Income streaming focuses on generating consistent cash flow through investments like dividends and interest, providing steady revenue for banks and clients. Asset management fees are charged based on the total value of assets under management, aligning bank earnings with portfolio growth and client success. Explore the differences between income streaming and asset management fees to optimize your financial strategy.

Why it is important

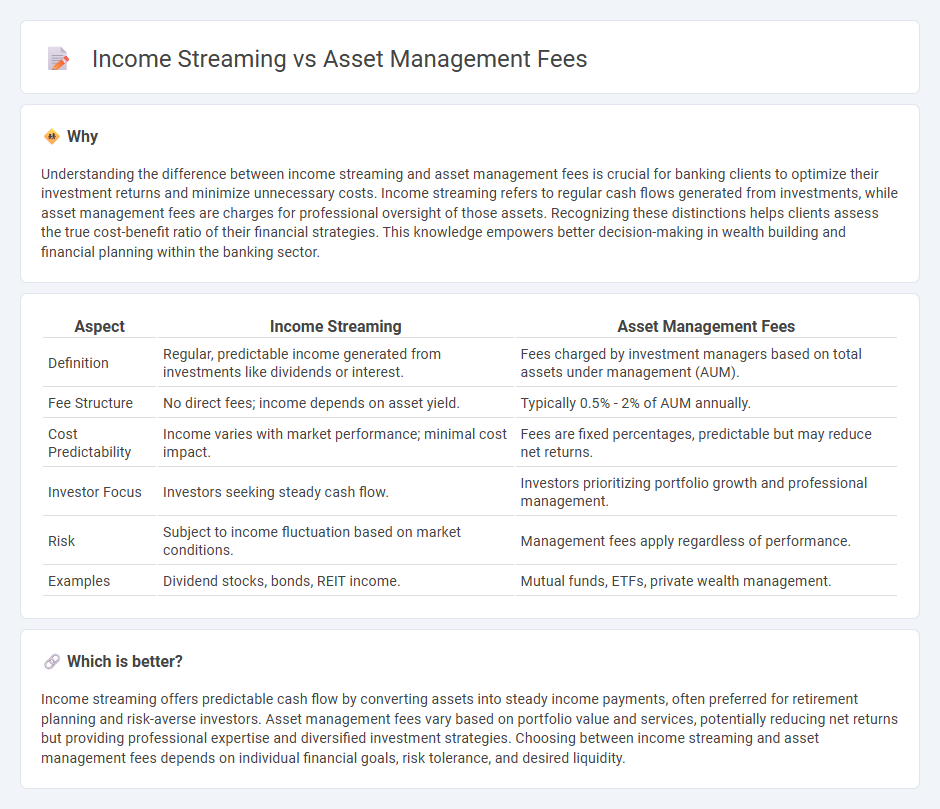

Understanding the difference between income streaming and asset management fees is crucial for banking clients to optimize their investment returns and minimize unnecessary costs. Income streaming refers to regular cash flows generated from investments, while asset management fees are charges for professional oversight of those assets. Recognizing these distinctions helps clients assess the true cost-benefit ratio of their financial strategies. This knowledge empowers better decision-making in wealth building and financial planning within the banking sector.

Comparison Table

| Aspect | Income Streaming | Asset Management Fees |

|---|---|---|

| Definition | Regular, predictable income generated from investments like dividends or interest. | Fees charged by investment managers based on total assets under management (AUM). |

| Fee Structure | No direct fees; income depends on asset yield. | Typically 0.5% - 2% of AUM annually. |

| Cost Predictability | Income varies with market performance; minimal cost impact. | Fees are fixed percentages, predictable but may reduce net returns. |

| Investor Focus | Investors seeking steady cash flow. | Investors prioritizing portfolio growth and professional management. |

| Risk | Subject to income fluctuation based on market conditions. | Management fees apply regardless of performance. |

| Examples | Dividend stocks, bonds, REIT income. | Mutual funds, ETFs, private wealth management. |

Which is better?

Income streaming offers predictable cash flow by converting assets into steady income payments, often preferred for retirement planning and risk-averse investors. Asset management fees vary based on portfolio value and services, potentially reducing net returns but providing professional expertise and diversified investment strategies. Choosing between income streaming and asset management fees depends on individual financial goals, risk tolerance, and desired liquidity.

Connection

Income streaming in banking refers to the regular generation of revenue from diversified financial products, while asset management fees are service charges imposed on portfolios under management. These fees directly impact income streaming by providing banks with a stable and predictable revenue source based on assets under management (AUM). Efficient asset management strategies enhance income streaming by increasing AUM and optimizing fee structures to maximize profitability.

Key Terms

Management Expense Ratio (MER)

Management Expense Ratio (MER) represents the annual fees a fund charges to manage assets, directly impacting overall returns by reducing net income for investors. In contrast, income streaming involves strategies to distribute income in a tax-efficient manner, potentially enhancing after-tax returns without altering the MER. Explore how optimizing MER alongside income streaming can maximize portfolio growth and tax efficiency.

Dividend Yield

Dividend yield serves as a critical metric in comparing asset management fees and income streaming strategies, highlighting the efficiency of income generated relative to investment size. While higher dividend yields can enhance income streaming by providing consistent cash flow without liquidating assets, asset management fees can diminish overall returns and should be carefully analyzed for their impact on net yield. Explore detailed comparisons to optimize your investment income strategy and maximize dividend yield benefits.

Performance-Based Fee

Performance-based fees in asset management align manager compensation with portfolio returns, incentivizing superior investment outcomes. Unlike fixed fees, income streaming models provide steady revenue without direct correlation to performance, potentially limiting manager motivation. Explore how performance-based fees can enhance shareholder value and investment effectiveness.

Source and External Links

What is an Asset Management Fee and How is it Calculated? - This article explains asset management fees, which typically range from 0.20% to 2.00% of assets under management, and how they are calculated based on the assets managed.

Understanding Asset Management Fees in a Mortgage Funds - This resource discusses asset management fees in the context of mortgage funds, highlighting their role in overseeing and managing assets within these funds.

A Guide to Management Fees - This guide outlines different types of management fee structures, including flat and tiered fees, commonly used by financial advisors and investment managers.

dowidth.com

dowidth.com