Embedded finance reconciliation integrates financial services directly within a platform, streamlining transaction tracking and reducing errors by automating data sync between embedded payment systems and internal ledgers. Third-party payment reconciliation involves matching transactions processed through external payment gateways with company records, often requiring manual verification to resolve discrepancies. Explore detailed insights on how each reconciliation method impacts accuracy and operational efficiency in accounting.

Why it is important

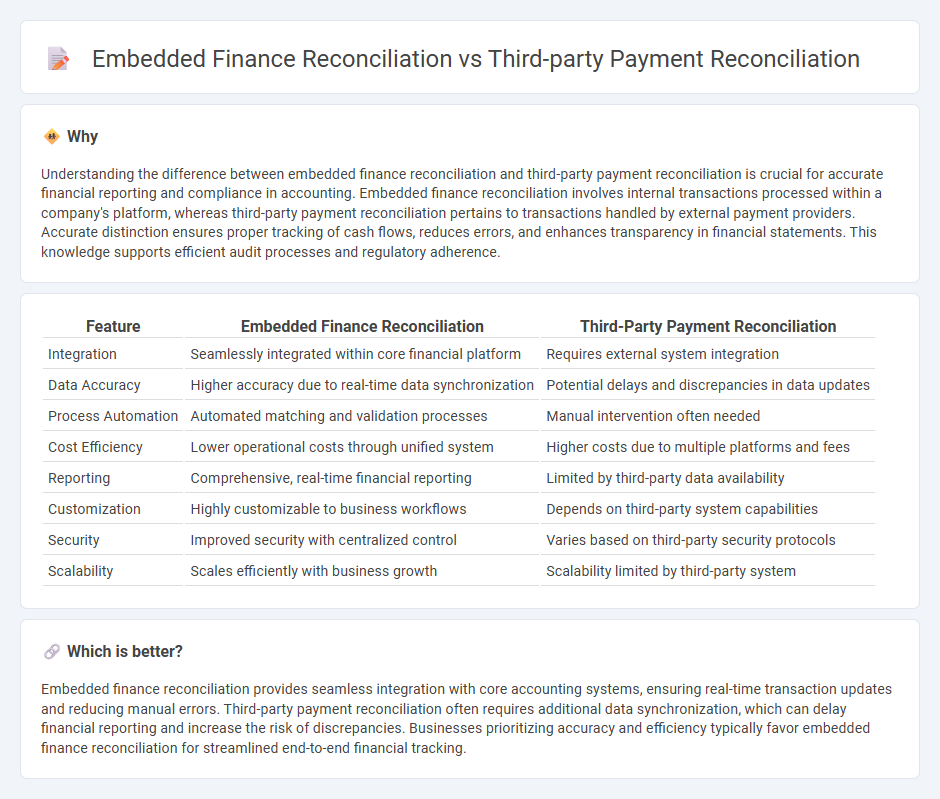

Understanding the difference between embedded finance reconciliation and third-party payment reconciliation is crucial for accurate financial reporting and compliance in accounting. Embedded finance reconciliation involves internal transactions processed within a company's platform, whereas third-party payment reconciliation pertains to transactions handled by external payment providers. Accurate distinction ensures proper tracking of cash flows, reduces errors, and enhances transparency in financial statements. This knowledge supports efficient audit processes and regulatory adherence.

Comparison Table

| Feature | Embedded Finance Reconciliation | Third-Party Payment Reconciliation |

|---|---|---|

| Integration | Seamlessly integrated within core financial platform | Requires external system integration |

| Data Accuracy | Higher accuracy due to real-time data synchronization | Potential delays and discrepancies in data updates |

| Process Automation | Automated matching and validation processes | Manual intervention often needed |

| Cost Efficiency | Lower operational costs through unified system | Higher costs due to multiple platforms and fees |

| Reporting | Comprehensive, real-time financial reporting | Limited by third-party data availability |

| Customization | Highly customizable to business workflows | Depends on third-party system capabilities |

| Security | Improved security with centralized control | Varies based on third-party security protocols |

| Scalability | Scales efficiently with business growth | Scalability limited by third-party system |

Which is better?

Embedded finance reconciliation provides seamless integration with core accounting systems, ensuring real-time transaction updates and reducing manual errors. Third-party payment reconciliation often requires additional data synchronization, which can delay financial reporting and increase the risk of discrepancies. Businesses prioritizing accuracy and efficiency typically favor embedded finance reconciliation for streamlined end-to-end financial tracking.

Connection

Embedded finance reconciliation and third-party payment reconciliation are interconnected processes essential for accurate financial reporting and transaction tracking in accounting. Embedded finance reconciliation integrates payment data directly within platforms, streamlining the verification of transactions, while third-party payment reconciliation involves matching external payment provider records with internal accounting ledgers to ensure consistency. Both methods enhance financial transparency, reduce discrepancies, and improve the efficiency of accounts reconciliation workflows.

Key Terms

**Third-party payment reconciliation:**

Third-party payment reconciliation involves matchings transactions processed by external payment gateways such as PayPal, Stripe, or Square with internal financial records to ensure accuracy and consistency in accounting. This process addresses discrepancies like transaction fees, chargebacks, and settlement delays by consolidating data from various sources to maintain transparent financial statements. Explore how leveraging advanced reconciliation tools can streamline third-party payment processes and improve cash flow management.

Payment gateway settlements

Third-party payment reconciliation involves managing transaction data and settlements between merchants and multiple external payment gateways, ensuring accurate tracking of fees, chargebacks, and payouts. Embedded finance reconciliation integrates payment processing directly within a platform, streamlining settlement processes and reducing reliance on external payment gateways while enhancing transaction transparency. Explore how these reconciliation methods impact payment accuracy and operational efficiency for businesses.

Transaction matching

Third-party payment reconciliation relies heavily on external transaction matching systems that aggregate data from various payment providers to ensure accuracy and completeness. Embedded finance reconciliation integrates transaction matching directly within the financial platform, enabling real-time verification and reducing discrepancies caused by data silos. Discover more about how these approaches impact transaction matching efficiency and accuracy in modern financial services.

Source and External Links

What is Payment Reconciliation? How It Works & Examples - Payment reconciliation is the accounts payable process of verifying bank account balances against the latest payment information, typically involving steps like paying open bills, combining bills for a supplier, initiating payment, and reviewing bank feeds to ensure accuracy between ERP and bank records.

Third Party Reconciliation - PioneerRx Pharmacy Software - Third-party payment reconciliation is the process of settling a customer's third-party payments against third-party claims, ensuring that reimbursements align with claims submitted and payments received, often supported by specialized software for industries like pharmacies.

Third-Party Delivery Services & Reconciliations - Trintech - In third-party payment reconciliation for delivery services, automated solutions help match POS orders with third-party service transactions, addressing typical issues such as mismatched order numbers or tax discrepancies to ensure accurate financial reconciliation.

dowidth.com

dowidth.com