Sustainability ledger focuses on tracking environmental, social, and governance (ESG) metrics within financial reporting to provide a comprehensive view of corporate responsibility. The triple bottom line framework expands this by emphasizing three key performance areas: people, planet, and profit, aiming to balance social equity, environmental health, and economic viability. Explore how these accounting approaches redefine business success and long-term value creation.

Why it is important

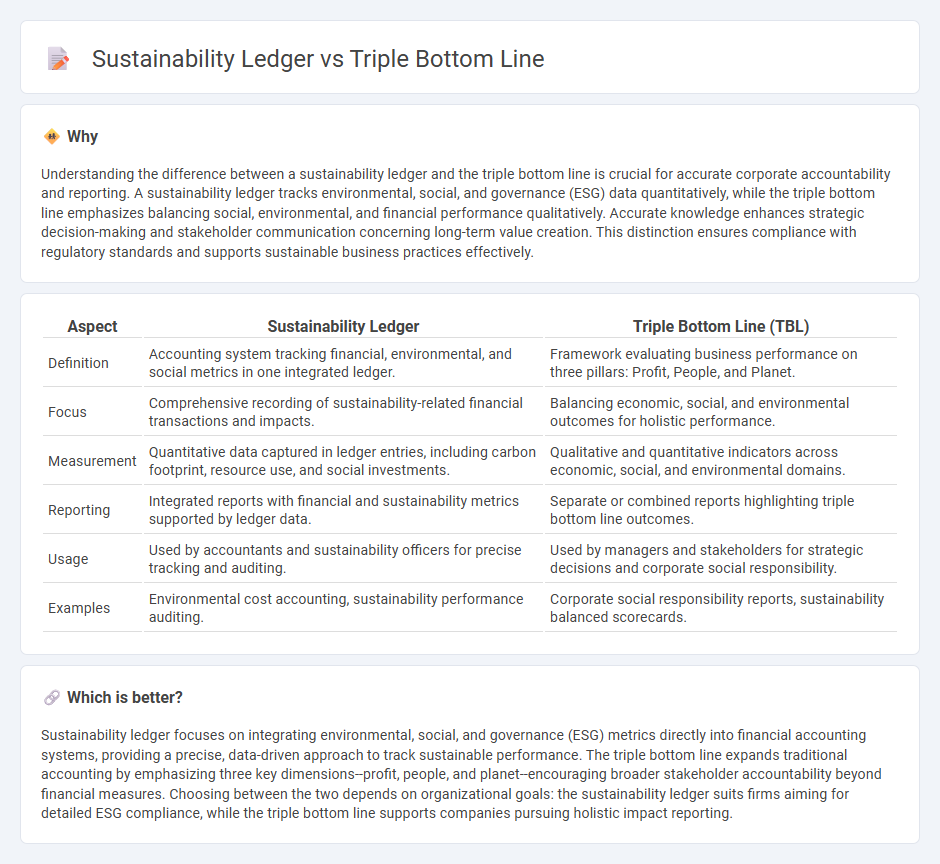

Understanding the difference between a sustainability ledger and the triple bottom line is crucial for accurate corporate accountability and reporting. A sustainability ledger tracks environmental, social, and governance (ESG) data quantitatively, while the triple bottom line emphasizes balancing social, environmental, and financial performance qualitatively. Accurate knowledge enhances strategic decision-making and stakeholder communication concerning long-term value creation. This distinction ensures compliance with regulatory standards and supports sustainable business practices effectively.

Comparison Table

| Aspect | Sustainability Ledger | Triple Bottom Line (TBL) |

|---|---|---|

| Definition | Accounting system tracking financial, environmental, and social metrics in one integrated ledger. | Framework evaluating business performance on three pillars: Profit, People, and Planet. |

| Focus | Comprehensive recording of sustainability-related financial transactions and impacts. | Balancing economic, social, and environmental outcomes for holistic performance. |

| Measurement | Quantitative data captured in ledger entries, including carbon footprint, resource use, and social investments. | Qualitative and quantitative indicators across economic, social, and environmental domains. |

| Reporting | Integrated reports with financial and sustainability metrics supported by ledger data. | Separate or combined reports highlighting triple bottom line outcomes. |

| Usage | Used by accountants and sustainability officers for precise tracking and auditing. | Used by managers and stakeholders for strategic decisions and corporate social responsibility. |

| Examples | Environmental cost accounting, sustainability performance auditing. | Corporate social responsibility reports, sustainability balanced scorecards. |

Which is better?

Sustainability ledger focuses on integrating environmental, social, and governance (ESG) metrics directly into financial accounting systems, providing a precise, data-driven approach to track sustainable performance. The triple bottom line expands traditional accounting by emphasizing three key dimensions--profit, people, and planet--encouraging broader stakeholder accountability beyond financial measures. Choosing between the two depends on organizational goals: the sustainability ledger suits firms aiming for detailed ESG compliance, while the triple bottom line supports companies pursuing holistic impact reporting.

Connection

The sustainability ledger integrates environmental, social, and economic data, aligning closely with the triple bottom line framework that measures corporate performance across people, planet, and profit. This connected approach enhances transparency in accounting by capturing financial and non-financial metrics crucial for sustainable business practices. Businesses utilizing both tools can better assess long-term impacts and drive responsible decision-making.

Key Terms

Social Impact

The triple bottom line framework evaluates organizational performance through social, environmental, and economic lenses, emphasizing tangible social impact metrics like community engagement and employee welfare. The sustainability ledger extends this by integrating detailed data analytics, offering a comprehensive social impact assessment that includes stakeholder feedback and long-term social value creation. Explore how these methodologies transform corporate social responsibility by diving deeper into their social impact strategies.

Environmental Performance

The triple bottom line framework evaluates environmental performance by measuring a company's impact on natural resources, emissions, and ecological conservation alongside social and economic outcomes. In contrast, the sustainability ledger provides a detailed accounting system that tracks environmental metrics such as carbon footprint, water usage, and waste generation over time to ensure transparency and accountability. Explore how these approaches enhance your organization's environmental stewardship and sustainability reporting.

Economic Value

The triple bottom line framework measures economic value alongside social and environmental impacts to provide a holistic view of organizational performance. In contrast, the sustainability ledger emphasizes comprehensive accounting of economic, environmental, and social metrics with granular tracking of resource flows and sustainability outcomes. Explore how these models enhance economic value analysis in sustainable business practices.

Source and External Links

What Is the Triple Bottom Line (TBL)? - IBM - The triple bottom line (TBL) is a sustainability framework focusing on three "P's" (People, Planet, Profit), measuring not just financial performance but also social impact and environmental responsibility to create long-term value for all stakeholders.

Why You Should Pay Attention to the Triple Bottom Line - The TBL concept, coined by John Elkington, encourages businesses to balance profit goals with social equity and environmental care, aiming to meet present needs without compromising future generations' ability to do the same.

Triple bottom line - Wikipedia - The triple bottom line framework evaluates business performance across three dimensions: social (people), environmental (planet), and economic (profit), promoting fair business practices, ecological responsibility, and financial viability--all critical for sustainable development.

dowidth.com

dowidth.com