Cryptocurrency taxation involves specific regulations on capital gains, income reporting, and transaction tracking, distinct from VAT/GST frameworks applied to digital assets that focus on consumption taxes during sales or exchanges. While cryptocurrency taxation addresses the treatment of profits from trading and mining activities, VAT/GST regulations primarily govern the value-added tax on goods and services exchanged using digital currencies. Explore detailed distinctions and compliance requirements to ensure accurate financial reporting and tax adherence.

Why it is important

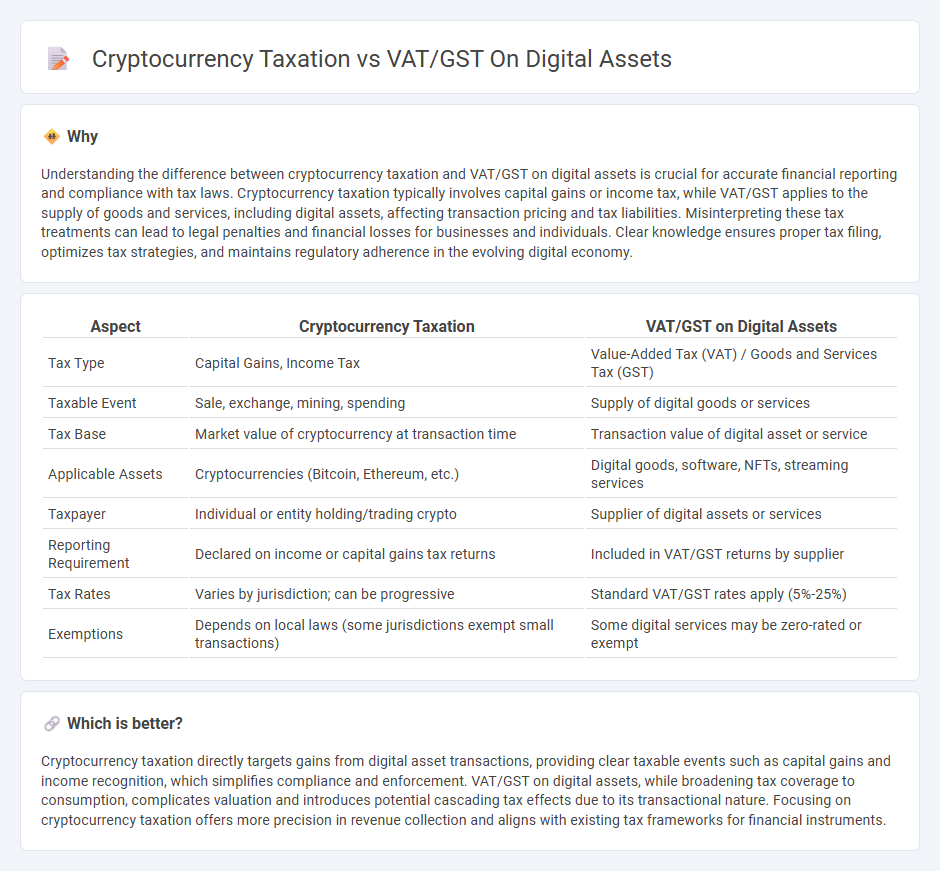

Understanding the difference between cryptocurrency taxation and VAT/GST on digital assets is crucial for accurate financial reporting and compliance with tax laws. Cryptocurrency taxation typically involves capital gains or income tax, while VAT/GST applies to the supply of goods and services, including digital assets, affecting transaction pricing and tax liabilities. Misinterpreting these tax treatments can lead to legal penalties and financial losses for businesses and individuals. Clear knowledge ensures proper tax filing, optimizes tax strategies, and maintains regulatory adherence in the evolving digital economy.

Comparison Table

| Aspect | Cryptocurrency Taxation | VAT/GST on Digital Assets |

|---|---|---|

| Tax Type | Capital Gains, Income Tax | Value-Added Tax (VAT) / Goods and Services Tax (GST) |

| Taxable Event | Sale, exchange, mining, spending | Supply of digital goods or services |

| Tax Base | Market value of cryptocurrency at transaction time | Transaction value of digital asset or service |

| Applicable Assets | Cryptocurrencies (Bitcoin, Ethereum, etc.) | Digital goods, software, NFTs, streaming services |

| Taxpayer | Individual or entity holding/trading crypto | Supplier of digital assets or services |

| Reporting Requirement | Declared on income or capital gains tax returns | Included in VAT/GST returns by supplier |

| Tax Rates | Varies by jurisdiction; can be progressive | Standard VAT/GST rates apply (5%-25%) |

| Exemptions | Depends on local laws (some jurisdictions exempt small transactions) | Some digital services may be zero-rated or exempt |

Which is better?

Cryptocurrency taxation directly targets gains from digital asset transactions, providing clear taxable events such as capital gains and income recognition, which simplifies compliance and enforcement. VAT/GST on digital assets, while broadening tax coverage to consumption, complicates valuation and introduces potential cascading tax effects due to its transactional nature. Focusing on cryptocurrency taxation offers more precision in revenue collection and aligns with existing tax frameworks for financial instruments.

Connection

Cryptocurrency taxation and VAT/GST on digital assets are interconnected through the treatment of digital currencies as taxable goods or financial instruments. Tax authorities classify cryptocurrency transactions as either sales or services, triggering VAT/GST obligations alongside income or capital gains tax liabilities. Understanding this dual tax framework ensures accurate compliance and prevents penalties in jurisdictions enforcing both cryptocurrency taxation and consumption taxes on digital asset transfers.

Key Terms

Place of Supply

VAT and GST on digital assets primarily depend on the Place of Supply rules, which determine the tax jurisdiction based on the location of the supplier or recipient during the transaction. Cryptocurrency taxation varies as governments often classify these assets differently, impacting how VAT/GST is applied or exempted, with jurisdictions like the EU and Australia providing specific guidelines. Explore detailed regulations and case studies to understand the nuances of Place of Supply in digital asset and cryptocurrency tax compliance.

Input Tax Credit

Input Tax Credit (ITC) mechanisms for VAT/GST on digital assets typically allow businesses to recover taxes paid on purchases related to digital services, whereas cryptocurrency taxation often lacks clear ITC provisions due to regulatory ambiguities. VAT/GST frameworks classify digital assets as goods or services, enabling ITC claims that reduce the effective tax burden, in contrast to cryptocurrency transactions which are frequently treated as financial or intangible assets with limited ITC applicability. Explore in-depth differences in ITC treatment for digital assets and cryptocurrencies to optimize compliance and tax strategy.

Capital Gains Tax

VAT and GST on digital assets typically apply to the supply of digital goods and services, while cryptocurrency taxation, specifically Capital Gains Tax (CGT), targets profits from the sale or exchange of crypto assets. Many jurisdictions exempt cryptocurrencies from VAT/GST, classifying them as financial instruments rather than consumable goods, but still impose CGT on gains realized from trading or investing in digital currencies. Explore further to understand the nuanced distinctions and regulatory frameworks governing digital asset taxation worldwide.

Source and External Links

GST on Supply of Crypto or Digital Assets - Discusses the status of GST on digital assets in India, noting that the GST Act does not define crypto or digital assets but refers to virtual digital assets defined in the finance budget.

VAT/GST Harmonization Challenges for Digital Assets - Explores VAT/GST compliance challenges for digital assets and NFTs, advocating for a unified approach to reduce uncertainty across EU member states.

VAT Considerations for Digital Assets - Provides insights into VAT and GST rules for digital assets like cryptocurrencies and NFTs, highlighting jurisdictional variations in taxation.

dowidth.com

dowidth.com