Smart contracts accounting automates financial transactions and record-keeping through blockchain technology, enhancing transparency and reducing errors compared to traditional methods. IFRS compliance mandates standardized financial reporting principles to ensure consistency and comparability across global entities. Explore how integrating smart contracts can streamline IFRS compliance and revolutionize accounting practices.

Why it is important

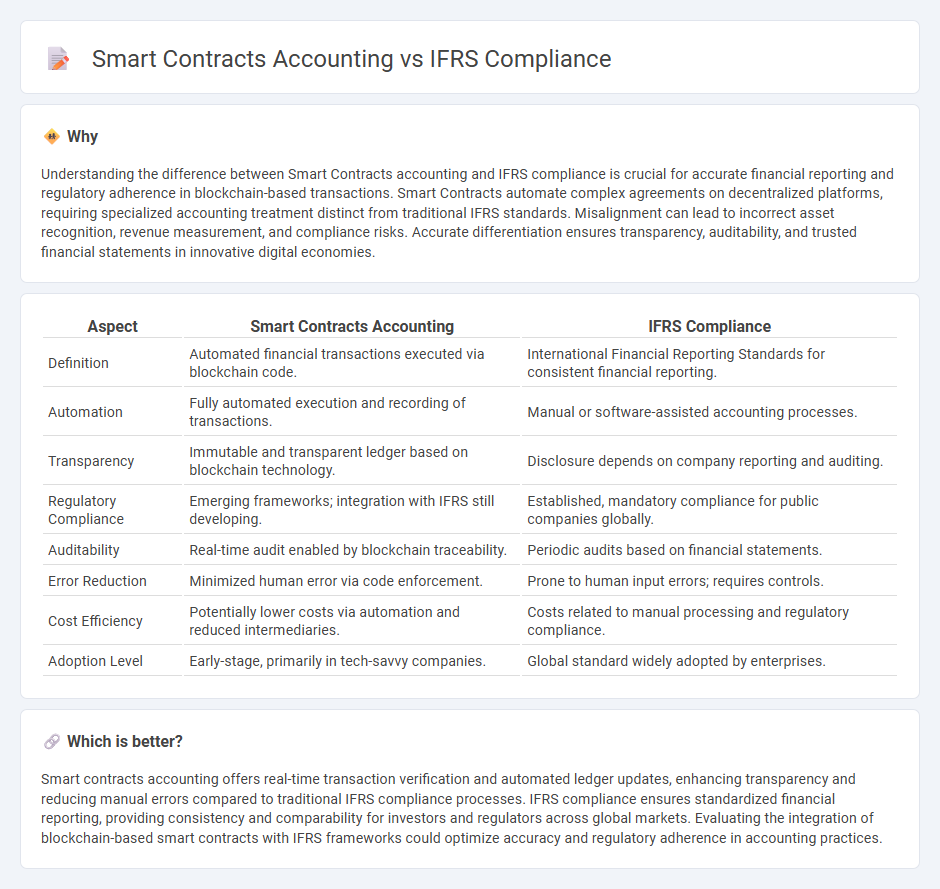

Understanding the difference between Smart Contracts accounting and IFRS compliance is crucial for accurate financial reporting and regulatory adherence in blockchain-based transactions. Smart Contracts automate complex agreements on decentralized platforms, requiring specialized accounting treatment distinct from traditional IFRS standards. Misalignment can lead to incorrect asset recognition, revenue measurement, and compliance risks. Accurate differentiation ensures transparency, auditability, and trusted financial statements in innovative digital economies.

Comparison Table

| Aspect | Smart Contracts Accounting | IFRS Compliance |

|---|---|---|

| Definition | Automated financial transactions executed via blockchain code. | International Financial Reporting Standards for consistent financial reporting. |

| Automation | Fully automated execution and recording of transactions. | Manual or software-assisted accounting processes. |

| Transparency | Immutable and transparent ledger based on blockchain technology. | Disclosure depends on company reporting and auditing. |

| Regulatory Compliance | Emerging frameworks; integration with IFRS still developing. | Established, mandatory compliance for public companies globally. |

| Auditability | Real-time audit enabled by blockchain traceability. | Periodic audits based on financial statements. |

| Error Reduction | Minimized human error via code enforcement. | Prone to human input errors; requires controls. |

| Cost Efficiency | Potentially lower costs via automation and reduced intermediaries. | Costs related to manual processing and regulatory compliance. |

| Adoption Level | Early-stage, primarily in tech-savvy companies. | Global standard widely adopted by enterprises. |

Which is better?

Smart contracts accounting offers real-time transaction verification and automated ledger updates, enhancing transparency and reducing manual errors compared to traditional IFRS compliance processes. IFRS compliance ensures standardized financial reporting, providing consistency and comparability for investors and regulators across global markets. Evaluating the integration of blockchain-based smart contracts with IFRS frameworks could optimize accuracy and regulatory adherence in accounting practices.

Connection

Smart contracts streamline accounting processes by automating transaction recording, ensuring accuracy and reducing errors. Their integration with IFRS compliance enables real-time verification of financial data against established reporting standards. This synergy enhances transparency and auditability in financial statements, promoting regulatory adherence.

Key Terms

Fair Value Measurement

IFRS compliance mandates that fair value measurement reflects the price at which an asset could be exchanged in an orderly transaction between market participants. Smart contracts accounting automates fair value calculations by integrating real-time market data and predetermined valuation algorithms, enhancing accuracy and transparency. Explore how smart contracts can revolutionize fair value measurement in IFRS frameworks for improved financial reporting.

Automated Audit Trail

IFRS compliance emphasizes transparent financial reporting and precise automated audit trails to ensure accuracy and regulatory adherence, while smart contracts accounting leverages blockchain technology to create immutable, real-time audit records that enhance verification processes and reduce manual errors. Automated audit trails in smart contracts offer end-to-end traceability and instant validation of transactions aligned with IFRS standards, facilitating more efficient audits and error detection. Explore how integrating smart contracts can revolutionize traditional IFRS compliance and elevate your audit trail reliability.

Real-time Revenue Recognition

IFRS compliance mandates accurate, periodic financial reporting, which challenges traditional revenue recognition processes due to timing and measurement complexities. Smart contracts enable real-time revenue recognition by automating contract execution and recording transactions instantly on blockchain platforms. Explore how integrating smart contracts can revolutionize IFRS-aligned accounting practices for enhanced transparency and efficiency.

Source and External Links

How to Prepare Financial Statements Under IFRS - Outlines the essential IFRS standards (such as IFRS 15 for revenue and IFRS 16 for leases) and provides checklists to guide accurate, compliant financial statement preparation, emphasizing transparency and comparability.

What are the IFRS Standards? - Highlights the importance of IFRS in ensuring financial transparency, the challenges of implementation (including training and compliance costs), and the value of automated reporting tools in simplifying IFRS compliance.

IFRS standards: What they are and how to comply - Quaderno - Explains that IFRS compliance is typically required for publicly traded companies (and sometimes SMEs), describes optional adoption for private companies seeking investment or planning to go public, and details the roles of the IFRS Foundation and IASB in setting and overseeing the standards.

dowidth.com

dowidth.com