Outsourced bookkeeping services focus on accurate transaction recording, financial statement preparation, and day-to-day financial data management, ensuring compliance and organized financial records. Virtual CFO services provide strategic financial guidance, budgeting, forecasting, and performance analysis to drive business growth and profitability. Explore the distinct benefits of both to determine which solution best fits your company's financial management needs.

Why it is important

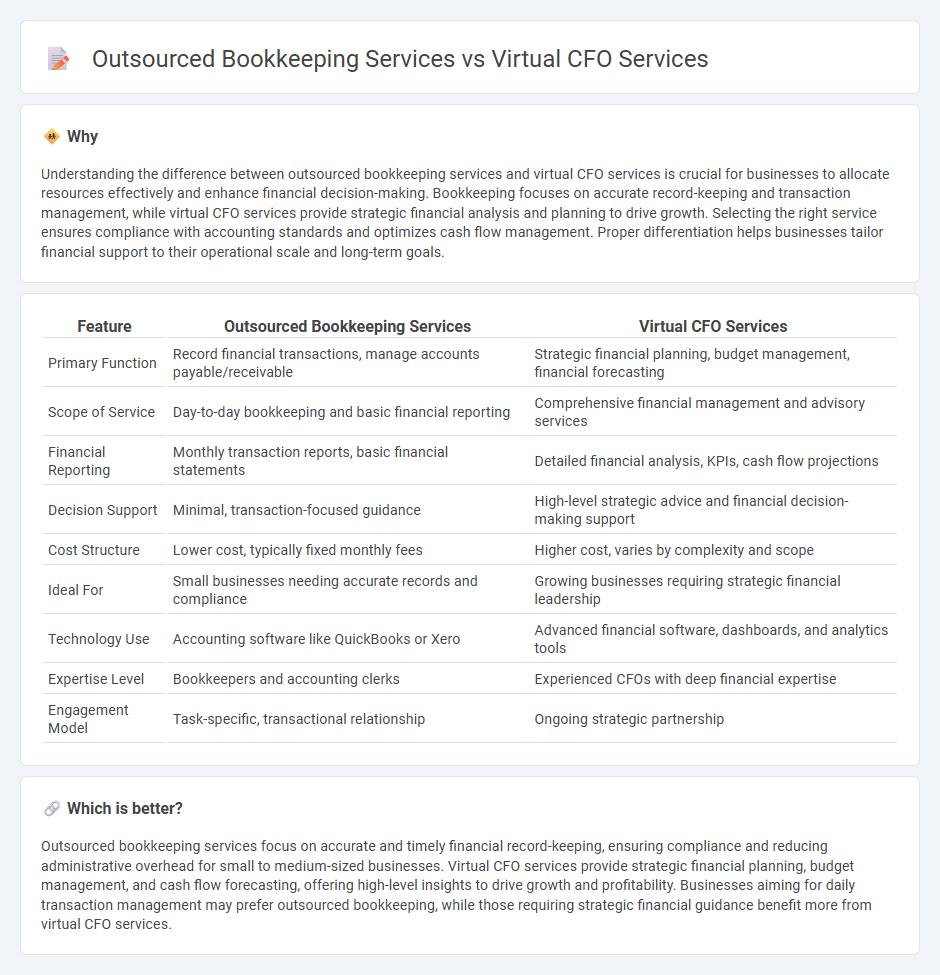

Understanding the difference between outsourced bookkeeping services and virtual CFO services is crucial for businesses to allocate resources effectively and enhance financial decision-making. Bookkeeping focuses on accurate record-keeping and transaction management, while virtual CFO services provide strategic financial analysis and planning to drive growth. Selecting the right service ensures compliance with accounting standards and optimizes cash flow management. Proper differentiation helps businesses tailor financial support to their operational scale and long-term goals.

Comparison Table

| Feature | Outsourced Bookkeeping Services | Virtual CFO Services |

|---|---|---|

| Primary Function | Record financial transactions, manage accounts payable/receivable | Strategic financial planning, budget management, financial forecasting |

| Scope of Service | Day-to-day bookkeeping and basic financial reporting | Comprehensive financial management and advisory services |

| Financial Reporting | Monthly transaction reports, basic financial statements | Detailed financial analysis, KPIs, cash flow projections |

| Decision Support | Minimal, transaction-focused guidance | High-level strategic advice and financial decision-making support |

| Cost Structure | Lower cost, typically fixed monthly fees | Higher cost, varies by complexity and scope |

| Ideal For | Small businesses needing accurate records and compliance | Growing businesses requiring strategic financial leadership |

| Technology Use | Accounting software like QuickBooks or Xero | Advanced financial software, dashboards, and analytics tools |

| Expertise Level | Bookkeepers and accounting clerks | Experienced CFOs with deep financial expertise |

| Engagement Model | Task-specific, transactional relationship | Ongoing strategic partnership |

Which is better?

Outsourced bookkeeping services focus on accurate and timely financial record-keeping, ensuring compliance and reducing administrative overhead for small to medium-sized businesses. Virtual CFO services provide strategic financial planning, budget management, and cash flow forecasting, offering high-level insights to drive growth and profitability. Businesses aiming for daily transaction management may prefer outsourced bookkeeping, while those requiring strategic financial guidance benefit more from virtual CFO services.

Connection

Outsourced bookkeeping services provide accurate and timely financial records essential for virtual CFO services to analyze and develop strategic financial plans. Virtual CFOs rely on detailed bookkeeping data to offer insights on cash flow management, budgeting, and financial forecasting. The integration of both services enhances overall financial decision-making and business growth.

Key Terms

Financial Strategy

Virtual CFO services provide comprehensive financial strategy development, budgeting, forecasting, and performance analysis, enabling businesses to make informed decisions and drive growth. Outsourced bookkeeping services primarily handle transaction recording, reconciliations, and compliance, offering accurate financial data but limited strategic insight. Explore how virtual CFOs can transform your financial planning and business outcomes by learning more about their strategic role.

Transaction Recording

Virtual CFO services provide strategic financial oversight, including transaction recording tailored to align with broader business goals, whereas outsourced bookkeeping services focus mainly on accurate and timely transaction recording without strategic input. Transaction recording under virtual CFO services often integrates real-time financial analysis and forecasting, enhancing decision-making processes. Discover how optimized transaction recording through these services can elevate your financial management.

Compliance

Virtual CFO services provide strategic financial oversight, including regulatory compliance, tax planning, and risk management, ensuring businesses meet all legal and financial reporting requirements. Outsourced bookkeeping services primarily handle day-to-day transaction recording and maintenance of accurate financial records but may lack comprehensive compliance management. Discover how virtual CFOs enhance compliance frameworks beyond basic bookkeeping by exploring our in-depth comparison.

Source and External Links

How Much Does a Virtual CFO Cost - Average Service Price - A virtual CFO provides expert financial services such as planning, budgeting, cash flow analysis, and risk management on a flexible basis, ideal for businesses needing financial guidance without hiring full-time, with customizable responsibilities depending on company needs.

What is a Virtual CFO, and What Does a Virtual CFO Do? - Anders - Virtual CFOs are outsourced financial executives offering strategic financial advice and forecasting services remotely to small-to-mid-size companies, often at a fraction of the cost of a traditional CFO, helping with cash flow management and business goal planning.

Delegate CFO: Virtual CFO Services - Delegate CFO offers fixed-rate virtual CFO services, providing high-level financial strategy like cash flow forecasting, budgeting, and investor reporting tailored to growth-focused businesses, combining remote expertise with customized service packages.

dowidth.com

dowidth.com