Forensic accounting software is designed to detect and investigate financial fraud by analyzing transaction patterns and ensuring compliance with auditing standards. Project accounting software focuses on tracking project-related costs, budgets, and financial performance to ensure profitability and resource optimization. Explore more to understand which solution fits your organizational needs best.

Why it is important

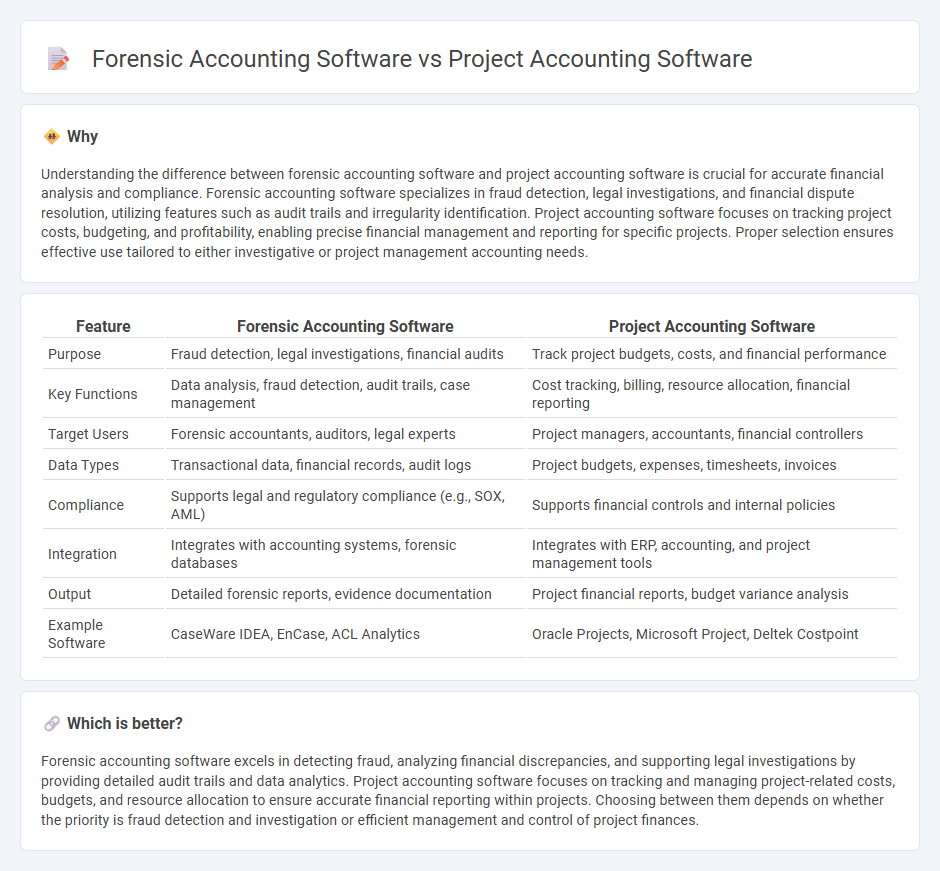

Understanding the difference between forensic accounting software and project accounting software is crucial for accurate financial analysis and compliance. Forensic accounting software specializes in fraud detection, legal investigations, and financial dispute resolution, utilizing features such as audit trails and irregularity identification. Project accounting software focuses on tracking project costs, budgeting, and profitability, enabling precise financial management and reporting for specific projects. Proper selection ensures effective use tailored to either investigative or project management accounting needs.

Comparison Table

| Feature | Forensic Accounting Software | Project Accounting Software |

|---|---|---|

| Purpose | Fraud detection, legal investigations, financial audits | Track project budgets, costs, and financial performance |

| Key Functions | Data analysis, fraud detection, audit trails, case management | Cost tracking, billing, resource allocation, financial reporting |

| Target Users | Forensic accountants, auditors, legal experts | Project managers, accountants, financial controllers |

| Data Types | Transactional data, financial records, audit logs | Project budgets, expenses, timesheets, invoices |

| Compliance | Supports legal and regulatory compliance (e.g., SOX, AML) | Supports financial controls and internal policies |

| Integration | Integrates with accounting systems, forensic databases | Integrates with ERP, accounting, and project management tools |

| Output | Detailed forensic reports, evidence documentation | Project financial reports, budget variance analysis |

| Example Software | CaseWare IDEA, EnCase, ACL Analytics | Oracle Projects, Microsoft Project, Deltek Costpoint |

Which is better?

Forensic accounting software excels in detecting fraud, analyzing financial discrepancies, and supporting legal investigations by providing detailed audit trails and data analytics. Project accounting software focuses on tracking and managing project-related costs, budgets, and resource allocation to ensure accurate financial reporting within projects. Choosing between them depends on whether the priority is fraud detection and investigation or efficient management and control of project finances.

Connection

Forensic accounting software enhances financial investigations by analyzing complex transactions and identifying discrepancies, which complements project accounting software's focus on tracking project-specific budgets, costs, and revenues. Both systems integrate detailed financial data to ensure transparency, accuracy, and compliance in financial reporting. This connection enables organizations to detect fraud, monitor project performance, and optimize financial decision-making processes.

Key Terms

Cost Tracking

Project accounting software excels in detailed cost tracking by allocating expenses to specific projects, enabling real-time budget monitoring and financial forecasting. Forensic accounting software, while capable of tracking costs, primarily focuses on detecting discrepancies and potential fraud rather than routine expense management. Explore how each software type optimizes cost tracking to enhance financial accuracy and project profitability.

Audit Trail

Project accounting software prioritizes detailed audit trails to track financial transactions and resource allocations across project phases, ensuring transparency and accountability. Forensic accounting software emphasizes audit trails designed for detecting fraud, irregularities, and anomalies within financial data, enabling thorough investigations and evidence collection. Explore the distinct audit trail features and benefits of both software types to enhance your financial oversight strategy.

Fraud Detection

Project accounting software primarily manages financial data related to specific projects, enabling budget tracking and resource allocation without specialized fraud detection features. Forensic accounting software integrates advanced analytical tools, such as data mining and anomaly detection algorithms, designed to identify fraudulent activities and discrepancies in financial records. Explore how these software solutions differ in enhancing fraud detection capabilities to make informed decisions.

Source and External Links

Sage Intacct Project Management Accounting Software - Sage Intacct offers cloud-based project accounting software that integrates financial and non-financial project data to track time, materials, personnel costs, revenue, and expenses for improved project visibility and profitability.

19 Best Accounting Project Management Software Reviewed For 2025 - This resource reviews top accounting project management software platforms, highlighting features like project budgeting, cost tracking, invoicing, expense management, and integration to streamline financial and project workflows.

NetSuite Project Accounting - NetSuite's project accounting solution automates billing, revenue recognition, job costing, and forecasting with integrated financial management tools to provide real-time insights into project profitability and performance.

dowidth.com

dowidth.com