Cryptocurrency taxation involves reporting gains and losses from digital asset transactions, which are subject to specific IRS guidelines distinct from traditional securities. Wash sale rules, designed to prevent tax loss harvesting in stock trading, currently do not apply to cryptocurrencies due to their classification as property by the IRS. Explore the nuances of cryptocurrency taxation and wash sale regulations to optimize your tax strategy.

Why it is important

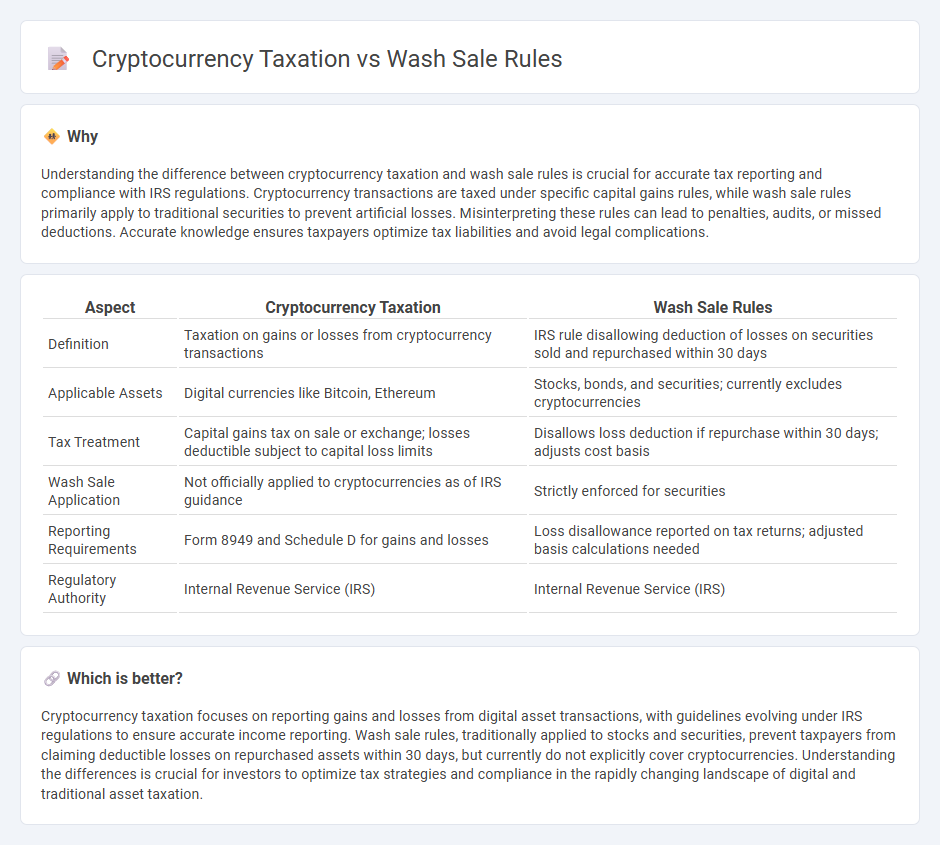

Understanding the difference between cryptocurrency taxation and wash sale rules is crucial for accurate tax reporting and compliance with IRS regulations. Cryptocurrency transactions are taxed under specific capital gains rules, while wash sale rules primarily apply to traditional securities to prevent artificial losses. Misinterpreting these rules can lead to penalties, audits, or missed deductions. Accurate knowledge ensures taxpayers optimize tax liabilities and avoid legal complications.

Comparison Table

| Aspect | Cryptocurrency Taxation | Wash Sale Rules |

|---|---|---|

| Definition | Taxation on gains or losses from cryptocurrency transactions | IRS rule disallowing deduction of losses on securities sold and repurchased within 30 days |

| Applicable Assets | Digital currencies like Bitcoin, Ethereum | Stocks, bonds, and securities; currently excludes cryptocurrencies |

| Tax Treatment | Capital gains tax on sale or exchange; losses deductible subject to capital loss limits | Disallows loss deduction if repurchase within 30 days; adjusts cost basis |

| Wash Sale Application | Not officially applied to cryptocurrencies as of IRS guidance | Strictly enforced for securities |

| Reporting Requirements | Form 8949 and Schedule D for gains and losses | Loss disallowance reported on tax returns; adjusted basis calculations needed |

| Regulatory Authority | Internal Revenue Service (IRS) | Internal Revenue Service (IRS) |

Which is better?

Cryptocurrency taxation focuses on reporting gains and losses from digital asset transactions, with guidelines evolving under IRS regulations to ensure accurate income reporting. Wash sale rules, traditionally applied to stocks and securities, prevent taxpayers from claiming deductible losses on repurchased assets within 30 days, but currently do not explicitly cover cryptocurrencies. Understanding the differences is crucial for investors to optimize tax strategies and compliance in the rapidly changing landscape of digital and traditional asset taxation.

Connection

Cryptocurrency taxation requires reporting capital gains and losses on digital asset transactions, where wash sale rules traditionally disallow claiming losses on repurchased securities within 30 days. Although IRS wash sale rules currently apply to stocks and securities, their extension to cryptocurrencies remains under discussion, impacting tax strategy for digital asset traders. Understanding this connection helps taxpayers accurately report gains while anticipating potential regulatory changes affecting loss deductions.

Key Terms

Cost Basis

Wash sale rules, which disallow claiming losses from sales of securities repurchased within 30 days, currently do not apply to cryptocurrency under IRS guidance, impacting cost basis calculations for crypto traders. Unlike stocks, cryptocurrency investors can realize losses and immediately repurchase assets without triggering wash sale disallowance, enabling tax-loss harvesting strategies to optimize their cost basis. Explore the nuances of cost basis management and tax implications in cryptocurrency trading to maximize your tax efficiency.

Substantially Identical

Wash sale rules disallow claiming a tax loss on the sale of a security if a substantially identical security is purchased within 30 days before or after the sale, primarily applying to stocks and securities under IRS regulations. Cryptocurrency taxation does not currently fall under these wash sale rules because the IRS treats cryptocurrencies as property, and the concept of "substantially identical" is not explicitly defined for digital assets. For deeper insights on wash sale applications and evolving crypto tax policies, explore comprehensive IRS guidelines and expert analyses.

Realized Gain/Loss

Wash sale rules disallow claiming a loss on the sale of a security if a substantially identical security is purchased within 30 days, impacting realized gains and losses for stocks but not currently applied to cryptocurrency by the IRS. Cryptocurrency transactions are taxed based on realized gains or losses when assets are sold, exchanged, or converted, without wash sale prohibitions, enabling taxpayers to recognize losses even if repurchasing similar assets quickly. Explore detailed IRS guidance and tax strategies for cryptocurrency to optimize your realized gain and loss reporting.

Source and External Links

Understanding the Wash Sale Rule for Investors - The IRS wash sale rule disallows a tax loss if you sell a stock or security at a loss and repurchase the same or substantially identical investment within 30 days before or after the sale, aiming to prevent tax loss deductions while retaining the investment position.

Wash Sale Rule: What Is It, How Does It Work, and More - This rule prohibits claiming a loss on stock or securities if you buy substantially identical shares within 30 days before or after selling them at a loss, covering stocks, bonds, ETFs, and mutual funds over a 61-day period.

The "wash sale" rule: Don't let losses circle the drain - The wash sale rule disallows tax loss if substantially identical securities are purchased within 30 days before or after selling at a loss, but disallowed losses are added to the cost basis of the new securities, preserving the loss for future tax calculations.

dowidth.com

dowidth.com