Shrinkflation and inflation both impact consumer purchasing power but differ in their mechanisms; shrinkflation reduces product sizes while maintaining prices, whereas inflation increases overall price levels across goods and services. Companies often use shrinkflation as a subtle response to rising production costs, making it less noticeable to consumers compared to overt inflation. Explore the nuances of shrinkflation versus inflation to understand their effects on your budget and market trends.

Why it is important

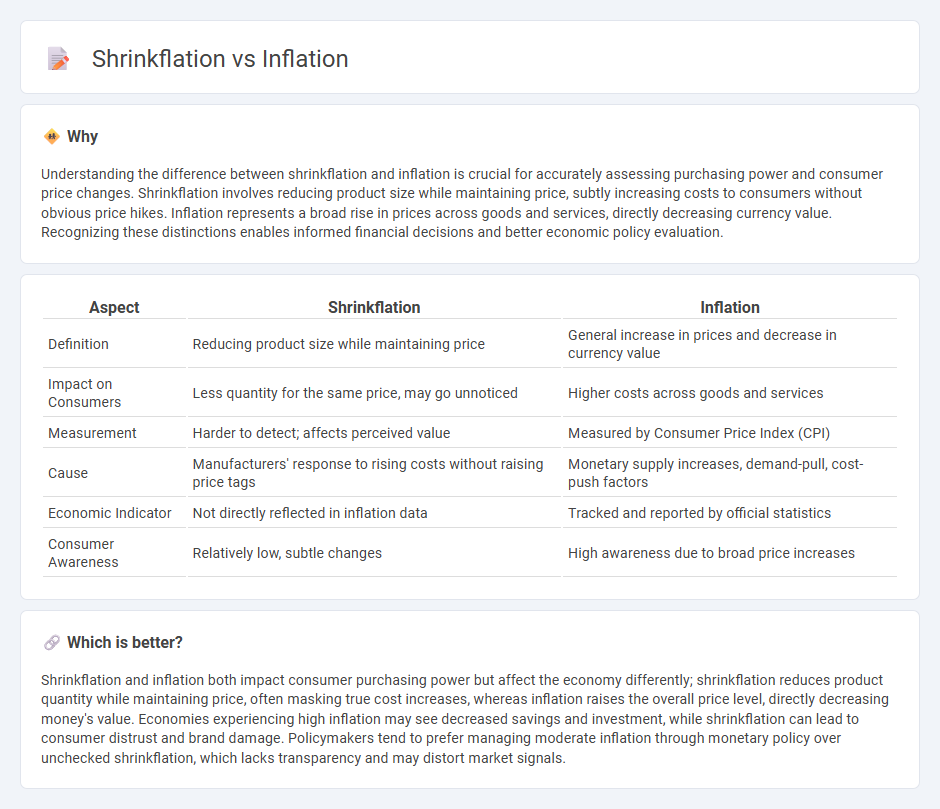

Understanding the difference between shrinkflation and inflation is crucial for accurately assessing purchasing power and consumer price changes. Shrinkflation involves reducing product size while maintaining price, subtly increasing costs to consumers without obvious price hikes. Inflation represents a broad rise in prices across goods and services, directly decreasing currency value. Recognizing these distinctions enables informed financial decisions and better economic policy evaluation.

Comparison Table

| Aspect | Shrinkflation | Inflation |

|---|---|---|

| Definition | Reducing product size while maintaining price | General increase in prices and decrease in currency value |

| Impact on Consumers | Less quantity for the same price, may go unnoticed | Higher costs across goods and services |

| Measurement | Harder to detect; affects perceived value | Measured by Consumer Price Index (CPI) |

| Cause | Manufacturers' response to rising costs without raising price tags | Monetary supply increases, demand-pull, cost-push factors |

| Economic Indicator | Not directly reflected in inflation data | Tracked and reported by official statistics |

| Consumer Awareness | Relatively low, subtle changes | High awareness due to broad price increases |

Which is better?

Shrinkflation and inflation both impact consumer purchasing power but affect the economy differently; shrinkflation reduces product quantity while maintaining price, often masking true cost increases, whereas inflation raises the overall price level, directly decreasing money's value. Economies experiencing high inflation may see decreased savings and investment, while shrinkflation can lead to consumer distrust and brand damage. Policymakers tend to prefer managing moderate inflation through monetary policy over unchecked shrinkflation, which lacks transparency and may distort market signals.

Connection

Shrinkflation and inflation are interconnected as shrinkflation occurs when manufacturers reduce product sizes or quantities while maintaining prices, effectively increasing the cost per unit without raising the sticker price. Inflation drives up production and raw material costs, prompting companies to adopt shrinkflation as a subtle method to preserve profit margins and manage consumer price sensitivity. This hidden price increase contributes to the overall inflationary pressures experienced in the economy.

Key Terms

Price Levels

Inflation refers to the general rise in price levels across most goods and services, reducing purchasing power over time. Shrinkflation occurs when product sizes decrease while prices remain stable or increase, effectively raising the price per unit without obvious price hikes. Explore how these concepts impact consumer spending and market trends in greater detail.

Purchasing Power

Inflation reduces the purchasing power of money by increasing prices across goods and services, causing consumers to pay more for the same items. Shrinkflation, a subtle form of inflation, decreases product sizes or quantities while maintaining prices, effectively eroding value without immediate price hikes. Explore how these phenomena impact your budget and strategies to protect purchasing power.

Product Size/Quantity

Shrinkflation occurs when product size or quantity decreases while the price remains the same, effectively increasing the cost per unit without overtly raising prices. Inflation generally causes prices to rise across the board, including for goods whose sizes or quantities remain stable. Explore further to understand how these phenomena impact your purchasing power and consumer choices.

Source and External Links

Inflation - Inflation refers to the increase in the average price level of goods and services over time, reducing the purchasing power of money.

United States Inflation Rate - The U.S. inflation rate has been rising, with expectations for further increases due to higher import costs and a rebound in gasoline prices.

Inflation: Prices on the Rise - Inflation often results from monetary policy or supply and demand imbalances, affecting the purchasing power of money and economic stability.

dowidth.com

dowidth.com