Cryptofinance reconciliation involves verifying cryptocurrency transactions and balances on blockchain ledgers to ensure accuracy and prevent fraud in digital asset management. Deposit reconciliation focuses on matching bank deposit records with accounting entries to confirm the correctness of cash inflows and maintain accurate financial statements. Explore more to understand how each reconciliation method plays a vital role in modern accounting practices.

Why it is important

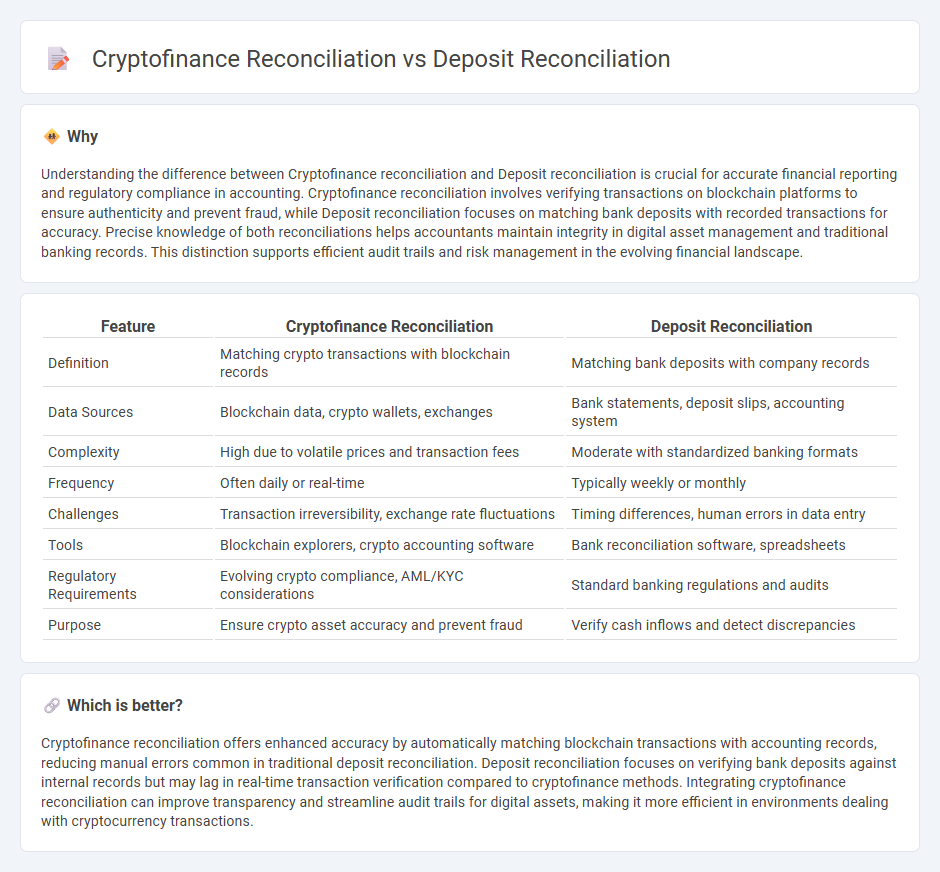

Understanding the difference between Cryptofinance reconciliation and Deposit reconciliation is crucial for accurate financial reporting and regulatory compliance in accounting. Cryptofinance reconciliation involves verifying transactions on blockchain platforms to ensure authenticity and prevent fraud, while Deposit reconciliation focuses on matching bank deposits with recorded transactions for accuracy. Precise knowledge of both reconciliations helps accountants maintain integrity in digital asset management and traditional banking records. This distinction supports efficient audit trails and risk management in the evolving financial landscape.

Comparison Table

| Feature | Cryptofinance Reconciliation | Deposit Reconciliation |

|---|---|---|

| Definition | Matching crypto transactions with blockchain records | Matching bank deposits with company records |

| Data Sources | Blockchain data, crypto wallets, exchanges | Bank statements, deposit slips, accounting system |

| Complexity | High due to volatile prices and transaction fees | Moderate with standardized banking formats |

| Frequency | Often daily or real-time | Typically weekly or monthly |

| Challenges | Transaction irreversibility, exchange rate fluctuations | Timing differences, human errors in data entry |

| Tools | Blockchain explorers, crypto accounting software | Bank reconciliation software, spreadsheets |

| Regulatory Requirements | Evolving crypto compliance, AML/KYC considerations | Standard banking regulations and audits |

| Purpose | Ensure crypto asset accuracy and prevent fraud | Verify cash inflows and detect discrepancies |

Which is better?

Cryptofinance reconciliation offers enhanced accuracy by automatically matching blockchain transactions with accounting records, reducing manual errors common in traditional deposit reconciliation. Deposit reconciliation focuses on verifying bank deposits against internal records but may lag in real-time transaction verification compared to cryptofinance methods. Integrating cryptofinance reconciliation can improve transparency and streamline audit trails for digital assets, making it more efficient in environments dealing with cryptocurrency transactions.

Connection

Cryptofinance reconciliation and deposit reconciliation are interconnected processes that ensure the accuracy of financial records by matching cryptocurrency transactions and traditional deposit entries, respectively. Effective cryptofinance reconciliation verifies blockchain transaction data against internal accounting systems, while deposit reconciliation confirms bank deposit records align with company ledger entries. Together, these reconciliations enhance overall financial transparency and accuracy in firms handling both digital and fiat currency.

Key Terms

Bank Statement Matching

Deposit reconciliation involves verifying bank deposits by comparing transaction records against bank statements to ensure accuracy and completeness. Cryptofinance reconciliation extends this process to digital assets, matching blockchain transaction logs with bank statements and internal ledgers to account for cryptocurrency volatility and unique transaction types. Explore how advanced algorithms enhance bank statement matching in both deposit and cryptofinance reconciliation for improved financial accuracy.

Blockchain Ledger Validation

Deposit reconciliation involves verifying transaction records between bank statements and internal accounting to ensure accuracy, while Cryptofinance reconciliation focuses on validating transactions on blockchain ledgers, ensuring integrity and transparency of digital asset movements. Blockchain ledger validation uses cryptographic proofs and consensus mechanisms to confirm transaction authenticity, making it a critical process for accurate cryptofinance reconciliation. Explore more about how blockchain enhances financial reconciliation processes and ensures decentralized asset verification.

Transaction Timestamp Alignment

Deposit reconciliation relies on matching transaction timestamps from banking systems to verify fund transfers, ensuring accurate cash flow records. Cryptofinance reconciliation demands precise alignment of blockchain transaction timestamps with internal ledgers to account for network delays and block confirmation times, critical for accurate asset tracking. Explore in-depth how timestamp synchronization impacts financial integrity in traditional and crypto finance reconciliations.

Source and External Links

Deposit Reconciliation - SFMS DESK MANUAL - Deposit reconciliation is a process to ensure that money is not spent until transactions are recorded in both the bank and internal accounting systems, with deposits only becoming available cash after they have been reconciled and matched with corresponding entries.

Interagency Guidance Regarding Deposit Reconciliation Practices - Financial institutions are expected to reconcile discrepancies that may arise when the amount credited to a customer's account differs from the total of items deposited, often due to errors in deposit slips, encoding, or image capture.

Deposit Reconciliation: Multiple Locations, One Account - Huntington Deposit Reconciliation consolidates deposits from multiple business locations into a single account, provides detailed daily reports, and separates cash and check deposits for auditing and tracking convenience.

dowidth.com

dowidth.com