Micro-dosing spending targets small-scale, frequent financial injections aimed at stimulating localized economic activity, contrasting with large-scale stimulus packages designed to boost broader economic growth quickly. This approach allows for more precise allocation of resources, potentially increasing efficiency in responding to specific sectoral needs and consumer behavior patterns. Explore the nuances and impacts of these economic strategies to understand their roles in modern fiscal policy.

Why it is important

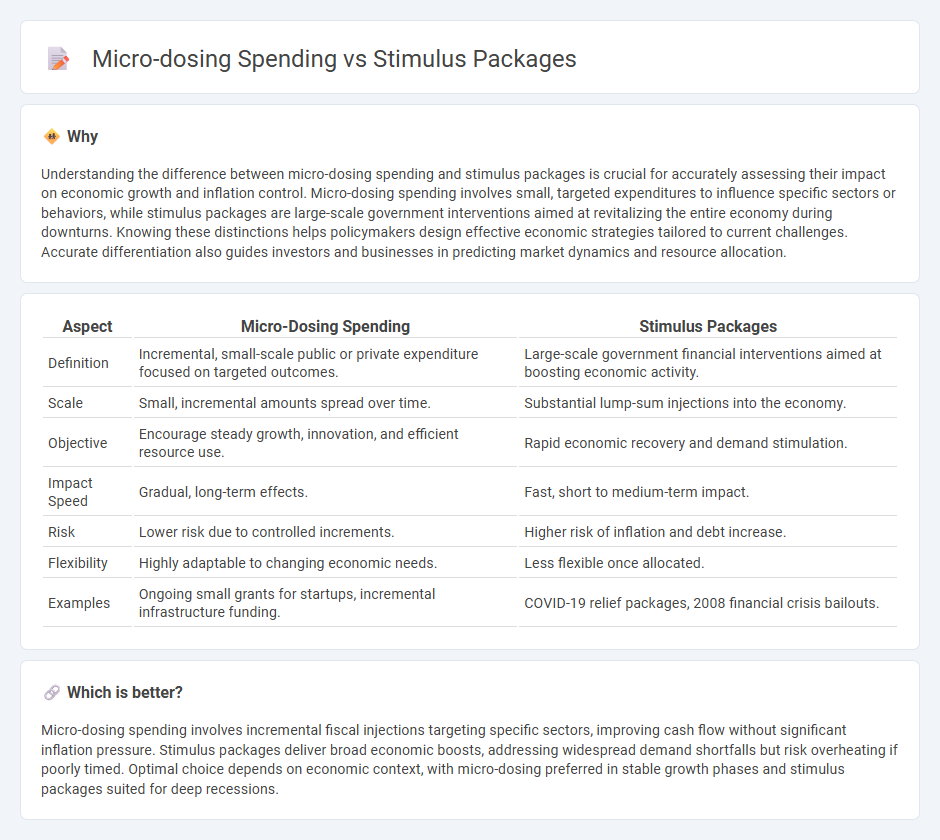

Understanding the difference between micro-dosing spending and stimulus packages is crucial for accurately assessing their impact on economic growth and inflation control. Micro-dosing spending involves small, targeted expenditures to influence specific sectors or behaviors, while stimulus packages are large-scale government interventions aimed at revitalizing the entire economy during downturns. Knowing these distinctions helps policymakers design effective economic strategies tailored to current challenges. Accurate differentiation also guides investors and businesses in predicting market dynamics and resource allocation.

Comparison Table

| Aspect | Micro-Dosing Spending | Stimulus Packages |

|---|---|---|

| Definition | Incremental, small-scale public or private expenditure focused on targeted outcomes. | Large-scale government financial interventions aimed at boosting economic activity. |

| Scale | Small, incremental amounts spread over time. | Substantial lump-sum injections into the economy. |

| Objective | Encourage steady growth, innovation, and efficient resource use. | Rapid economic recovery and demand stimulation. |

| Impact Speed | Gradual, long-term effects. | Fast, short to medium-term impact. |

| Risk | Lower risk due to controlled increments. | Higher risk of inflation and debt increase. |

| Flexibility | Highly adaptable to changing economic needs. | Less flexible once allocated. |

| Examples | Ongoing small grants for startups, incremental infrastructure funding. | COVID-19 relief packages, 2008 financial crisis bailouts. |

Which is better?

Micro-dosing spending involves incremental fiscal injections targeting specific sectors, improving cash flow without significant inflation pressure. Stimulus packages deliver broad economic boosts, addressing widespread demand shortfalls but risk overheating if poorly timed. Optimal choice depends on economic context, with micro-dosing preferred in stable growth phases and stimulus packages suited for deep recessions.

Connection

Micro-dosing spending involves distributing small, consistent amounts of funds to stimulate targeted economic activities, aligning closely with the strategic deployment of stimulus packages designed to maximize economic impact. Stimulus packages often incorporate micro-dosing by allocating funds incrementally to sectors like small businesses and infrastructure, fostering steady economic growth without triggering inflation. This approach enhances fiscal efficiency, ensuring that government expenditure adapts dynamically to real-time economic needs and mitigates the risks of large-scale funding injections.

Key Terms

Fiscal Policy

Fiscal policy employs stimulus packages to boost economic activity through increased government spending and tax cuts, targeting large-scale infrastructure projects and social programs to stimulate demand. In contrast, micro-dosing spending involves smaller, frequent injections of funds aimed at sustaining consumer confidence and incrementally supporting local businesses. Explore the nuanced impacts of these approaches on economic recovery and growth by learning more about their fiscal mechanisms.

Aggregate Demand

Stimulus packages significantly boost Aggregate Demand by increasing government spending and household incomes, which drives higher consumption and investment. Micro-dosing spending, involving smaller, frequent fiscal injections, maintains consistent demand but may lack the immediate impact necessary to counteract sharp economic downturns. Explore deeper insights into how these fiscal strategies differently influence Aggregate Demand and economic recovery.

Marginal Propensity to Consume

Marginal Propensity to Consume (MPC) significantly influences the effectiveness of stimulus packages compared to micro-dosing spending, with larger, lump-sum payments generally yielding higher immediate consumption boosts due to increased liquidity for consumers. Micro-dosing spending, characterized by smaller, frequent disbursements, may sustain consumption over time but often results in a lower MPC per transaction due to reduced perceived immediacy and urgency. Explore detailed analysis to understand how optimal spending strategies can leverage MPC for maximizing economic stimulus impact.

Source and External Links

History of Stimulus Packages | Center Forward - The Coronavirus Aid, Relief, and Economic Security (CARES) Act was a $2 trillion stimulus package providing funds to individuals, businesses, healthcare, and government entities to combat the economic impacts of COVID-19, including direct payments to families and loans to small businesses and airlines.

Economic Stimulus Package - Overview, How It Works, Risks - An economic stimulus package is a set of government measures such as lowering interest rates and increasing spending designed to stimulate a struggling economy, typically through fiscal and monetary policies influenced by Keynesian economic principles.

Stimulus package - Wikipedia - Stimulus packages are government programs aimed at economic stimulus, with notable examples including the U.S. CARES Act (2020) and American Recovery and Reinvestment Act (2009), as well as similar programs in other countries to boost employment and economic growth.

dowidth.com

dowidth.com