Tokenized assets accounting leverages blockchain technology to provide real-time, transparent valuation and tracking of digital assets, contrasting with historical cost accounting that records assets based on original purchase prices without reflecting current market values. Tokenized assets enable dynamic asset management and enhanced liquidity in financial statements, while historical cost accounting offers simplicity and audit reliability by maintaining fixed asset values over time. Explore how these accounting methods impact financial reporting and decision-making in modern finance.

Why it is important

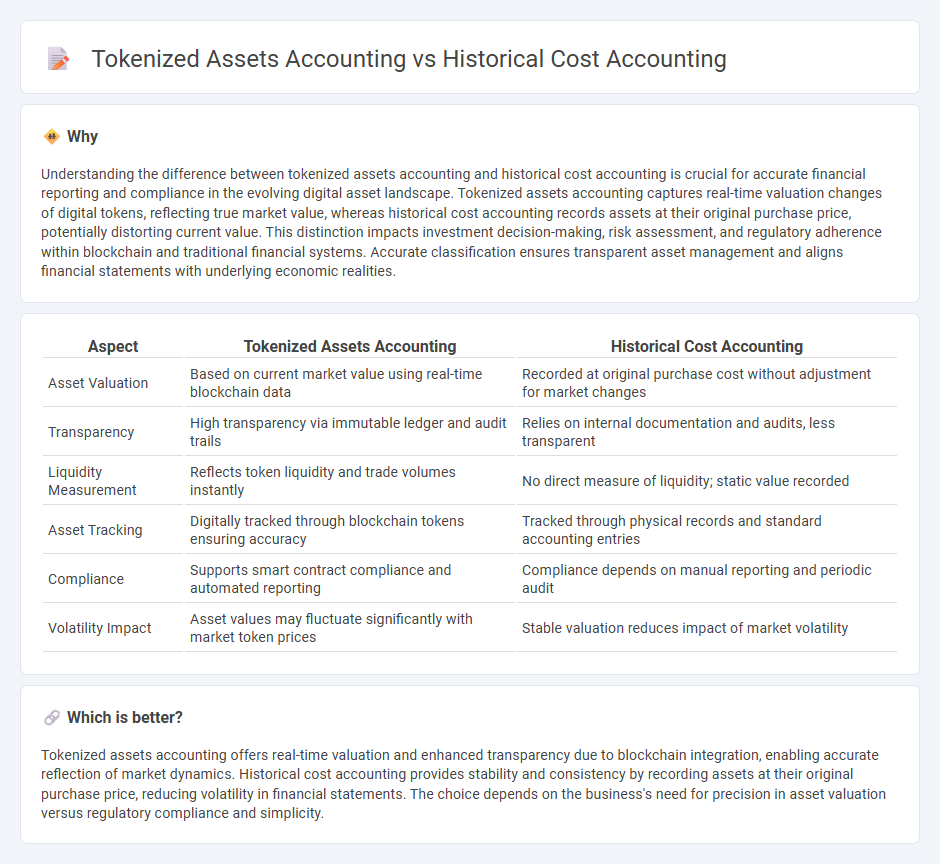

Understanding the difference between tokenized assets accounting and historical cost accounting is crucial for accurate financial reporting and compliance in the evolving digital asset landscape. Tokenized assets accounting captures real-time valuation changes of digital tokens, reflecting true market value, whereas historical cost accounting records assets at their original purchase price, potentially distorting current value. This distinction impacts investment decision-making, risk assessment, and regulatory adherence within blockchain and traditional financial systems. Accurate classification ensures transparent asset management and aligns financial statements with underlying economic realities.

Comparison Table

| Aspect | Tokenized Assets Accounting | Historical Cost Accounting |

|---|---|---|

| Asset Valuation | Based on current market value using real-time blockchain data | Recorded at original purchase cost without adjustment for market changes |

| Transparency | High transparency via immutable ledger and audit trails | Relies on internal documentation and audits, less transparent |

| Liquidity Measurement | Reflects token liquidity and trade volumes instantly | No direct measure of liquidity; static value recorded |

| Asset Tracking | Digitally tracked through blockchain tokens ensuring accuracy | Tracked through physical records and standard accounting entries |

| Compliance | Supports smart contract compliance and automated reporting | Compliance depends on manual reporting and periodic audit |

| Volatility Impact | Asset values may fluctuate significantly with market token prices | Stable valuation reduces impact of market volatility |

Which is better?

Tokenized assets accounting offers real-time valuation and enhanced transparency due to blockchain integration, enabling accurate reflection of market dynamics. Historical cost accounting provides stability and consistency by recording assets at their original purchase price, reducing volatility in financial statements. The choice depends on the business's need for precision in asset valuation versus regulatory compliance and simplicity.

Connection

Tokenized assets accounting integrates blockchain-based digital representations of assets with traditional accounting principles, allowing for enhanced traceability and real-time valuation. Historical cost accounting records asset values based on their original purchase price, providing a stable reference point that supports the verification and auditing processes of tokenized asset transactions. Combining these approaches ensures accurate financial reporting by reconciling immutable blockchain data with established cost measurement standards.

Key Terms

Valuation basis

Historical cost accounting records assets based on their original purchase price, providing consistency and simplicity but often lacking current market value relevance. Tokenized assets accounting leverages blockchain technology to reflect real-time, market-driven valuations, enhancing transparency and liquidity for digital asset holders. Explore how evolving valuation bases impact financial reporting and investment strategies in emerging asset classes.

Asset recording

Historical cost accounting records assets based on their original purchase price, ensuring consistency and reliability in financial statements but often overlooking market value fluctuations. Tokenized assets accounting captures real-time market values through blockchain technology, enhancing transparency and liquidity but introducing volatility in asset reporting. Explore the evolving accounting frameworks to better understand these contrasting approaches.

Fair value measurement

Historical cost accounting records assets based on their original purchase price, providing a stable but potentially outdated valuation method. Tokenized assets accounting leverages blockchain technology to enable real-time fair value measurement through transparent market pricing and dynamic asset tokenization. Explore how fair value measurement in tokenized assets revolutionizes financial reporting accuracy and asset liquidity.

Source and External Links

Historical cost - Wikipedia - Historical cost accounting reports assets and liabilities at their original acquisition cost, ignoring subsequent changes in market value, thus providing verifiable but sometimes outdated financial information; it remains widely used despite criticism and has alternatives like fair value measurement and capital maintenance models during inflationary periods.

Historical cost definition - AccountingTools - Historical cost is the original purchase price of an asset recorded in accounting records, including costs to bring the asset to usable condition, and follows the cost principle that prevents upward revaluation of assets under generally accepted accounting principles.

what is the historical cost principle | Xenett - The Historical Cost Convention records assets and liabilities at their original cost to promote accuracy, consistency, reliability, and cost-effectiveness in financial statements, enabling easier comparison over time and across companies.

dowidth.com

dowidth.com