Transfer pricing analytics focuses on evaluating intercompany transactions to ensure compliance with tax regulations and optimize tax liabilities, using detailed data analysis and benchmarking studies. Financial statement consolidation aggregates the financial results of multiple subsidiaries into a single set of financial statements to present a unified view of a corporation's financial position. Discover how mastering both processes can enhance corporate financial transparency and regulatory compliance.

Why it is important

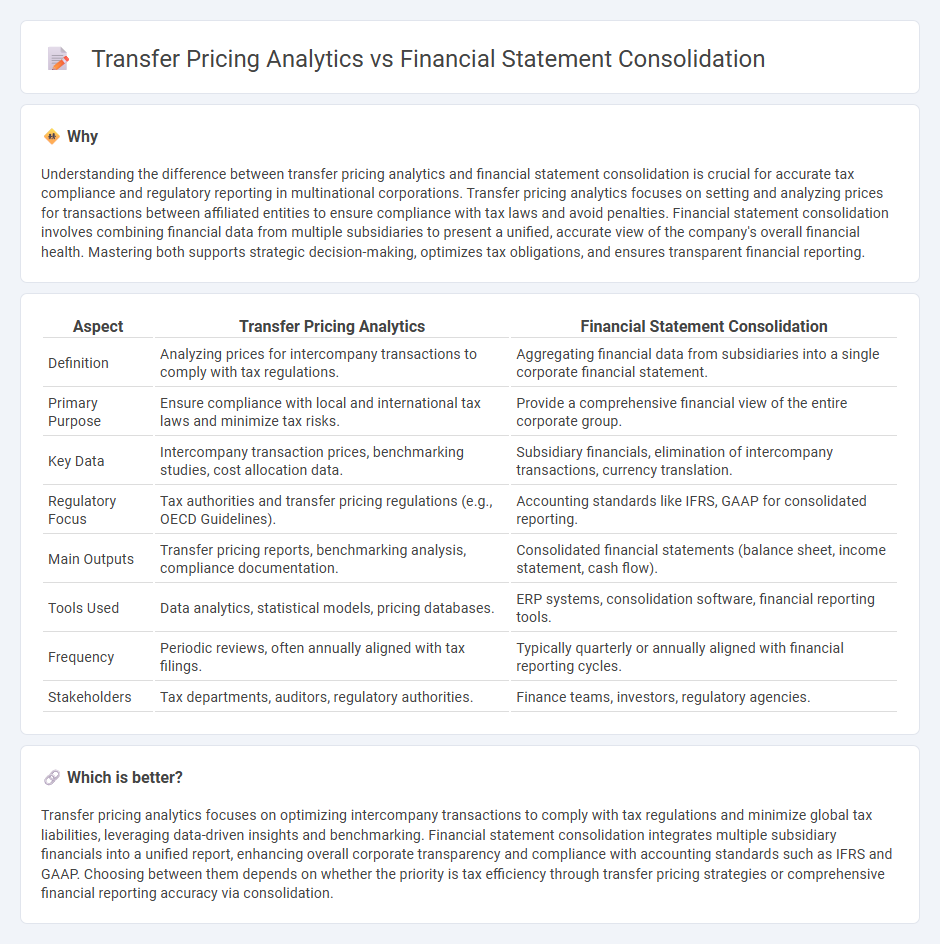

Understanding the difference between transfer pricing analytics and financial statement consolidation is crucial for accurate tax compliance and regulatory reporting in multinational corporations. Transfer pricing analytics focuses on setting and analyzing prices for transactions between affiliated entities to ensure compliance with tax laws and avoid penalties. Financial statement consolidation involves combining financial data from multiple subsidiaries to present a unified, accurate view of the company's overall financial health. Mastering both supports strategic decision-making, optimizes tax obligations, and ensures transparent financial reporting.

