Cryptocurrency taxation involves the complex valuation and reporting of digital asset transactions, often subject to capital gains and income tax regulations that differ from traditional financial instruments. In contrast, fiat tax pertains to the taxation of conventional currency transactions and income, typically governed by established regulatory frameworks with clearer reporting standards. Explore the nuances and implications of crypto tax versus fiat tax to optimize your financial strategy.

Why it is important

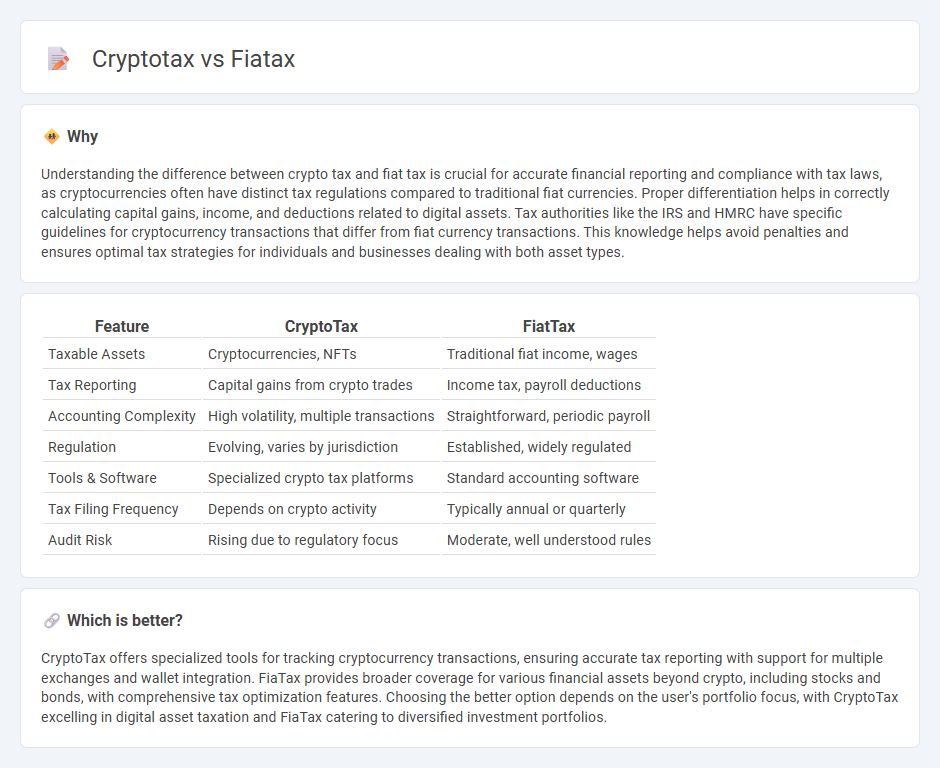

Understanding the difference between crypto tax and fiat tax is crucial for accurate financial reporting and compliance with tax laws, as cryptocurrencies often have distinct tax regulations compared to traditional fiat currencies. Proper differentiation helps in correctly calculating capital gains, income, and deductions related to digital assets. Tax authorities like the IRS and HMRC have specific guidelines for cryptocurrency transactions that differ from fiat currency transactions. This knowledge helps avoid penalties and ensures optimal tax strategies for individuals and businesses dealing with both asset types.

Comparison Table

| Feature | CryptoTax | FiatTax |

|---|---|---|

| Taxable Assets | Cryptocurrencies, NFTs | Traditional fiat income, wages |

| Tax Reporting | Capital gains from crypto trades | Income tax, payroll deductions |

| Accounting Complexity | High volatility, multiple transactions | Straightforward, periodic payroll |

| Regulation | Evolving, varies by jurisdiction | Established, widely regulated |

| Tools & Software | Specialized crypto tax platforms | Standard accounting software |

| Tax Filing Frequency | Depends on crypto activity | Typically annual or quarterly |

| Audit Risk | Rising due to regulatory focus | Moderate, well understood rules |

Which is better?

CryptoTax offers specialized tools for tracking cryptocurrency transactions, ensuring accurate tax reporting with support for multiple exchanges and wallet integration. FiaTax provides broader coverage for various financial assets beyond crypto, including stocks and bonds, with comprehensive tax optimization features. Choosing the better option depends on the user's portfolio focus, with CryptoTax excelling in digital asset taxation and FiaTax catering to diversified investment portfolios.

Connection

CryptoTax and FiaTax are connected through their shared focus on simplifying tax compliance for digital assets and fiat currency transactions by leveraging advanced algorithms and blockchain technology. Both platforms integrate with various accounting software to provide accurate transaction tracking, automatic tax calculations, and regulatory reporting tailored to cryptocurrency and traditional financial activities. Their synergy enhances the accuracy and efficiency of tax reporting, helping individuals and businesses stay compliant with evolving tax laws in the digital economy.

Key Terms

Reporting Standards

Fiatax reporting standards emphasize compliance with regulatory frameworks such as GAAP and IRS guidelines, ensuring accurate documentation of income, expenses, and taxable events in traditional currencies. Cryptotax reporting requires adherence to blockchain-specific regulations, including transaction traceability, capital gains reporting on digital asset sales, and the use of IRS Form 8949 for cryptocurrency transactions. Explore detailed comparisons of Fiatax and Cryptotax reporting standards to optimize your tax filing strategy.

Valuation Methods

Fiatax valuation methods typically rely on standardized accounting principles and market-based assessments tied to fiat currency exchange rates. Cryptotax valuation involves real-time tracking of cryptocurrency prices, often using spot rates from multiple exchanges to determine accurate taxable values. Explore the nuances of each valuation approach to optimize tax reporting strategies effectively.

Regulatory Compliance

Fiatax emphasizes strict adherence to traditional financial regulations, ensuring comprehensive reporting and tax filing compliance for fiat currency transactions. Cryptotax specializes in managing digital asset taxation by aligning with evolving blockchain regulations and IRS guidelines for cryptocurrency gains and transfers. Explore the nuances of regulatory compliance in both systems to optimize your tax strategy effectively.

Source and External Links

2023 Publication OR-FIA, Oregon Farm Income Averaging (FIA) - FIA refers to Farm Income Averaging, a tax method in Oregon allowing farmers to average their taxable farm income over three prior years to potentially reduce personal income tax.

FIATX - Fidelity Advisor International Capital Appreciation Fund - FIATX is a mutual fund offering exposure to foreign large growth stocks, with strong recent performance and a focus on international capital appreciation.

Meet The Beloved Fiat 500x | FIAT USA Official Site - The Fiat 500X vehicle is discontinued in North America as of late 2023, with parts and support continuing via Stellantis dealers, unrelated to the tax or fund terms.

dowidth.com

dowidth.com