Intercompany automation streamlines financial transactions between affiliated entities by reducing manual errors and accelerating reconciliation processes. Shared services centralize accounting functions such as payroll, accounts payable, and financial reporting to enhance operational efficiency and lower costs across business units. Explore how integrating intercompany automation with shared services can transform your organization's accounting workflow for maximum productivity.

Why it is important

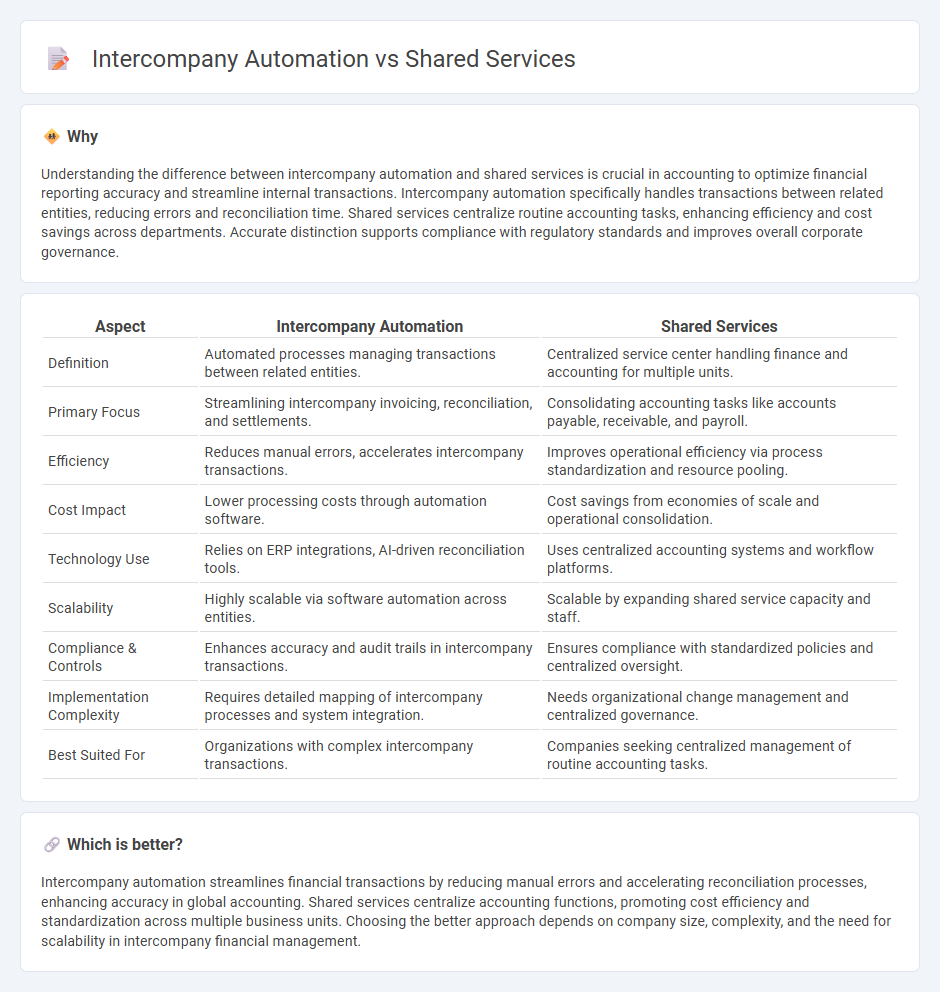

Understanding the difference between intercompany automation and shared services is crucial in accounting to optimize financial reporting accuracy and streamline internal transactions. Intercompany automation specifically handles transactions between related entities, reducing errors and reconciliation time. Shared services centralize routine accounting tasks, enhancing efficiency and cost savings across departments. Accurate distinction supports compliance with regulatory standards and improves overall corporate governance.

Comparison Table

| Aspect | Intercompany Automation | Shared Services |

|---|---|---|

| Definition | Automated processes managing transactions between related entities. | Centralized service center handling finance and accounting for multiple units. |

| Primary Focus | Streamlining intercompany invoicing, reconciliation, and settlements. | Consolidating accounting tasks like accounts payable, receivable, and payroll. |

| Efficiency | Reduces manual errors, accelerates intercompany transactions. | Improves operational efficiency via process standardization and resource pooling. |

| Cost Impact | Lower processing costs through automation software. | Cost savings from economies of scale and operational consolidation. |

| Technology Use | Relies on ERP integrations, AI-driven reconciliation tools. | Uses centralized accounting systems and workflow platforms. |

| Scalability | Highly scalable via software automation across entities. | Scalable by expanding shared service capacity and staff. |

| Compliance & Controls | Enhances accuracy and audit trails in intercompany transactions. | Ensures compliance with standardized policies and centralized oversight. |

| Implementation Complexity | Requires detailed mapping of intercompany processes and system integration. | Needs organizational change management and centralized governance. |

| Best Suited For | Organizations with complex intercompany transactions. | Companies seeking centralized management of routine accounting tasks. |

Which is better?

Intercompany automation streamlines financial transactions by reducing manual errors and accelerating reconciliation processes, enhancing accuracy in global accounting. Shared services centralize accounting functions, promoting cost efficiency and standardization across multiple business units. Choosing the better approach depends on company size, complexity, and the need for scalability in intercompany financial management.

Connection

Intercompany automation streamlines financial transactions between subsidiaries by standardizing processes and reducing manual intervention, which directly enhances the efficiency of shared services centers. Shared services leverage automated intercompany systems to centralize accounting tasks such as reconciliations, invoicing, and compliance, driving cost savings and improved accuracy. Integrating these technologies facilitates real-time data exchange and consistent reporting across the corporate group, optimizing overall financial operations.

Key Terms

Cost Allocation

Shared services streamline cost allocation by centralizing financial management across business units, reducing redundancies and enhancing transparency. Intercompany automation optimizes cost allocation through real-time transaction processing, minimizing errors and accelerating reconciliation between affiliated entities. Explore how integrating these approaches can maximize efficiency and accuracy in your cost allocation strategy.

Process Standardization

Process standardization in shared services streamlines operations by consolidating repetitive tasks across business units, enhancing efficiency and reducing costs. Intercompany automation focuses on harmonizing transactions between subsidiaries, improving accuracy and compliance in financial reporting. Discover how leveraging both approaches can optimize your organization's operational and financial workflows.

Transaction Reconciliation

Transaction reconciliation in shared services centers streamlines financial processes by centralizing data management and leveraging standardized protocols, reducing manual errors and enhancing accuracy. Intercompany automation further advances reconciliation by enabling real-time matching and settlement of intercompany transactions through integrated ERP systems, minimizing delays and improving compliance. Explore how combining these approaches can optimize your financial close cycles and boost operational efficiency.

Source and External Links

What are Shared Services? Benefits and Examples | ScottMadden - Shared services involve consolidating support functions like HR, finance, IT, and supply chain into a central unit to achieve cost savings, improved service, and greater organizational efficiency.

Shared services - Wikipedia - Shared services is the centralized provision of a service by one part of an organization where it was previously duplicated, aiming to reduce costs and increase efficiency through standardization and specialization.

What are shared services? | Definition from TechTarget - Shared services is an organizational model that consolidates similar business functions into a single unit serving the entire organization, often with formal service agreements and sometimes using chargeback systems for internal billing.

dowidth.com

dowidth.com