Dark data auditing uncovers hidden, unstructured information within organizations that is often overlooked in traditional audits, enhancing data accuracy and compliance. Continuous auditing employs automated, real-time monitoring systems to provide ongoing assurance, reducing risks and improving financial reliability. Explore more to understand how these innovative auditing methods transform financial oversight.

Why it is important

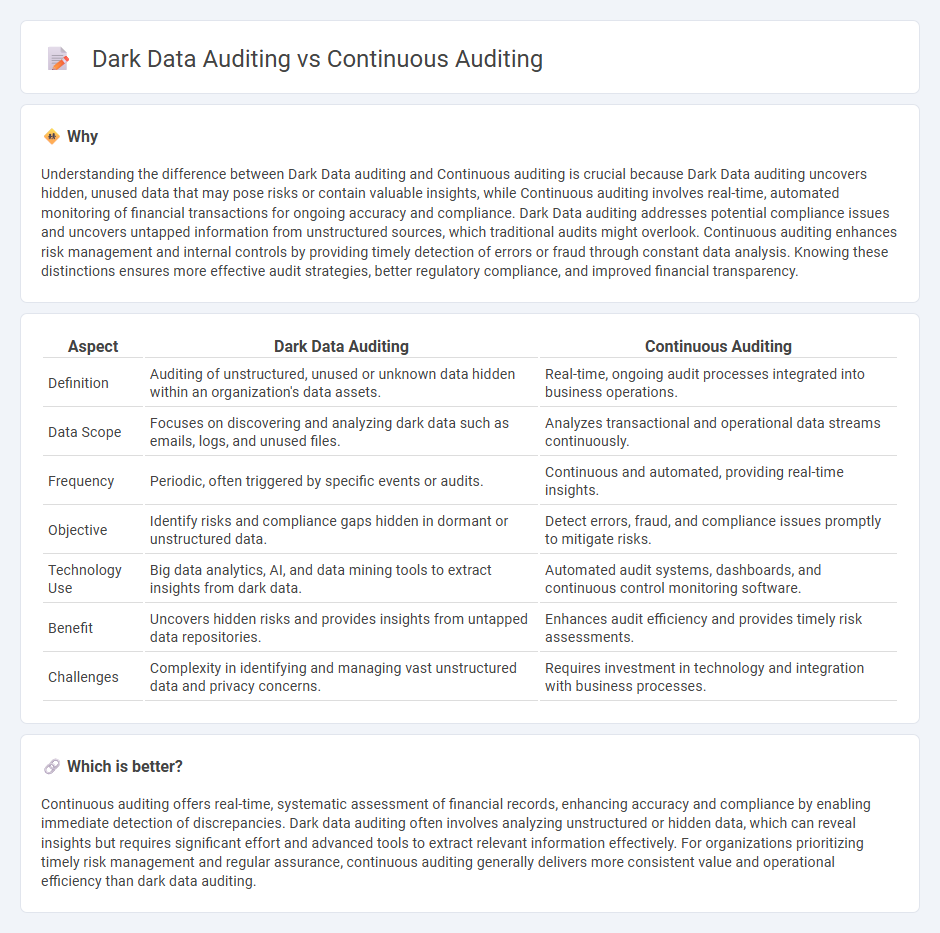

Understanding the difference between Dark Data auditing and Continuous auditing is crucial because Dark Data auditing uncovers hidden, unused data that may pose risks or contain valuable insights, while Continuous auditing involves real-time, automated monitoring of financial transactions for ongoing accuracy and compliance. Dark Data auditing addresses potential compliance issues and uncovers untapped information from unstructured sources, which traditional audits might overlook. Continuous auditing enhances risk management and internal controls by providing timely detection of errors or fraud through constant data analysis. Knowing these distinctions ensures more effective audit strategies, better regulatory compliance, and improved financial transparency.

Comparison Table

| Aspect | Dark Data Auditing | Continuous Auditing |

|---|---|---|

| Definition | Auditing of unstructured, unused or unknown data hidden within an organization's data assets. | Real-time, ongoing audit processes integrated into business operations. |

| Data Scope | Focuses on discovering and analyzing dark data such as emails, logs, and unused files. | Analyzes transactional and operational data streams continuously. |

| Frequency | Periodic, often triggered by specific events or audits. | Continuous and automated, providing real-time insights. |

| Objective | Identify risks and compliance gaps hidden in dormant or unstructured data. | Detect errors, fraud, and compliance issues promptly to mitigate risks. |

| Technology Use | Big data analytics, AI, and data mining tools to extract insights from dark data. | Automated audit systems, dashboards, and continuous control monitoring software. |

| Benefit | Uncovers hidden risks and provides insights from untapped data repositories. | Enhances audit efficiency and provides timely risk assessments. |

| Challenges | Complexity in identifying and managing vast unstructured data and privacy concerns. | Requires investment in technology and integration with business processes. |

Which is better?

Continuous auditing offers real-time, systematic assessment of financial records, enhancing accuracy and compliance by enabling immediate detection of discrepancies. Dark data auditing often involves analyzing unstructured or hidden data, which can reveal insights but requires significant effort and advanced tools to extract relevant information effectively. For organizations prioritizing timely risk management and regular assurance, continuous auditing generally delivers more consistent value and operational efficiency than dark data auditing.

Connection

Dark data auditing enhances continuous auditing by identifying and analyzing previously overlooked or unused data sources, thereby improving the accuracy and completeness of financial assessments. Continuous auditing leverages advanced analytics and real-time data processing to monitor transactions and controls consistently, which is strengthened by integrating insights derived from dark data. Together, these approaches enable more comprehensive risk management and fraud detection in accounting practices.

Key Terms

Real-time data analysis

Continuous auditing utilizes automated tools to perform real-time data analysis, ensuring immediate detection of anomalies and compliance issues within financial systems. Dark data auditing targets unstructured and hidden data sources to uncover overlooked risks, focusing on extracting valuable insights that remain outside traditional audits. Explore deeper insights into real-time data analysis techniques in continuous and dark data auditing to enhance organizational transparency.

Data visibility

Continuous auditing leverages real-time data analysis and automated controls to enhance data visibility and compliance monitoring throughout business processes. Dark data auditing focuses on uncovering and analyzing unstructured, hidden data that organizations typically overlook, improving risk assessment and decision-making by revealing valuable insights. Explore more to understand how these auditing methodologies transform data visibility and governance.

Risk detection

Continuous auditing employs automated, real-time data analysis to detect risks promptly across financial transactions and compliance processes, reducing the likelihood of undetected errors and fraud. Dark data auditing targets unstructured or hidden data sources, uncovering risks embedded in unused logs, emails, and other non-traditional datasets often overlooked in standard audits. Explore how integrating continuous auditing with dark data auditing enhances comprehensive risk detection strategies.

Source and External Links

Continuous audit and monitoring - Continuous auditing involves ongoing audit-related activities to detect anomalies and risks in real-time, refining audit rules based on transactional data to ensure financial integrity and compliance.

A framework for continuous auditing - This article discusses the framework and procedures for continuous auditing, focusing on testing risks and control effectiveness on a more frequent basis, enhancing audit methodology and effectiveness.

Continuous Auditing: Advantages & Challenges - Continuous auditing provides real-time financial reviews through automation, allowing auditors to identify risks proactively and maintain higher accuracy compared to traditional methods.

dowidth.com

dowidth.com