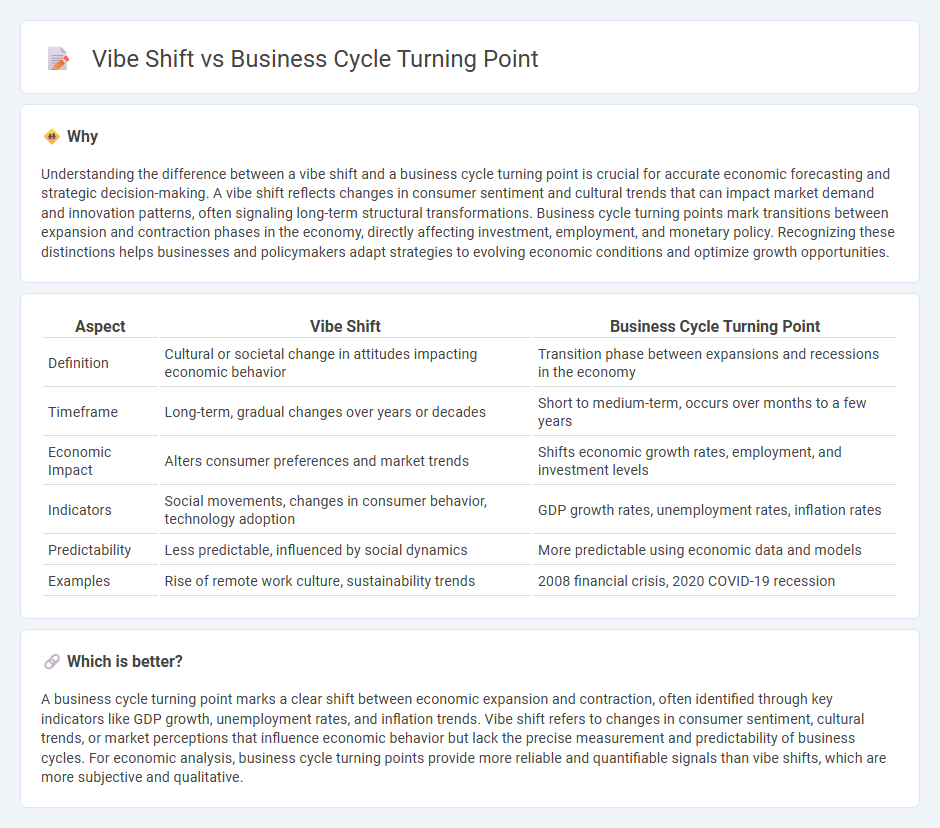

Understanding the difference between a vibe shift and a business cycle turning point is crucial for accurate economic forecasting and strategic decision-making. A vibe shift reflects changes in consumer sentiment and cultural trends that can impact market demand and innovation patterns, often signaling long-term structural transformations. Business cycle turning points mark transitions between expansion and contraction phases in the economy, directly affecting investment, employment, and monetary policy. Recognizing these distinctions helps businesses and policymakers adapt strategies to evolving economic conditions and optimize growth opportunities.

Comparison Table

| Aspect | Vibe Shift | Business Cycle Turning Point |

|---|---|---|

| Definition | Cultural or societal change in attitudes impacting economic behavior | Transition phase between expansions and recessions in the economy |

| Timeframe | Long-term, gradual changes over years or decades | Short to medium-term, occurs over months to a few years |

| Economic Impact | Alters consumer preferences and market trends | Shifts economic growth rates, employment, and investment levels |

| Indicators | Social movements, changes in consumer behavior, technology adoption | GDP growth rates, unemployment rates, inflation rates |

| Predictability | Less predictable, influenced by social dynamics | More predictable using economic data and models |

| Examples | Rise of remote work culture, sustainability trends | 2008 financial crisis, 2020 COVID-19 recession |

Which is better?

A business cycle turning point marks a clear shift between economic expansion and contraction, often identified through key indicators like GDP growth, unemployment rates, and inflation trends. Vibe shift refers to changes in consumer sentiment, cultural trends, or market perceptions that influence economic behavior but lack the precise measurement and predictability of business cycles. For economic analysis, business cycle turning points provide more reliable and quantifiable signals than vibe shifts, which are more subjective and qualitative.

Connection

Vibe shifts reflect changes in consumer attitudes and cultural trends that influence market demand and business strategies. These shifts can signal emerging opportunities or risks, often aligning with business cycle turning points such as recessions or expansions. Recognizing vibe shifts helps businesses anticipate economic transitions, optimize investments, and adapt to evolving market conditions.

Key Terms

Recession

Business cycle turning points mark transitions between phases such as expansion, peak, recession, and recovery, reflecting macroeconomic shifts in GDP, employment, and production. Vibe shifts capture changes in consumer sentiment and cultural mood that can precede or intensify economic recessions by influencing spending behavior and market confidence. Explore deeper insights into how these concepts interplay to forecast and navigate recessions effectively.

Consumer Sentiment

Business cycle turning points mark phases where economic indicators such as GDP growth, unemployment rates, and inflation pivot, significantly influencing consumer sentiment and spending behavior. A vibe shift refers to rapid, often cultural or psychological changes in consumer attitudes and preferences that can precede or amplify economic trends without immediate macroeconomic shifts. Explore the intricate links between consumer sentiment, business cycles, and vibe shifts to understand market dynamics more deeply.

Leading Indicators

Leading indicators such as manufacturing orders, consumer confidence indexes, and stock market performance provide critical signals for predicting business cycle turning points by highlighting economic expansions or contractions ahead of time. A vibe shift, reflecting sudden changes in consumer sentiment or cultural trends, can complement these indicators by signaling shifts in demand patterns that influence the economic cycle. Explore how integrating leading economic indicators with social sentiment analysis improves forecasting accuracy for market and business strategy adjustments.

Source and External Links

Dating Business Cycle Turning Points - This paper introduces formal quantitative algorithms, including recession probability indexes, to identify business cycle turning points using real-time GDP and multiple economic indicators.

How Are Business Cycles Measured? - The Bry-Boschan algorithm applies systematic rules to detect peaks and troughs in economic data, providing a business cycle chronology that forms the basis for official recession dating by institutions such as the NBER.

Predicting Turning Points in Economic Activity - A common rule, popularized by Arthur Okun, defines a recession's beginning as the first of two consecutive quarters of decline in real GDP, and its end as the first of two consecutive quarters of real GDP growth, marking the turning points in the business cycle.

dowidth.com

dowidth.com