Outsourced bookkeeping services provide expert financial record management by skilled professionals, ensuring accuracy and compliance with regulatory standards, while accounting software automation offers efficient, cost-effective solutions through real-time data processing and customizable reporting features. Businesses seeking expert oversight can benefit from outsourced services, whereas those preferring control and scalability often choose software automation. Explore the advantages and suitability of each method to optimize your financial management strategy.

Why it is important

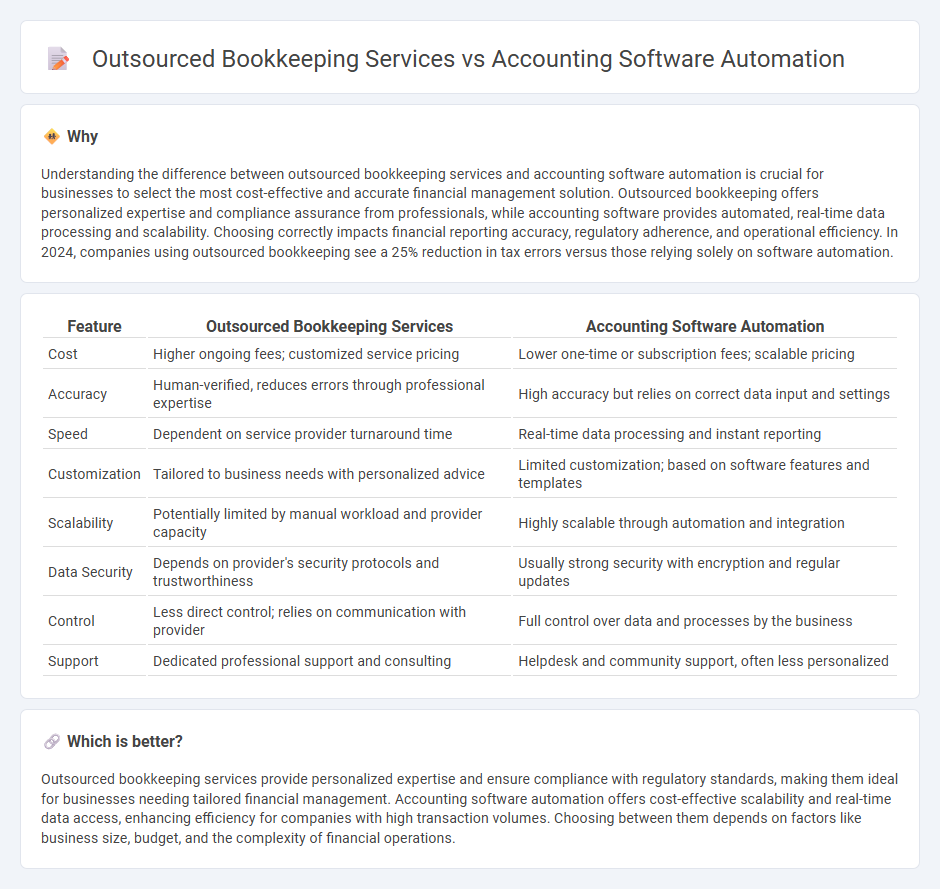

Understanding the difference between outsourced bookkeeping services and accounting software automation is crucial for businesses to select the most cost-effective and accurate financial management solution. Outsourced bookkeeping offers personalized expertise and compliance assurance from professionals, while accounting software provides automated, real-time data processing and scalability. Choosing correctly impacts financial reporting accuracy, regulatory adherence, and operational efficiency. In 2024, companies using outsourced bookkeeping see a 25% reduction in tax errors versus those relying solely on software automation.

Comparison Table

| Feature | Outsourced Bookkeeping Services | Accounting Software Automation |

|---|---|---|

| Cost | Higher ongoing fees; customized service pricing | Lower one-time or subscription fees; scalable pricing |

| Accuracy | Human-verified, reduces errors through professional expertise | High accuracy but relies on correct data input and settings |

| Speed | Dependent on service provider turnaround time | Real-time data processing and instant reporting |

| Customization | Tailored to business needs with personalized advice | Limited customization; based on software features and templates |

| Scalability | Potentially limited by manual workload and provider capacity | Highly scalable through automation and integration |

| Data Security | Depends on provider's security protocols and trustworthiness | Usually strong security with encryption and regular updates |

| Control | Less direct control; relies on communication with provider | Full control over data and processes by the business |

| Support | Dedicated professional support and consulting | Helpdesk and community support, often less personalized |

Which is better?

Outsourced bookkeeping services provide personalized expertise and ensure compliance with regulatory standards, making them ideal for businesses needing tailored financial management. Accounting software automation offers cost-effective scalability and real-time data access, enhancing efficiency for companies with high transaction volumes. Choosing between them depends on factors like business size, budget, and the complexity of financial operations.

Connection

Outsourced bookkeeping services leverage accounting software automation to enhance accuracy, efficiency, and real-time financial reporting for businesses. Cloud-based platforms like QuickBooks Online and Xero enable seamless data integration, reducing manual input and minimizing errors. This synergy allows companies to focus on strategic tasks while maintaining compliant and up-to-date financial records.

Key Terms

Integration

Accounting software automation offers seamless integration with existing financial systems, enabling real-time data synchronization and reducing manual entry errors. Outsourced bookkeeping services may provide personalized expertise but often rely on manually uploaded documents, limiting immediate integration with internal platforms. Explore how integration capabilities impact efficiency and data accuracy in your financial workflow.

Cost Efficiency

Accounting software automation reduces operational costs by minimizing manual data entry and streamlining transaction processing, saving businesses up to 40% on bookkeeping expenses. Outsourced bookkeeping services offer specialized expertise and scalability but often involve higher recurring fees, typically ranging from $300 to $800 monthly, depending on business size. Explore detailed comparisons to determine the best cost-efficient solution tailored to your financial management needs.

Data Control

Accounting software automation offers businesses direct data control through real-time access and customizable workflows, enhancing accuracy and efficiency in financial management. Outsourced bookkeeping services provide expertise and reduce internal workload but may limit immediate access and control over data, raising concerns about data security and responsiveness. Explore our detailed comparison to understand which solution aligns best with your company's data control needs.

Source and External Links

Brex - Accounting Automation - Brex's AI-driven platform automates GL coding, merchant mapping, expense categorization, and accrual accounting, integrates with major ERPs, and provides real-time spending analytics and anomaly detection to streamline closing and reporting.

TaxDome - Accounting Automation Blog - Accounting automation uses software to perform tasks like bank reconciliation, expense management, and financial reporting with minimal human intervention, reducing errors and saving time across accounting workflows.

Ramp - Accounting Automation Software - Ramp automates receipt collection, expense coding, and transaction categorization using AI, integrates seamlessly with accounting systems, and flags inconsistencies to minimize manual review and improve compliance.

dowidth.com

dowidth.com