Fraud orchestration integrates multiple security tools and data sources to streamline the detection and response to fraudulent activities across banking systems. Behavioral analytics examines user patterns and anomalies to identify potential fraud through deviations from normal behavior in real time. Explore how combining these technologies enhances fraud prevention strategies in modern banking.

Why it is important

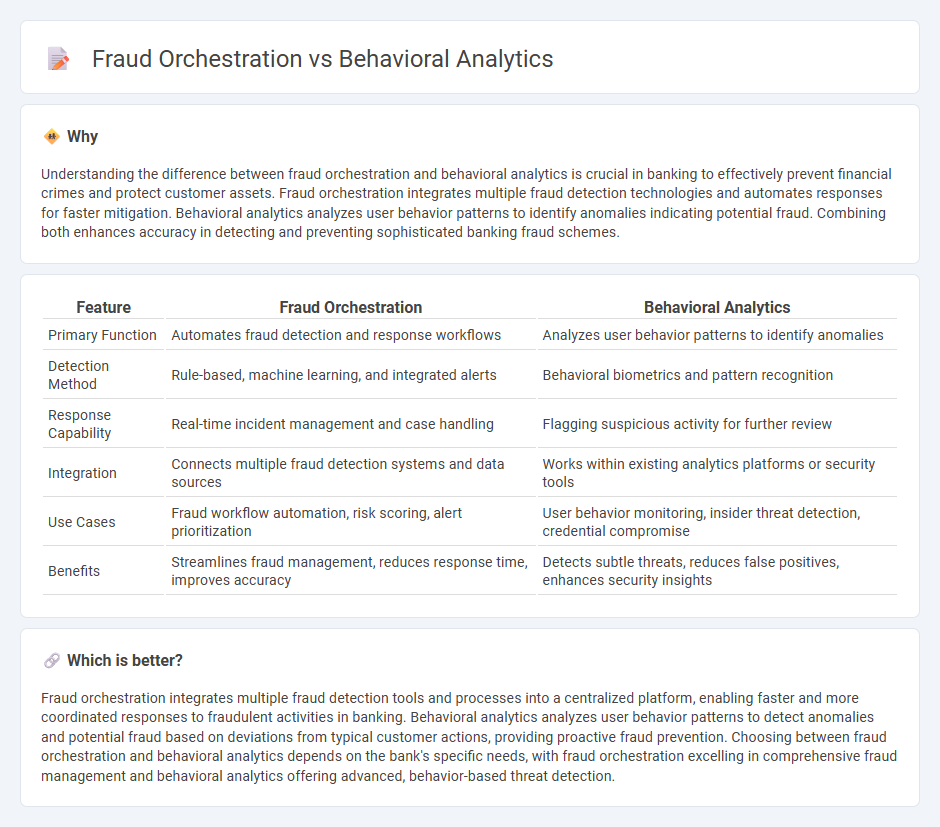

Understanding the difference between fraud orchestration and behavioral analytics is crucial in banking to effectively prevent financial crimes and protect customer assets. Fraud orchestration integrates multiple fraud detection technologies and automates responses for faster mitigation. Behavioral analytics analyzes user behavior patterns to identify anomalies indicating potential fraud. Combining both enhances accuracy in detecting and preventing sophisticated banking fraud schemes.

Comparison Table

| Feature | Fraud Orchestration | Behavioral Analytics |

|---|---|---|

| Primary Function | Automates fraud detection and response workflows | Analyzes user behavior patterns to identify anomalies |

| Detection Method | Rule-based, machine learning, and integrated alerts | Behavioral biometrics and pattern recognition |

| Response Capability | Real-time incident management and case handling | Flagging suspicious activity for further review |

| Integration | Connects multiple fraud detection systems and data sources | Works within existing analytics platforms or security tools |

| Use Cases | Fraud workflow automation, risk scoring, alert prioritization | User behavior monitoring, insider threat detection, credential compromise |

| Benefits | Streamlines fraud management, reduces response time, improves accuracy | Detects subtle threats, reduces false positives, enhances security insights |

Which is better?

Fraud orchestration integrates multiple fraud detection tools and processes into a centralized platform, enabling faster and more coordinated responses to fraudulent activities in banking. Behavioral analytics analyzes user behavior patterns to detect anomalies and potential fraud based on deviations from typical customer actions, providing proactive fraud prevention. Choosing between fraud orchestration and behavioral analytics depends on the bank's specific needs, with fraud orchestration excelling in comprehensive fraud management and behavioral analytics offering advanced, behavior-based threat detection.

Connection

Fraud orchestration leverages behavioral analytics to identify unusual patterns in customer transactions and activities, enhancing the detection of sophisticated fraud schemes. By integrating real-time behavioral data, banks can automate response strategies, reducing false positives and minimizing financial losses. This connection enables a proactive fraud prevention framework, improving security while maintaining seamless customer experiences.

Key Terms

Behavioral analytics:

Behavioral analytics leverages machine learning algorithms to analyze user behavior patterns, enabling early detection of anomalies indicative of fraud. This approach provides real-time insights by monitoring device usage, transaction habits, and login behaviors across multiple channels. Explore how advanced behavioral analytics can enhance your fraud prevention strategy and reduce false positives.

User activity monitoring

Behavioral analytics leverages machine learning algorithms to analyze user activity patterns, detecting anomalies indicative of potential fraud by monitoring login times, transaction behaviors, and device usage. Fraud orchestration integrates multiple data sources and automated response strategies to coordinate fraud detection and prevention workflows in real-time, enhancing efficiency in managing user activity risks. Discover how combining behavioral analytics with fraud orchestration can significantly strengthen your security posture and reduce fraudulent activities.

Anomaly detection

Behavioral analytics uses machine learning to identify unusual user patterns by analyzing historical data and real-time behavior, enhancing anomaly detection accuracy. Fraud orchestration integrates multiple detection tools, including behavioral analytics, to automate and coordinate responses in complex threat environments. Explore detailed comparisons to understand how each approach strengthens anomaly detection frameworks.

Source and External Links

The Role of Behavioral Analytics in Cybersecurity - Behavioral analytics analyzes patterns in user and entity activities using AI and machine learning to detect unusual behaviors and potential threats in cybersecurity.

What is Behavioral Analytics? - Behavioral analytics is the study of online customer behaviors, tracking interactions with products or services to improve engagement, retention, and conversions by analyzing event data from websites, apps, and other digital platforms.

What is behavioral analytics? - Behavioral analytics involves collecting and analyzing large amounts of user data to identify patterns and trends, leveraging AI and big data for actionable insights across industries like eCommerce, cybersecurity, and healthcare.

dowidth.com

dowidth.com