Shadow bailouts occur when governments or central banks support failing institutions through indirect financial assistance, often bypassing formal oversight and risk assessments, leading to moral hazard. Macroprudential regulation implements systemic risk controls by setting capital requirements, monitoring financial institutions, and preventing asset bubbles to ensure overall economic stability. Explore this topic further to understand how these approaches impact financial resilience and economic policy.

Why it is important

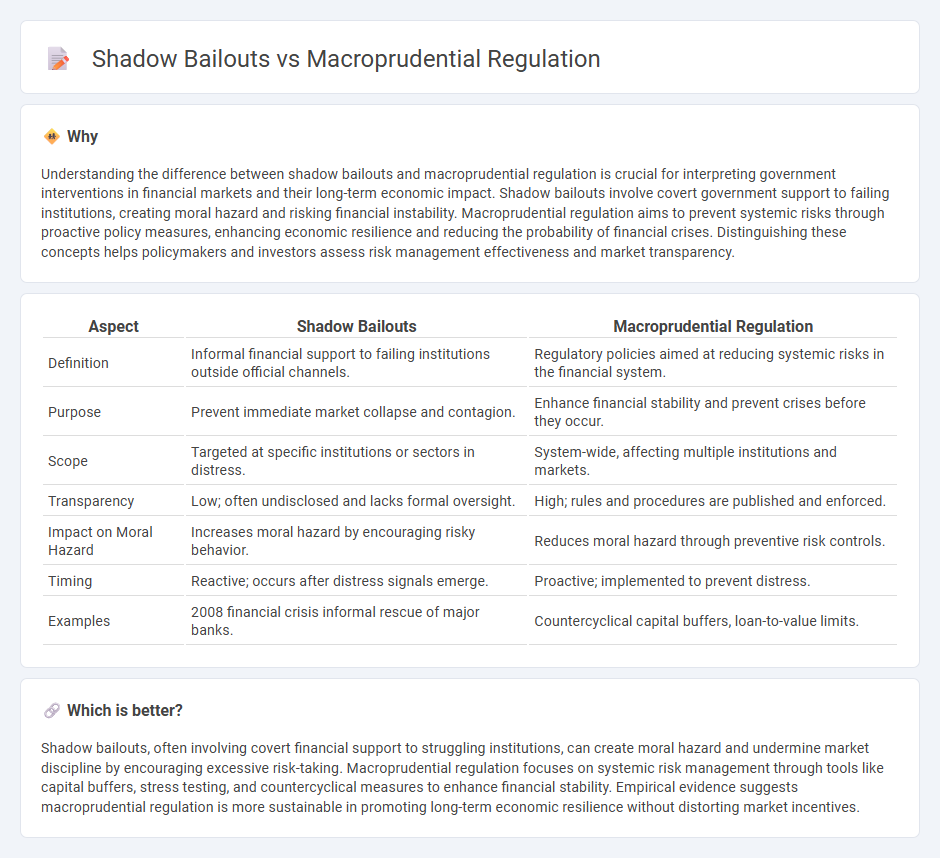

Understanding the difference between shadow bailouts and macroprudential regulation is crucial for interpreting government interventions in financial markets and their long-term economic impact. Shadow bailouts involve covert government support to failing institutions, creating moral hazard and risking financial instability. Macroprudential regulation aims to prevent systemic risks through proactive policy measures, enhancing economic resilience and reducing the probability of financial crises. Distinguishing these concepts helps policymakers and investors assess risk management effectiveness and market transparency.

Comparison Table

| Aspect | Shadow Bailouts | Macroprudential Regulation |

|---|---|---|

| Definition | Informal financial support to failing institutions outside official channels. | Regulatory policies aimed at reducing systemic risks in the financial system. |

| Purpose | Prevent immediate market collapse and contagion. | Enhance financial stability and prevent crises before they occur. |

| Scope | Targeted at specific institutions or sectors in distress. | System-wide, affecting multiple institutions and markets. |

| Transparency | Low; often undisclosed and lacks formal oversight. | High; rules and procedures are published and enforced. |

| Impact on Moral Hazard | Increases moral hazard by encouraging risky behavior. | Reduces moral hazard through preventive risk controls. |

| Timing | Reactive; occurs after distress signals emerge. | Proactive; implemented to prevent distress. |

| Examples | 2008 financial crisis informal rescue of major banks. | Countercyclical capital buffers, loan-to-value limits. |

Which is better?

Shadow bailouts, often involving covert financial support to struggling institutions, can create moral hazard and undermine market discipline by encouraging excessive risk-taking. Macroprudential regulation focuses on systemic risk management through tools like capital buffers, stress testing, and countercyclical measures to enhance financial stability. Empirical evidence suggests macroprudential regulation is more sustainable in promoting long-term economic resilience without distorting market incentives.

Connection

Shadow bailouts influence macroprudential regulation by raising concerns about hidden financial system risks that evade traditional oversight. Macroprudential policies adapt to address these off-balance-sheet support mechanisms, aiming to enhance systemic resilience and prevent moral hazard. Effective regulation incorporates transparency measures to limit shadow bailouts' impact on economic stability and market discipline.

Key Terms

Macroeconomic Stability

Macroprudential regulation aims to enhance macroeconomic stability by addressing systemic risks through tools like capital requirements, countercyclical buffers, and stress testing of financial institutions. Shadow bailouts, often involving implicit or covert government support to large financial entities during crises, can undermine market discipline and exacerbate moral hazard concerns. Explore deeper insights into their comparative impact on financial system resilience and policy effectiveness.

Systemic Risk

Macroprudential regulation aims to mitigate systemic risk by monitoring and controlling financial institutions' interconnectedness and vulnerabilities to prevent market-wide crises. Shadow bailouts refer to indirect government interventions that support failing institutions without formal rescue announcements, potentially exacerbating moral hazard and systemic risk. Explore the mechanisms and impacts of these regulatory approaches to better understand their role in financial stability.

Regulatory Arbitrage

Macroprudential regulation aims to strengthen the financial system by reducing systemic risks through tools such as capital buffers and stress testing, ensuring banks maintain resilience against economic shocks. Shadow bailouts, often occurring in less regulated areas like the shadow banking sector, result from implicit government guarantees that create regulatory arbitrage opportunities by shifting risks off the formal financial system. Explore deeper insights on how regulatory arbitrage influences financial stability and the evolving landscape of macroprudential policies.

Source and External Links

Macroprudential regulation: history, theory and policy - Macroprudential regulation addresses systemic financial risks arising from interconnectedness, strategic complementarities, and pecuniary externalities that individual agents do not internalize, justifying policies to mitigate these market failures and enhance financial stability.

What are macroprudential tools? - Macroprudential policies aim to reduce systemic risk by limiting financial vulnerabilities across the whole system, for example through higher capital requirements for systemically important banks, contrasting with microprudential regulation which focuses on individual firm safety.

Macroprudential regulation - Macroprudential regulation seeks to mitigate risk to the entire financial system by complementing microprudential efforts, focusing on systemic risk factors such as collective behavior and common exposures across institutions to avoid widespread financial distress and economic costs.

dowidth.com

dowidth.com