Account aggregation consolidates financial data from multiple accounts into a single view, enhancing personal finance management. Payment initiation enables customers to directly authorize payments from their bank accounts, streamlining transactions without using traditional card networks. Explore how these fintech innovations transform banking efficiency and security.

Why it is important

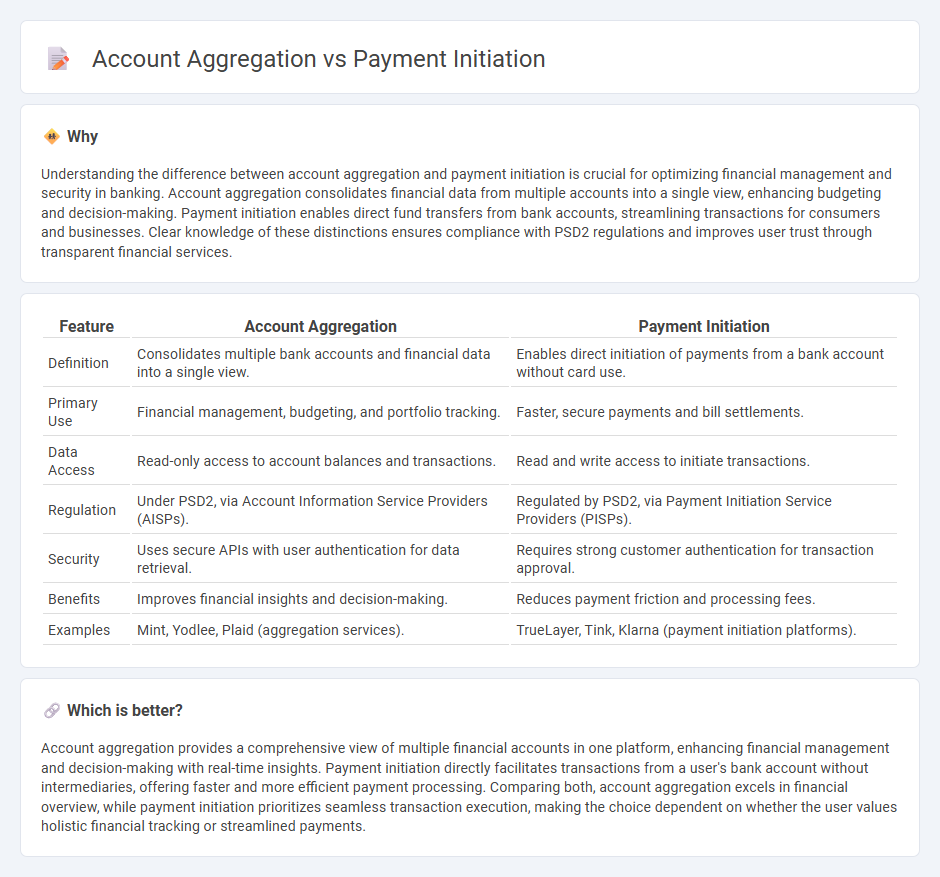

Understanding the difference between account aggregation and payment initiation is crucial for optimizing financial management and security in banking. Account aggregation consolidates financial data from multiple accounts into a single view, enhancing budgeting and decision-making. Payment initiation enables direct fund transfers from bank accounts, streamlining transactions for consumers and businesses. Clear knowledge of these distinctions ensures compliance with PSD2 regulations and improves user trust through transparent financial services.

Comparison Table

| Feature | Account Aggregation | Payment Initiation |

|---|---|---|

| Definition | Consolidates multiple bank accounts and financial data into a single view. | Enables direct initiation of payments from a bank account without card use. |

| Primary Use | Financial management, budgeting, and portfolio tracking. | Faster, secure payments and bill settlements. |

| Data Access | Read-only access to account balances and transactions. | Read and write access to initiate transactions. |

| Regulation | Under PSD2, via Account Information Service Providers (AISPs). | Regulated by PSD2, via Payment Initiation Service Providers (PISPs). |

| Security | Uses secure APIs with user authentication for data retrieval. | Requires strong customer authentication for transaction approval. |

| Benefits | Improves financial insights and decision-making. | Reduces payment friction and processing fees. |

| Examples | Mint, Yodlee, Plaid (aggregation services). | TrueLayer, Tink, Klarna (payment initiation platforms). |

Which is better?

Account aggregation provides a comprehensive view of multiple financial accounts in one platform, enhancing financial management and decision-making with real-time insights. Payment initiation directly facilitates transactions from a user's bank account without intermediaries, offering faster and more efficient payment processing. Comparing both, account aggregation excels in financial overview, while payment initiation prioritizes seamless transaction execution, making the choice dependent on whether the user values holistic financial tracking or streamlined payments.

Connection

Account aggregation consolidates financial data from multiple bank accounts into a single interface, enhancing user visibility and management. Payment initiation leverages this aggregated data to facilitate seamless transactions directly from the user's accounts without redirecting to multiple banking platforms. Together, account aggregation and payment initiation streamline financial operations, improve user experience, and support open banking frameworks.

Key Terms

**Payment Initiation:**

Payment initiation involves securely authorizing transactions directly from a user's bank account, enabling seamless and real-time fund transfers without the need for cards or intermediaries. This process enhances transaction speed, reduces costs, and improves security through strong customer authentication protocols. Discover how payment initiation transforms digital payments and drives innovation in financial services.

SEPA Credit Transfer

Payment initiation allows users to directly initiate SEPA Credit Transfers from their bank accounts via third-party providers, enhancing transaction speed and convenience. Account aggregation consolidates financial data from multiple SEPA accounts into a single interface, providing users comprehensive visibility but without enabling direct payments. Discover detailed comparisons and practical applications of SEPA Credit Transfer through payment initiation and account aggregation for better financial management.

Strong Customer Authentication (SCA)

Payment initiation services require Strong Customer Authentication (SCA) to verify user identity during fund transfers, ensuring secure transactions directly from bank accounts under PSD2 regulations. Account aggregation services, while accessing a consolidated view of multiple accounts, must also comply with SCA but primarily during login and consent processes rather than every data retrieval. Explore detailed insights on how SCA impacts these two fintech services and regulatory compliance.

Source and External Links

What is the difference between open banking payment initiation ... - Payment initiation service providers (PISPs) enable real-time payment instructions sent directly to a bank, allowing customers to pay by selecting their bank, authenticating, and confirming the payment without traditional card methods, thus offering a faster, often cheaper alternative.

What is open finance payment initiation and why you should care in ... - Payment initiation is an account-to-account payment method enabled by open banking APIs, allowing third parties to securely access a user's bank account and initiate payments directly, enhancing convenience and efficiency in digital payments for customers and merchants.

What is payment initiation, and what is it good for? - Tink - Payment initiation lets users authorize bank transfers directly through third-party services without leaving the platform, providing a seamless, low-cost payment experience that benefits both consumers and businesses by improving conversion and engagement.

dowidth.com

dowidth.com