Environmental Social Governance (ESG) integration focuses on embedding sustainability metrics into core accounting practices to evaluate a company's long-term value and risk management. Triple Bottom Line (TBL) accounting expands traditional financial reporting by adding social and environmental impact assessments alongside economic performance. Explore the differences and benefits of these frameworks to enhance comprehensive corporate responsibility reporting.

Why it is important

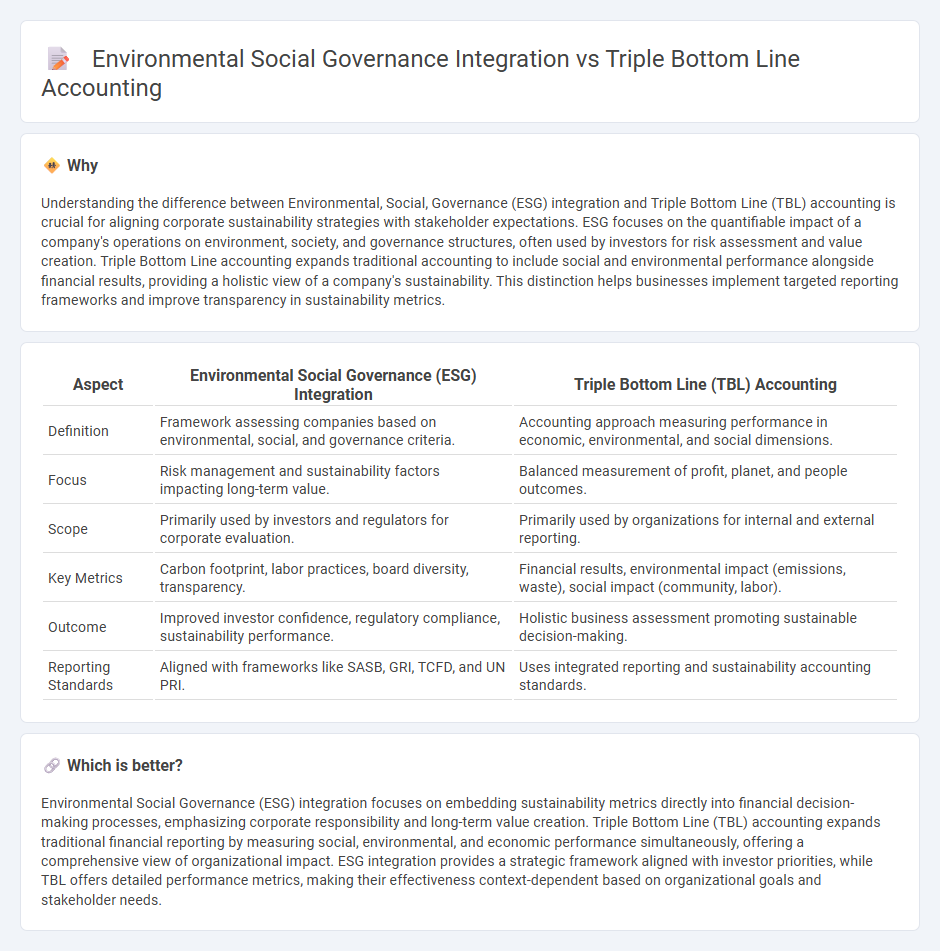

Understanding the difference between Environmental, Social, Governance (ESG) integration and Triple Bottom Line (TBL) accounting is crucial for aligning corporate sustainability strategies with stakeholder expectations. ESG focuses on the quantifiable impact of a company's operations on environment, society, and governance structures, often used by investors for risk assessment and value creation. Triple Bottom Line accounting expands traditional accounting to include social and environmental performance alongside financial results, providing a holistic view of a company's sustainability. This distinction helps businesses implement targeted reporting frameworks and improve transparency in sustainability metrics.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Integration | Triple Bottom Line (TBL) Accounting |

|---|---|---|

| Definition | Framework assessing companies based on environmental, social, and governance criteria. | Accounting approach measuring performance in economic, environmental, and social dimensions. |

| Focus | Risk management and sustainability factors impacting long-term value. | Balanced measurement of profit, planet, and people outcomes. |

| Scope | Primarily used by investors and regulators for corporate evaluation. | Primarily used by organizations for internal and external reporting. |

| Key Metrics | Carbon footprint, labor practices, board diversity, transparency. | Financial results, environmental impact (emissions, waste), social impact (community, labor). |

| Outcome | Improved investor confidence, regulatory compliance, sustainability performance. | Holistic business assessment promoting sustainable decision-making. |

| Reporting Standards | Aligned with frameworks like SASB, GRI, TCFD, and UN PRI. | Uses integrated reporting and sustainability accounting standards. |

Which is better?

Environmental Social Governance (ESG) integration focuses on embedding sustainability metrics directly into financial decision-making processes, emphasizing corporate responsibility and long-term value creation. Triple Bottom Line (TBL) accounting expands traditional financial reporting by measuring social, environmental, and economic performance simultaneously, offering a comprehensive view of organizational impact. ESG integration provides a strategic framework aligned with investor priorities, while TBL offers detailed performance metrics, making their effectiveness context-dependent based on organizational goals and stakeholder needs.

Connection

Environmental Social Governance (ESG) integration and Triple Bottom Line (TBL) accounting are connected through their focus on measuring a company's performance beyond financial profits, incorporating environmental sustainability, social responsibility, and economic impact. ESG metrics provide quantitative data that enhances TBL accounting frameworks, enabling organizations to assess and report on sustainability and social outcomes alongside traditional financial results. This integration supports comprehensive corporate accountability and drives strategic decision-making aligned with long-term value creation and stakeholder interests.

Key Terms

Sustainability Reporting

Triple bottom line accounting emphasizes measuring a company's performance across social, environmental, and financial dimensions to provide a holistic view of sustainability impact. Environmental Social Governance (ESG) integration incorporates these factors into core business strategies and investment decisions, aligning sustainability reporting with stakeholder expectations and regulatory standards. Discover how these frameworks shape transparent and effective sustainability reporting for businesses.

Stakeholder Value

Triple bottom line accounting evaluates performance through economic, environmental, and social dimensions to enhance stakeholder value by balancing profit, planet, and people. Environmental Social Governance (ESG) integration incorporates sustainability metrics into corporate decision-making processes, aligning with investor expectations and regulatory standards to drive long-term value creation. Explore how these frameworks reshape stakeholder priorities and corporate accountability for deeper insights.

Non-Financial Metrics

Triple bottom line accounting evaluates corporate performance through social, environmental, and financial metrics, emphasizing sustainability and stakeholder impact beyond profit. Environmental Social Governance (ESG) integration prioritizes non-financial metrics by embedding environmental responsibility, social equity, and governance standards into investment and corporate strategies. Explore how these frameworks shape sustainable business practices and drive value creation.

Source and External Links

The Triple Bottom Line: What Is It and How Does It Work? - The Triple Bottom Line (TBL) is an accounting framework that expands traditional financial measures to also include social and environmental performance, focusing on profits, people, and the planet to support sustainable growth.

What Is the Triple Bottom Line (TBL)? - The TBL is a sustainability framework focusing on the three P's--people, planet, and profit--where businesses measure and maximize social impact, environmental stewardship, and financial success collectively.

Triple bottom line - The triple bottom line is an accounting concept introduced by John Elkington that evaluates corporate performance based on three dimensions: social, environmental, and economic, aimed at broader value creation beyond financial profit alone.

dowidth.com

dowidth.com