ESG reporting focuses on Environmental, Social, and Governance metrics to provide insights into a company's sustainability and ethical impact, while tax reporting centers on compliance with tax laws and accurate financial disclosures to government authorities. Both reporting types require precise data management and adherence to regulatory standards, yet ESG emphasizes non-financial performance indicators. Explore further to understand the critical differences and integration strategies between ESG and tax reporting.

Why it is important

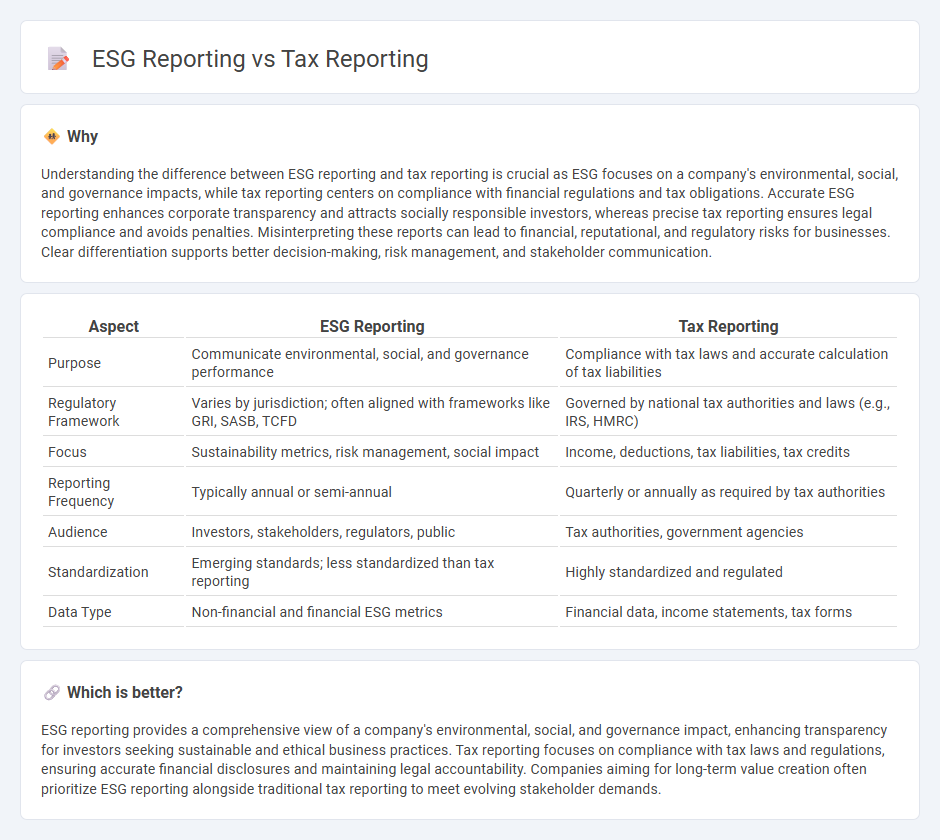

Understanding the difference between ESG reporting and tax reporting is crucial as ESG focuses on a company's environmental, social, and governance impacts, while tax reporting centers on compliance with financial regulations and tax obligations. Accurate ESG reporting enhances corporate transparency and attracts socially responsible investors, whereas precise tax reporting ensures legal compliance and avoids penalties. Misinterpreting these reports can lead to financial, reputational, and regulatory risks for businesses. Clear differentiation supports better decision-making, risk management, and stakeholder communication.

Comparison Table

| Aspect | ESG Reporting | Tax Reporting |

|---|---|---|

| Purpose | Communicate environmental, social, and governance performance | Compliance with tax laws and accurate calculation of tax liabilities |

| Regulatory Framework | Varies by jurisdiction; often aligned with frameworks like GRI, SASB, TCFD | Governed by national tax authorities and laws (e.g., IRS, HMRC) |

| Focus | Sustainability metrics, risk management, social impact | Income, deductions, tax liabilities, tax credits |

| Reporting Frequency | Typically annual or semi-annual | Quarterly or annually as required by tax authorities |

| Audience | Investors, stakeholders, regulators, public | Tax authorities, government agencies |

| Standardization | Emerging standards; less standardized than tax reporting | Highly standardized and regulated |

| Data Type | Non-financial and financial ESG metrics | Financial data, income statements, tax forms |

Which is better?

ESG reporting provides a comprehensive view of a company's environmental, social, and governance impact, enhancing transparency for investors seeking sustainable and ethical business practices. Tax reporting focuses on compliance with tax laws and regulations, ensuring accurate financial disclosures and maintaining legal accountability. Companies aiming for long-term value creation often prioritize ESG reporting alongside traditional tax reporting to meet evolving stakeholder demands.

Connection

ESG reporting and tax reporting intersect through the disclosure of financial data, where ESG metrics increasingly influence tax strategies and compliance frameworks. Companies incorporate environmental and social risk assessments into tax planning to align with regulatory requirements and stakeholder expectations. This integration enhances transparency, mitigates fiscal risks, and supports sustainable business practices critical for long-term financial reporting.

Key Terms

Compliance

Tax reporting centers on accurately documenting financial obligations to meet governmental regulations and avoid penalties, ensuring thorough disclosure of income, expenses, and deductions. ESG reporting emphasizes transparent communication of environmental, social, and governance practices to stakeholders, aligning with sustainability standards and regulatory frameworks for corporate responsibility. Explore the nuances of compliance requirements and reporting standards by diving deeper into the distinctions between tax and ESG reporting.

Materiality

Tax reporting centers on compliance with financial regulations and accurate disclosure of taxable income, ensuring transparency for government authorities. ESG reporting emphasizes materiality by identifying environmental, social, and governance factors that significantly impact a company's long-term value and stakeholder interests. Explore how integrating materiality enhances strategic decision-making in both tax and ESG disclosures.

Disclosure

Tax reporting involves the systematic disclosure of financial obligations and compliance with tax laws, ensuring transparency in fiscal responsibilities. ESG reporting, by contrast, emphasizes the disclosure of environmental, social, and governance practices to demonstrate corporate sustainability and ethical impact. Explore how integrating tax reporting with ESG disclosure can enhance corporate transparency and stakeholder trust.

Source and External Links

Administering Tax Reporting - Oracle Help Center - Oracle Tax Reporting is a global tax provision solution for multinational companies, automating data collection, tax provision calculation, and financial disclosure reporting under GAAP or IFRS standards.

Tax information reporting - Wikipedia - In the U.S., tax information reporting requires organizations to report wage and non-wage payments to the IRS, with strict deadlines and penalties for late or incorrect filings, as part of efforts to reduce the tax gap.

Sales and Use Tax - Texas Comptroller - Texas requires businesses to file sales tax reports monthly, quarterly, or annually, with specific deadlines and electronic payment requirements for larger taxpayers.

dowidth.com

dowidth.com