Comparison Table

| Aspect | Transfer Pricing Analytics | Financial Statement Consolidation |

|---|---|---|

| Definition | Analyzing prices for intercompany transactions to comply with tax regulations. | Aggregating financial data from subsidiaries into a single corporate financial statement. |

| Primary Purpose | Ensure compliance with local and international tax laws and minimize tax risks. | Provide a comprehensive financial view of the entire corporate group. |

| Key Data | Intercompany transaction prices, benchmarking studies, cost allocation data. | Subsidiary financials, elimination of intercompany transactions, currency translation. |

| Regulatory Focus | Tax authorities and transfer pricing regulations (e.g., OECD Guidelines). | Accounting standards like IFRS, GAAP for consolidated reporting. |

| Main Outputs | Transfer pricing reports, benchmarking analysis, compliance documentation. | Consolidated financial statements (balance sheet, income statement, cash flow). |

| Tools Used | Data analytics, statistical models, pricing databases. | ERP systems, consolidation software, financial reporting tools. |

| Frequency | Periodic reviews, often annually aligned with tax filings. | Typically quarterly or annually aligned with financial reporting cycles. |

| Stakeholders | Tax departments, auditors, regulatory authorities. | Finance teams, investors, regulatory agencies. |

Which is better?

Transfer pricing analytics focuses on optimizing intercompany transactions to comply with tax regulations and minimize global tax liabilities, leveraging data-driven insights and benchmarking. Financial statement consolidation integrates multiple subsidiary financials into a unified report, enhancing overall corporate transparency and compliance with accounting standards such as IFRS and GAAP. Choosing between them depends on whether the priority is tax efficiency through transfer pricing strategies or comprehensive financial reporting accuracy via consolidation.

Connection

Transfer pricing analytics directly impact financial statement consolidation by ensuring intercompany transactions are accurately valued and compliant with tax regulations. Precise transfer pricing data supports consistent elimination of intercompany profits and balances during consolidation, enhancing the accuracy of consolidated financial reports. Integrated analytics streamline risk assessment and regulatory compliance, ultimately improving the reliability of financial statements for multinational organizations.

Key Terms

**Financial Statement Consolidation:**

Financial statement consolidation involves combining the financial data of multiple subsidiaries into a single set of financial statements to provide a comprehensive view of a parent company's overall financial position. This process requires detailed adjustments for intercompany transactions, minority interests, and uniform accounting policies to ensure accuracy and compliance with accounting standards such as IFRS or GAAP. Explore more to understand how advanced consolidation software solutions improve accuracy and transparency in financial reporting.

Minority Interest

Financial statement consolidation involves combining the financial results of parent companies and their subsidiaries, reflecting minority interest as the non-controlling shareholders' claim on subsidiary equity. Transfer pricing analytics examines intercompany transaction prices to ensure compliance with tax regulations, indirectly affecting reported earnings attributable to minority interests. Explore how minority interest impacts both consolidation accuracy and transfer pricing strategies for comprehensive financial analysis.

Intercompany Eliminations

Intercompany eliminations are crucial in financial statement consolidation to remove transactions between subsidiaries and present accurate consolidated financials. Transfer pricing analytics focus on setting and analyzing prices for intercompany transactions to comply with tax regulations and optimize profit allocation across jurisdictions. Explore detailed methodologies and best practices to master both intercompany eliminations and transfer pricing analytics.

Source and External Links

What is Financial Consolidation? Definition & Guide - Fathom - Financial consolidation is the process of combining financial data from multiple subsidiaries into one cohesive set of financial statements, involving synchronizing reporting periods, standardizing accounting policies, eliminating intercompany transactions, calculating non-controlling interests, and compiling consolidated financial statements.

Preparing Consolidated Financial Statements: A Step-by-step Guide - To prepare consolidated financial statements, gather financial data from all reporting entities, adjust for unrealized gains/losses, align accounting policies, combine financial statements into one set, and disclose relevant information transparently.

Consolidated Financial Statements Guide - Datarails - Consolidated financial statements aggregate the financials of the parent and subsidiaries into one report that shows the overall financial position and performance, after eliminating intercompany transactions, unlike combined statements which keep entities separate.

dowidth.com

dowidth.com