Real-time audit involves continuous monitoring and analysis of financial transactions as they occur, enabling immediate detection of discrepancies and ensuring ongoing compliance. Forensic audit focuses on investigating financial records to uncover fraud, embezzlement, or other illegal activities, often used in legal proceedings. Explore the differences to understand how each audit type safeguards business integrity.

Why it is important

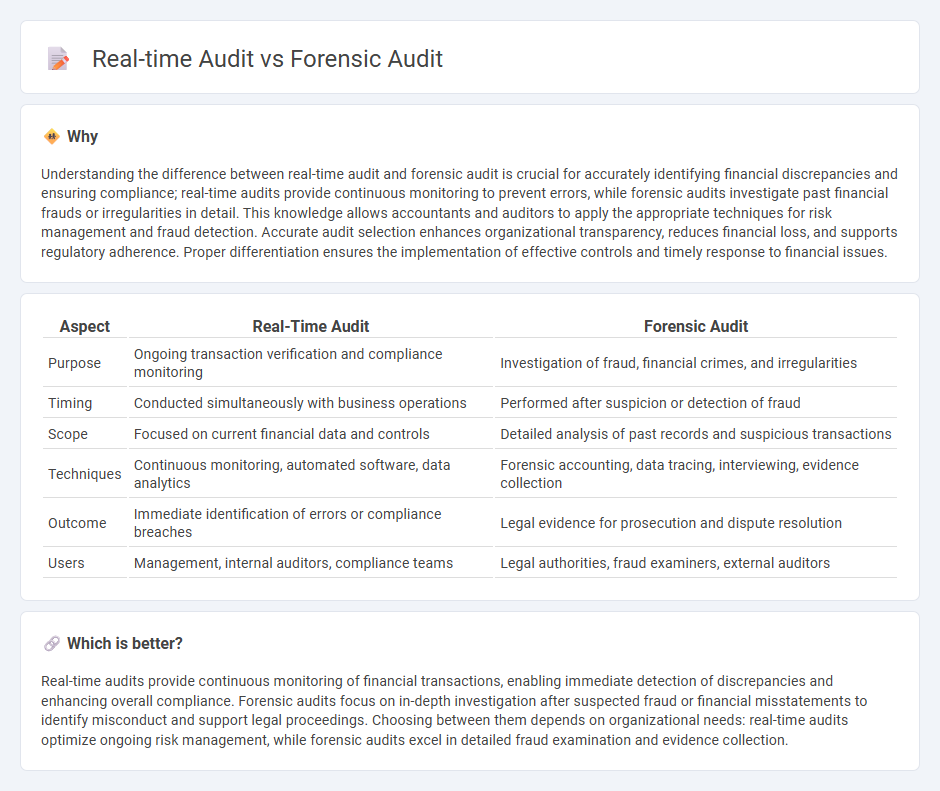

Understanding the difference between real-time audit and forensic audit is crucial for accurately identifying financial discrepancies and ensuring compliance; real-time audits provide continuous monitoring to prevent errors, while forensic audits investigate past financial frauds or irregularities in detail. This knowledge allows accountants and auditors to apply the appropriate techniques for risk management and fraud detection. Accurate audit selection enhances organizational transparency, reduces financial loss, and supports regulatory adherence. Proper differentiation ensures the implementation of effective controls and timely response to financial issues.

Comparison Table

| Aspect | Real-Time Audit | Forensic Audit |

|---|---|---|

| Purpose | Ongoing transaction verification and compliance monitoring | Investigation of fraud, financial crimes, and irregularities |

| Timing | Conducted simultaneously with business operations | Performed after suspicion or detection of fraud |

| Scope | Focused on current financial data and controls | Detailed analysis of past records and suspicious transactions |

| Techniques | Continuous monitoring, automated software, data analytics | Forensic accounting, data tracing, interviewing, evidence collection |

| Outcome | Immediate identification of errors or compliance breaches | Legal evidence for prosecution and dispute resolution |

| Users | Management, internal auditors, compliance teams | Legal authorities, fraud examiners, external auditors |

Which is better?

Real-time audits provide continuous monitoring of financial transactions, enabling immediate detection of discrepancies and enhancing overall compliance. Forensic audits focus on in-depth investigation after suspected fraud or financial misstatements to identify misconduct and support legal proceedings. Choosing between them depends on organizational needs: real-time audits optimize ongoing risk management, while forensic audits excel in detailed fraud examination and evidence collection.

Connection

Real-time audits and forensic audits are connected through their emphasis on continuous monitoring and detailed examination of financial data to detect irregularities. Real-time audits provide ongoing insights enabling immediate identification of discrepancies, which forensic audits then investigate deeply to uncover fraud or misconduct. This synergy enhances the accuracy and timeliness of financial fraud detection within organizations.

Key Terms

Forensic Audit:

Forensic audit involves a detailed examination of financial records to detect fraud, embezzlement, or financial discrepancies, often used in legal investigations and dispute resolutions. This audit emphasizes accuracy, evidence collection, and legal compliance, making it critical in identifying and preventing financial crimes. Explore more to understand how forensic audits safeguard organizational integrity and support legal processes.

Fraud detection

Forensic audits involve a detailed examination of financial records to uncover fraud after suspicious activity is identified, using historical data analysis and evidence collection for legal proceedings. Real-time audits leverage continuous monitoring technologies and advanced analytics to detect fraudulent transactions as they occur, enabling immediate intervention and reducing financial losses. Explore how integrating both audit types enhances fraud prevention strategies and strengthens organizational security.

Evidence collection

Forensic audits concentrate on meticulous evidence collection to uncover fraud or financial misconduct, relying heavily on detailed documentation, transactional data, and witness statements to build a robust case. Real-time audits focus on continuous monitoring and immediate evidence gathering to detect and prevent errors or irregularities as they occur, utilizing automated tools and live data analysis for prompt decision-making. Explore more to understand the techniques and benefits of each audit type in enhancing financial oversight.

Source and External Links

What is a Forensic Audit and Do I Need One? - A forensic audit is a detailed examination of financial records to uncover issues or provide evidence for legal proceedings.

Forensic Audit Guide - A forensic audit is conducted to gather evidence for use in legal proceedings, often involving fraud investigations.

Forensic Accounting - Forensic accounting involves applying specialized skills to detect financial misconduct and interpret complex financial data for legal contexts.

dowidth.com

dowidth.com