Smart contracts accounting automates transaction verification and reduces errors by embedding financial rules within blockchain technology, enhancing real-time accuracy in ledger management. Regulatory reporting focuses on compliance, ensuring that financial statements meet legal standards and reporting deadlines mandated by authorities like the SEC or IFRS. Explore how integrating smart contracts transforms traditional regulatory processes and streamlines accounting workflows.

Why it is important

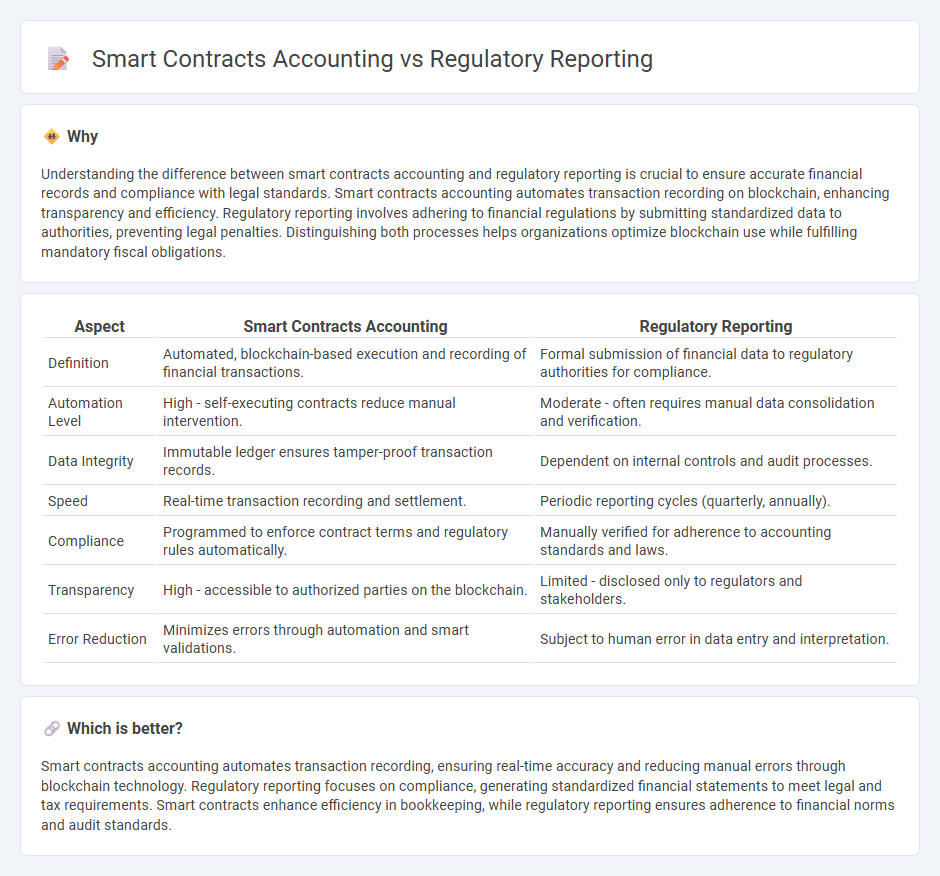

Understanding the difference between smart contracts accounting and regulatory reporting is crucial to ensure accurate financial records and compliance with legal standards. Smart contracts accounting automates transaction recording on blockchain, enhancing transparency and efficiency. Regulatory reporting involves adhering to financial regulations by submitting standardized data to authorities, preventing legal penalties. Distinguishing both processes helps organizations optimize blockchain use while fulfilling mandatory fiscal obligations.

Comparison Table

| Aspect | Smart Contracts Accounting | Regulatory Reporting |

|---|---|---|

| Definition | Automated, blockchain-based execution and recording of financial transactions. | Formal submission of financial data to regulatory authorities for compliance. |

| Automation Level | High - self-executing contracts reduce manual intervention. | Moderate - often requires manual data consolidation and verification. |

| Data Integrity | Immutable ledger ensures tamper-proof transaction records. | Dependent on internal controls and audit processes. |

| Speed | Real-time transaction recording and settlement. | Periodic reporting cycles (quarterly, annually). |

| Compliance | Programmed to enforce contract terms and regulatory rules automatically. | Manually verified for adherence to accounting standards and laws. |

| Transparency | High - accessible to authorized parties on the blockchain. | Limited - disclosed only to regulators and stakeholders. |

| Error Reduction | Minimizes errors through automation and smart validations. | Subject to human error in data entry and interpretation. |

Which is better?

Smart contracts accounting automates transaction recording, ensuring real-time accuracy and reducing manual errors through blockchain technology. Regulatory reporting focuses on compliance, generating standardized financial statements to meet legal and tax requirements. Smart contracts enhance efficiency in bookkeeping, while regulatory reporting ensures adherence to financial norms and audit standards.

Connection

Smart contracts automate accounting processes by executing transactions and recording financial data in real time on blockchain ledgers, enhancing accuracy and transparency. Regulatory reporting benefits from this automation as it enables timely, tamper-proof submission of compliance data, reducing errors and audit risks. Integration of smart contracts in accounting systems streamlines compliance workflows, making regulatory adherence more efficient and reliable.

Key Terms

Compliance

Regulatory reporting requires adherence to strict frameworks like IFRS and GAAP, ensuring transparent financial disclosures for compliance audits and risk management. Smart contracts accounting automates compliance by embedding regulatory rules into blockchain code, enabling real-time reporting and reducing human errors. Explore how integrating smart contracts can revolutionize your compliance strategy and streamline regulatory reporting processes.

Automation

Regulatory reporting automates the collection and submission of financial data to comply with legal standards, reducing manual errors and ensuring timely disclosures. Smart contracts accounting leverages blockchain technology to execute and record transactions automatically based on predefined rules, enhancing transparency and real-time accuracy. Discover how integrating these automation tools can revolutionize financial compliance and operational efficiency.

Transparency

Regulatory reporting mandates accurate, timely disclosure of financial data to ensure compliance with legal standards and enhance transparency for stakeholders. Smart contracts accounting leverages blockchain technology to automate transaction recording, enabling real-time verification and immutable audit trails that bolster transparency by reducing human error and fraud. Explore how integrating smart contracts can revolutionize transparency in regulatory reporting frameworks.

Source and External Links

What is Regulatory Reporting? - SolveXia - Regulatory reporting is the process by which financial institutions submit data and information to regulatory authorities to ensure compliance with laws and promote transparency and stability in financial markets.

What is Regulatory Reporting: A Beginner's Guide - Finreg-E - Regulatory reporting involves systematically collecting and submitting financial and operational data to regulators, covering reports like financial statements, risk exposure, and transactions to demonstrate compliance and manage risks.

What Is Regulatory Reporting? A Complete Guide - HighGear - Regulatory reporting is the systematic submission of data to regulatory bodies focused on compliance, with submissions often required monthly, quarterly, annually, or event-driven, and non-compliance can lead to fines, legal issues, and reputational damage.

dowidth.com

dowidth.com