Continuous auditing employs real-time data analysis and automated tools to monitor financial transactions and internal controls, enhancing the accuracy and timeliness of audit findings. Compliance auditing focuses on verifying adherence to regulatory standards, policies, and legal requirements to ensure organizational accountability and risk mitigation. Explore the key differences and benefits of both auditing approaches to improve your organization's financial oversight.

Why it is important

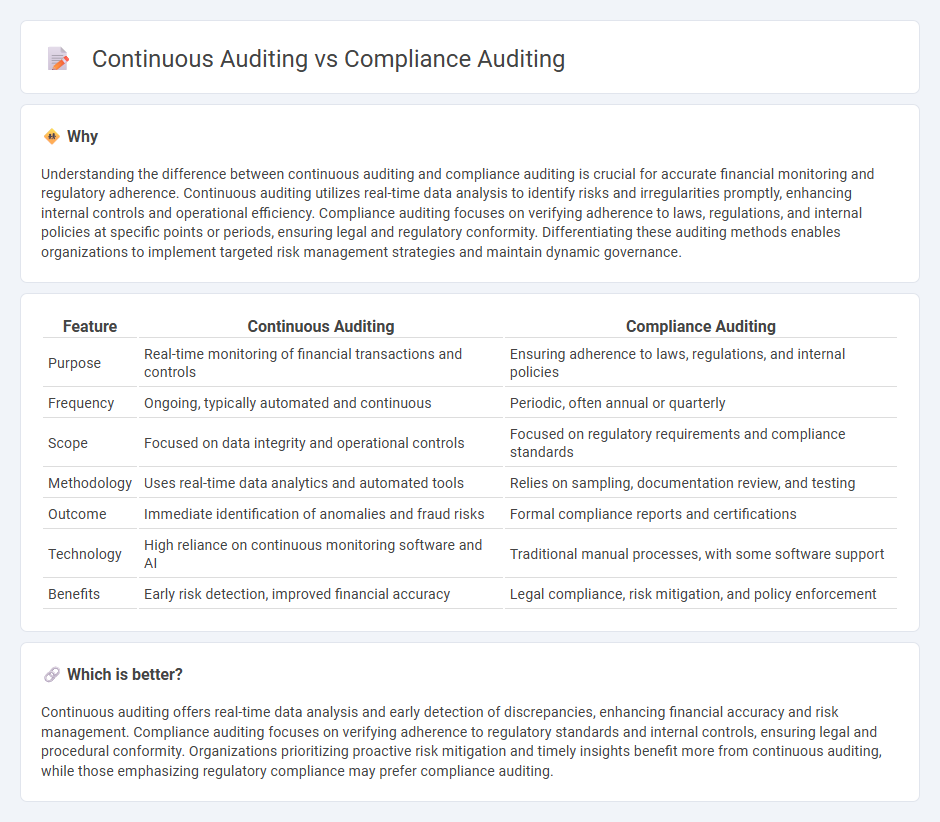

Understanding the difference between continuous auditing and compliance auditing is crucial for accurate financial monitoring and regulatory adherence. Continuous auditing utilizes real-time data analysis to identify risks and irregularities promptly, enhancing internal controls and operational efficiency. Compliance auditing focuses on verifying adherence to laws, regulations, and internal policies at specific points or periods, ensuring legal and regulatory conformity. Differentiating these auditing methods enables organizations to implement targeted risk management strategies and maintain dynamic governance.

Comparison Table

| Feature | Continuous Auditing | Compliance Auditing |

|---|---|---|

| Purpose | Real-time monitoring of financial transactions and controls | Ensuring adherence to laws, regulations, and internal policies |

| Frequency | Ongoing, typically automated and continuous | Periodic, often annual or quarterly |

| Scope | Focused on data integrity and operational controls | Focused on regulatory requirements and compliance standards |

| Methodology | Uses real-time data analytics and automated tools | Relies on sampling, documentation review, and testing |

| Outcome | Immediate identification of anomalies and fraud risks | Formal compliance reports and certifications |

| Technology | High reliance on continuous monitoring software and AI | Traditional manual processes, with some software support |

| Benefits | Early risk detection, improved financial accuracy | Legal compliance, risk mitigation, and policy enforcement |

Which is better?

Continuous auditing offers real-time data analysis and early detection of discrepancies, enhancing financial accuracy and risk management. Compliance auditing focuses on verifying adherence to regulatory standards and internal controls, ensuring legal and procedural conformity. Organizations prioritizing proactive risk mitigation and timely insights benefit more from continuous auditing, while those emphasizing regulatory compliance may prefer compliance auditing.

Connection

Continuous auditing employs real-time data analysis to identify discrepancies, ensuring ongoing adherence to regulatory standards. Compliance auditing systematically reviews financial records and processes to verify conformity with laws and internal policies. Together, these auditing methods enhance organizational transparency and mitigate risks by enabling timely detection and correction of compliance issues.

Key Terms

**Compliance Auditing:**

Compliance auditing involves systematic examination of an organization's adherence to regulatory requirements, internal policies, and industry standards, ensuring legal and ethical compliance. This process typically occurs at scheduled intervals, providing comprehensive reports on compliance status and identifying areas of risk or non-conformance. Explore more about how compliance auditing safeguards organizational integrity and mitigates legal risks.

Regulatory Standards

Compliance auditing involves periodic evaluations of an organization's adherence to regulatory standards such as GDPR, HIPAA, or SOX, ensuring documented evidence of compliance at specific points in time. Continuous auditing leverages real-time data analysis and automated monitoring systems to provide up-to-date insights on regulatory adherence, enabling quicker identification and remediation of non-compliance issues. Explore further to understand how integrating continuous auditing can enhance regulatory compliance management.

Documentation

Compliance auditing emphasizes thorough documentation to verify adherence to regulatory standards through periodic, structured reviews. Continuous auditing integrates automated tools to maintain real-time documentation updates, ensuring ongoing compliance monitoring and rapid issue detection. Explore more to understand how documentation strategies differ significantly between these auditing approaches.

Source and External Links

What is a compliance audit? Definition, strategy & reporting - This webpage provides an overview of compliance audits, including their importance, types, and strategies for conducting them effectively.

What is compliance audit? - This resource offers a definition and explanation of compliance audits, highlighting their role in reviewing an organization's adherence to regulatory guidelines.

Compliance Audit: Definition, Types, and What to Expect - This article defines compliance audits, discusses their characteristics, and outlines what organizations can expect during the audit process.

dowidth.com

dowidth.com