Predictive close uses data analytics and forecasting models to anticipate financial outcomes and optimize the closing process, enhancing accuracy and efficiency in accounting periods. Hard close involves a strict, fixed deadline by which all financial transactions must be finalized, ensuring compliance and operational discipline. Explore the benefits and challenges of both methods to determine the best fit for your organization's accounting practices.

Why it is important

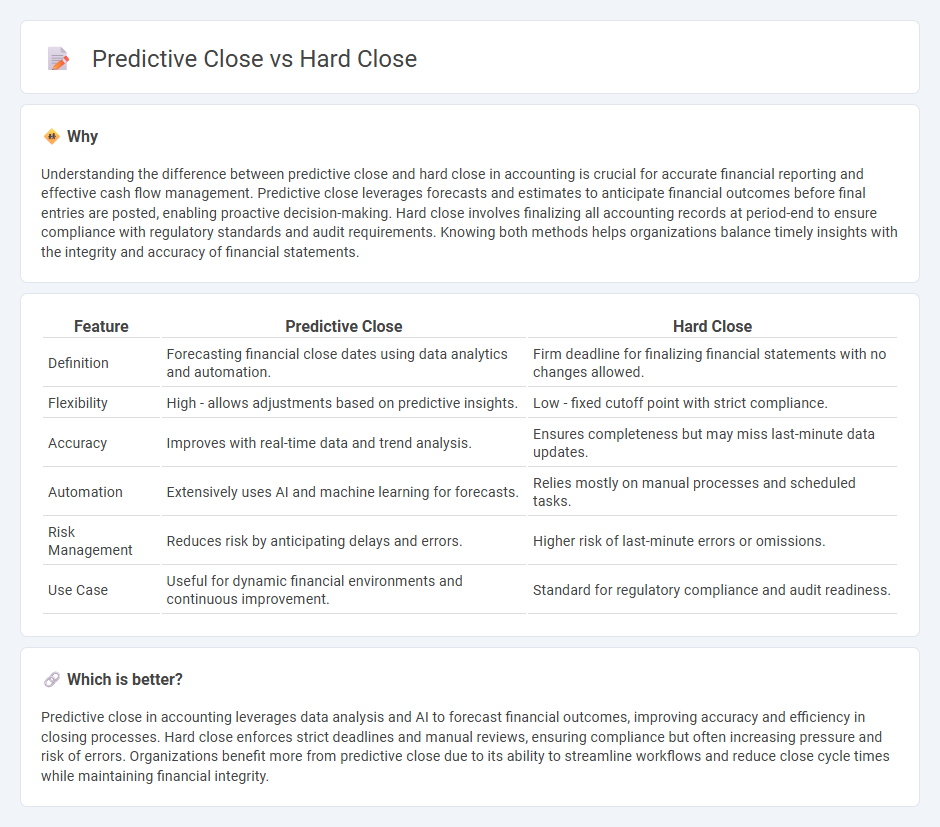

Understanding the difference between predictive close and hard close in accounting is crucial for accurate financial reporting and effective cash flow management. Predictive close leverages forecasts and estimates to anticipate financial outcomes before final entries are posted, enabling proactive decision-making. Hard close involves finalizing all accounting records at period-end to ensure compliance with regulatory standards and audit requirements. Knowing both methods helps organizations balance timely insights with the integrity and accuracy of financial statements.

Comparison Table

| Feature | Predictive Close | Hard Close |

|---|---|---|

| Definition | Forecasting financial close dates using data analytics and automation. | Firm deadline for finalizing financial statements with no changes allowed. |

| Flexibility | High - allows adjustments based on predictive insights. | Low - fixed cutoff point with strict compliance. |

| Accuracy | Improves with real-time data and trend analysis. | Ensures completeness but may miss last-minute data updates. |

| Automation | Extensively uses AI and machine learning for forecasts. | Relies mostly on manual processes and scheduled tasks. |

| Risk Management | Reduces risk by anticipating delays and errors. | Higher risk of last-minute errors or omissions. |

| Use Case | Useful for dynamic financial environments and continuous improvement. | Standard for regulatory compliance and audit readiness. |

Which is better?

Predictive close in accounting leverages data analysis and AI to forecast financial outcomes, improving accuracy and efficiency in closing processes. Hard close enforces strict deadlines and manual reviews, ensuring compliance but often increasing pressure and risk of errors. Organizations benefit more from predictive close due to its ability to streamline workflows and reduce close cycle times while maintaining financial integrity.

Connection

Predictive close and hard close are interconnected in accounting through their roles in streamlining the financial closing process. Predictive close leverages data analytics and automation to anticipate and address discrepancies before the final financial statements are prepared, reducing errors and time. Hard close enforces strict deadlines and controls to finalize accounts, ensuring compliance and timely reporting, which is enhanced by the accuracy and foresight provided by predictive close techniques.

Key Terms

Financial Statements

Hard close involves finalizing financial statements by a strict deadline, ensuring all transactions are recorded and reports are accurate up to a specific cutoff date. Predictive close uses forecasting techniques and real-time data analysis to estimate financial outcomes before the formal close, improving decision-making and agility. Explore how these closing methods impact audit readiness and financial transparency for your organization.

Forecast Accuracy

Hard close demands a firm commitment by a specific deadline, ensuring concrete sales results that boost forecast accuracy through definitive deal closures. Predictive close relies on analyzing buying signals and customer behavior patterns, offering a data-driven approach that refines forecast precision over time. Discover how integrating these closing techniques can elevate your sales forecasting effectiveness and drive revenue growth.

Closing Process

Hard close techniques rely on direct, assertive statements to prompt an immediate buying decision, often emphasizing urgency or limited availability. Predictive close uses data-driven insights and customer behavior analysis to forecast the optimal moment to suggest a purchase, increasing the likelihood of conversion. Explore effective closing strategies to enhance your sales process and boost revenue.

Source and External Links

Soft Close vs Hard Close: Which is Best? - This webpage discusses the hard close as a sales technique that involves presenting a clear, immediate choice to the client, often used in time-sensitive situations or competitive markets.

Sales 101: The hard and soft close - This article explains the hard close as a direct sales method requiring an immediate response, useful for creating urgency or finalizing deals.

Lessening the year-end rush: embracing a hard close audit - This blog post discusses the hard close audit process, which involves preparing and auditing financial statements early to improve quality and efficiency.

dowidth.com

dowidth.com