Continuous audit uses automated tools to perform real-time transaction analysis, enhancing accuracy and timely detection of irregularities. Internal audit focuses on periodic, comprehensive evaluations of financial statements, internal controls, and compliance within an organization. Explore the benefits and applications of each audit type to optimize financial oversight.

Why it is important

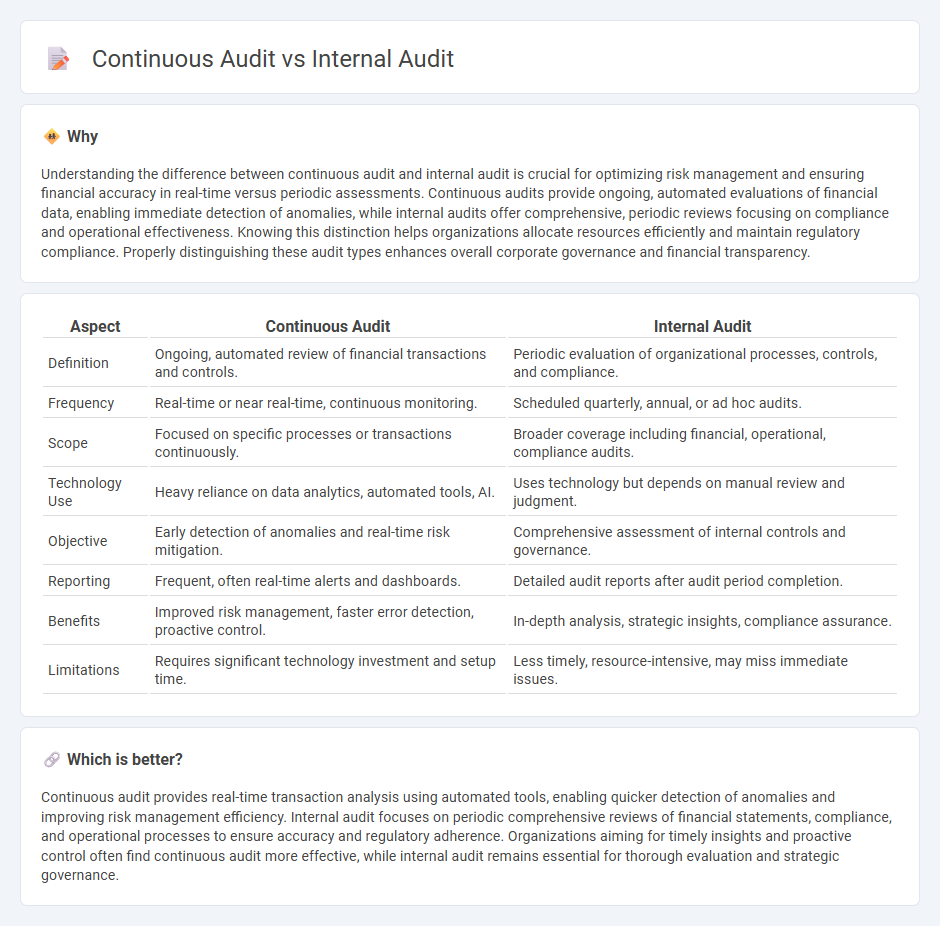

Understanding the difference between continuous audit and internal audit is crucial for optimizing risk management and ensuring financial accuracy in real-time versus periodic assessments. Continuous audits provide ongoing, automated evaluations of financial data, enabling immediate detection of anomalies, while internal audits offer comprehensive, periodic reviews focusing on compliance and operational effectiveness. Knowing this distinction helps organizations allocate resources efficiently and maintain regulatory compliance. Properly distinguishing these audit types enhances overall corporate governance and financial transparency.

Comparison Table

| Aspect | Continuous Audit | Internal Audit |

|---|---|---|

| Definition | Ongoing, automated review of financial transactions and controls. | Periodic evaluation of organizational processes, controls, and compliance. |

| Frequency | Real-time or near real-time, continuous monitoring. | Scheduled quarterly, annual, or ad hoc audits. |

| Scope | Focused on specific processes or transactions continuously. | Broader coverage including financial, operational, compliance audits. |

| Technology Use | Heavy reliance on data analytics, automated tools, AI. | Uses technology but depends on manual review and judgment. |

| Objective | Early detection of anomalies and real-time risk mitigation. | Comprehensive assessment of internal controls and governance. |

| Reporting | Frequent, often real-time alerts and dashboards. | Detailed audit reports after audit period completion. |

| Benefits | Improved risk management, faster error detection, proactive control. | In-depth analysis, strategic insights, compliance assurance. |

| Limitations | Requires significant technology investment and setup time. | Less timely, resource-intensive, may miss immediate issues. |

Which is better?

Continuous audit provides real-time transaction analysis using automated tools, enabling quicker detection of anomalies and improving risk management efficiency. Internal audit focuses on periodic comprehensive reviews of financial statements, compliance, and operational processes to ensure accuracy and regulatory adherence. Organizations aiming for timely insights and proactive control often find continuous audit more effective, while internal audit remains essential for thorough evaluation and strategic governance.

Connection

Continuous audit leverages automated tools and real-time data analysis to provide ongoing assurance of financial transactions and controls, closely aligning with internal audit functions that focus on evaluating risk management and compliance frameworks. Both processes share the objective of enhancing audit accuracy and efficiency by integrating technology-driven insights into traditional audit methodologies. This synergy enables organizations to promptly identify and mitigate risks, ensuring robust financial integrity and regulatory adherence.

Key Terms

Independence

Internal audit traditionally operates on a periodic schedule, with independence maintained through organizational separation and reporting lines to the audit committee or board. Continuous audit uses automated tools to perform real-time or near-real-time assessments, requiring robust controls to ensure auditor independence despite ongoing access to operational data. Explore further to understand how maintaining independence differs in these audit approaches and impacts audit effectiveness.

Real-time monitoring

Internal audit traditionally performs periodic reviews to assess compliance, controls, and risk management effectiveness. Continuous audit leverages real-time monitoring tools and data analytics to provide instant insights, enabling organizations to detect and address issues promptly. Explore how continuous audit transforms risk management through advanced real-time monitoring techniques.

Periodicity

Internal audits are typically conducted on a periodic basis, such as annually or quarterly, providing comprehensive evaluations of financial records and compliance at specific intervals. Continuous audits utilize automated systems and real-time data analysis to monitor and review transactions frequently, often daily or weekly, enabling timely detection of irregularities. Explore further to understand how the frequency of audits impacts risk management and organizational efficiency.

Source and External Links

What is Internal Audit? - Provides an overview of internal audit's role in ensuring effective risk management, governance, and internal controls within an organization.

What is Internal Audit? - Describes the types and value of internal audits, including compliance, environmental, IT, operational, and performance audits.

Internal audit - Explains internal auditing as an independent, objective assurance and consulting activity aimed at improving organizational operations.

dowidth.com

dowidth.com