On-demand accruals recognize expenses or revenues when they are incurred, ensuring accurate financial statements by matching transactions to the correct accounting period. Provisioning involves setting aside estimated liabilities or expenses to cover future obligations, reflecting prudent financial management and risk mitigation. Explore these accounting methods to improve your financial reporting and compliance strategies.

Why it is important

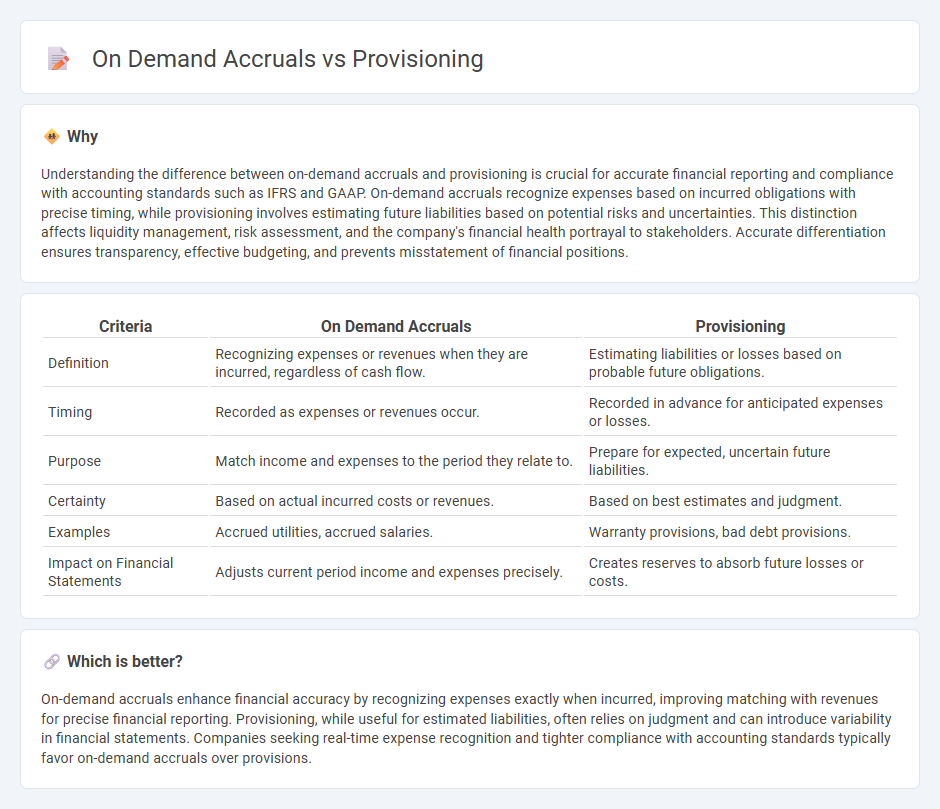

Understanding the difference between on-demand accruals and provisioning is crucial for accurate financial reporting and compliance with accounting standards such as IFRS and GAAP. On-demand accruals recognize expenses based on incurred obligations with precise timing, while provisioning involves estimating future liabilities based on potential risks and uncertainties. This distinction affects liquidity management, risk assessment, and the company's financial health portrayal to stakeholders. Accurate differentiation ensures transparency, effective budgeting, and prevents misstatement of financial positions.

Comparison Table

| Criteria | On Demand Accruals | Provisioning |

|---|---|---|

| Definition | Recognizing expenses or revenues when they are incurred, regardless of cash flow. | Estimating liabilities or losses based on probable future obligations. |

| Timing | Recorded as expenses or revenues occur. | Recorded in advance for anticipated expenses or losses. |

| Purpose | Match income and expenses to the period they relate to. | Prepare for expected, uncertain future liabilities. |

| Certainty | Based on actual incurred costs or revenues. | Based on best estimates and judgment. |

| Examples | Accrued utilities, accrued salaries. | Warranty provisions, bad debt provisions. |

| Impact on Financial Statements | Adjusts current period income and expenses precisely. | Creates reserves to absorb future losses or costs. |

Which is better?

On-demand accruals enhance financial accuracy by recognizing expenses exactly when incurred, improving matching with revenues for precise financial reporting. Provisioning, while useful for estimated liabilities, often relies on judgment and can introduce variability in financial statements. Companies seeking real-time expense recognition and tighter compliance with accounting standards typically favor on-demand accruals over provisions.

Connection

On-demand accruals and provisioning are interconnected accounting concepts that ensure accurate financial reporting by recognizing expenses and liabilities in the appropriate accounting periods. On-demand accruals involve recording expenses as they are incurred, even if payment is not yet made, while provisioning sets aside estimated amounts for future obligations or potential losses. Both processes are critical for maintaining compliance with accounting standards like GAAP or IFRS and for providing a true and fair view of a company's financial position.

Key Terms

Liability Recognition

Provisioning involves recognizing a liability for expenses that are probable and can be estimated, ensuring that financial statements reflect anticipated obligations accurately. On-demand accruals, however, pertain to liabilities recognized only when the obligation is confirmed or triggered by specific events, allowing for more precise matching of expenses to relevant periods. Explore detailed accounting standards and examples to deepen your understanding of liability recognition nuances in provisioning versus on-demand accruals.

Estimation Methods

Provisioning accruals rely on historical data and statistical models to estimate liabilities, ensuring financial statements reflect probable future expenses accurately. On-demand accruals use real-time transaction analysis and predictive algorithms for immediate expense recognition, enhancing responsiveness to fluctuating business conditions. Explore detailed estimation techniques and their impact on financial accuracy to optimize accrual management.

Expense Timing

Provisioning accruals involve estimating expenses in advance, ensuring liabilities are recognized before payment, enhancing financial accuracy and compliance with accounting standards such as IFRS and GAAP. On demand accruals record expenses as they are incurred, offering real-time expense tracking but potentially causing timing mismatches in financial reports. Explore detailed comparisons and best practices to optimize expense timing in your financial processes.

Source and External Links

What is Provisioning? | IBM - Provisioning involves setting up IT infrastructure, including hardware, networks, and virtual machines, to make resources available for use.

Understanding Provisioning In IT: A Complete Guide For ... - This guide explains provisioning as the process of preparing and activating IT infrastructure components like servers and networks according to user needs.

What is provisioning? | Definition from TechTarget - Provisioning refers to the setup of IT infrastructure and providing access to authorized users for various IT resources.

dowidth.com

dowidth.com