Instant payments provide real-time fund transfers, enabling businesses and individuals to send and receive money within seconds, enhancing cash flow efficiency. Standing orders automate recurring payments by instructing banks to transfer fixed amounts at scheduled intervals, ideal for regular obligations like rent or subscriptions. Explore how instant payments and standing orders can optimize your financial management and transaction speed.

Why it is important

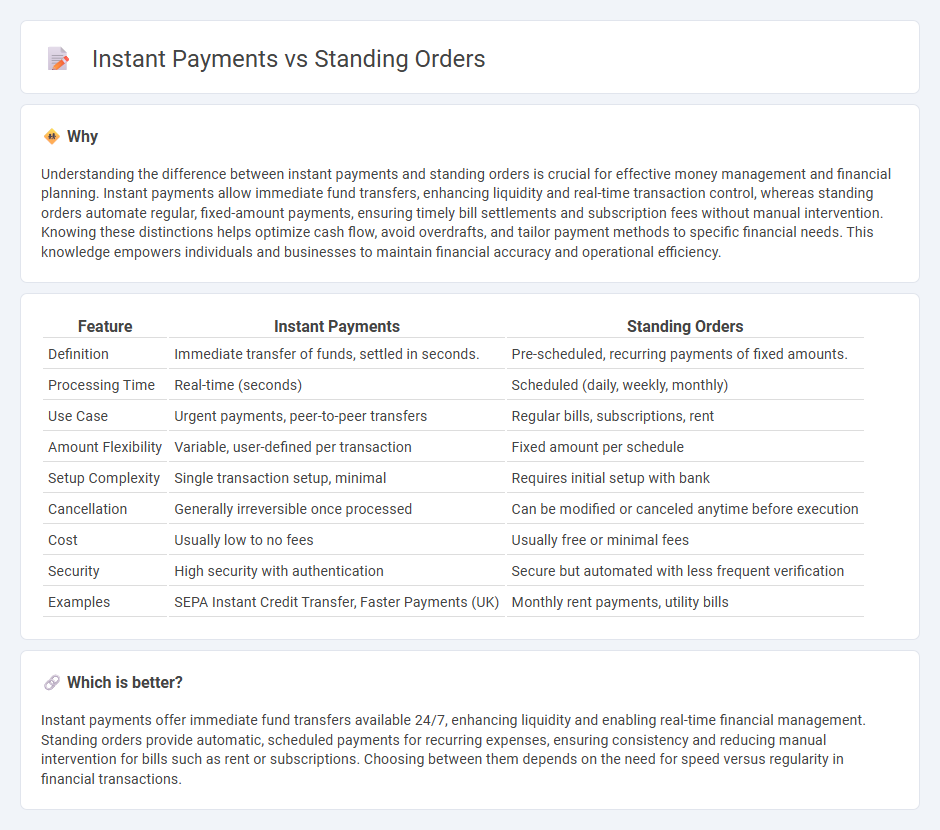

Understanding the difference between instant payments and standing orders is crucial for effective money management and financial planning. Instant payments allow immediate fund transfers, enhancing liquidity and real-time transaction control, whereas standing orders automate regular, fixed-amount payments, ensuring timely bill settlements and subscription fees without manual intervention. Knowing these distinctions helps optimize cash flow, avoid overdrafts, and tailor payment methods to specific financial needs. This knowledge empowers individuals and businesses to maintain financial accuracy and operational efficiency.

Comparison Table

| Feature | Instant Payments | Standing Orders |

|---|---|---|

| Definition | Immediate transfer of funds, settled in seconds. | Pre-scheduled, recurring payments of fixed amounts. |

| Processing Time | Real-time (seconds) | Scheduled (daily, weekly, monthly) |

| Use Case | Urgent payments, peer-to-peer transfers | Regular bills, subscriptions, rent |

| Amount Flexibility | Variable, user-defined per transaction | Fixed amount per schedule |

| Setup Complexity | Single transaction setup, minimal | Requires initial setup with bank |

| Cancellation | Generally irreversible once processed | Can be modified or canceled anytime before execution |

| Cost | Usually low to no fees | Usually free or minimal fees |

| Security | High security with authentication | Secure but automated with less frequent verification |

| Examples | SEPA Instant Credit Transfer, Faster Payments (UK) | Monthly rent payments, utility bills |

Which is better?

Instant payments offer immediate fund transfers available 24/7, enhancing liquidity and enabling real-time financial management. Standing orders provide automatic, scheduled payments for recurring expenses, ensuring consistency and reducing manual intervention for bills such as rent or subscriptions. Choosing between them depends on the need for speed versus regularity in financial transactions.

Connection

Instant payments enable real-time fund transfers between accounts, ensuring immediate availability of funds, which complements standing orders by providing timely execution of scheduled payments. Standing orders automate recurring transactions with fixed amounts, relying on efficient payment processing systems like instant payments to maintain consistent financial operations. This integration enhances cash flow management and reduces the risk of payment delays or failures within banking services.

Key Terms

Scheduled Transactions (for standing orders)

Standing orders are pre-authorized, scheduled transactions enabling automatic, recurring payments of fixed amounts at specific intervals, commonly used for rent or utility bills. Instant payments, by contrast, are real-time transactions settled immediately, offering speed without recurring scheduling. Explore our detailed guide to understand which payment method best suits your financial needs.

Real-Time Settlement (for instant payments)

Standing orders are pre-authorized, recurring payments set up to debit a fixed amount from an account at regular intervals, typically settled in batch processes. Instant payments, enabled by Real-Time Settlement systems, ensure immediate fund transfers and availability, enhancing liquidity and reducing settlement risk for businesses and consumers. Explore how Real-Time Settlement transforms instant payments and streamlines financial operations.

Automation

Standing orders automate recurring payments by scheduling fixed amounts to be transferred at regular intervals, ideal for predictable expenses like rent or subscriptions. Instant payments enable real-time fund transfers, supporting immediate transactions without manual intervention and enhancing cash flow efficiency. Explore how combining standing orders with instant payments can optimize your automated payment processes.

Source and External Links

Standing order - Wikipedia - Standing orders can refer to various concepts including a banking instruction for regular payments, parliamentary procedure rules, military commands, and medical protocols allowing healthcare providers to administer treatment without direct physician orders.

Standing Orders | Texas Law Help - In Texas family law, standing orders are court-imposed rules that require or prohibit actions by parties to maintain the status quo until a judge makes a decision, differing from temporary restraining orders in duration and issuance.

What standing orders can do for your practice - AAFP - Standing orders in healthcare are written protocols allowing designated medical staff to perform specific clinical tasks without a physician's direct order, improving efficiency and preventive care delivery.

dowidth.com

dowidth.com