Continuous close accounting involves real-time transaction recording, enabling up-to-date financial statements and immediate insight into business performance. Periodic close accounting consolidates financial data at specific intervals, such as monthly or quarterly, which can delay visibility but simplifies auditing processes. Explore the differences further to determine the best closing method for your financial operations.

Why it is important

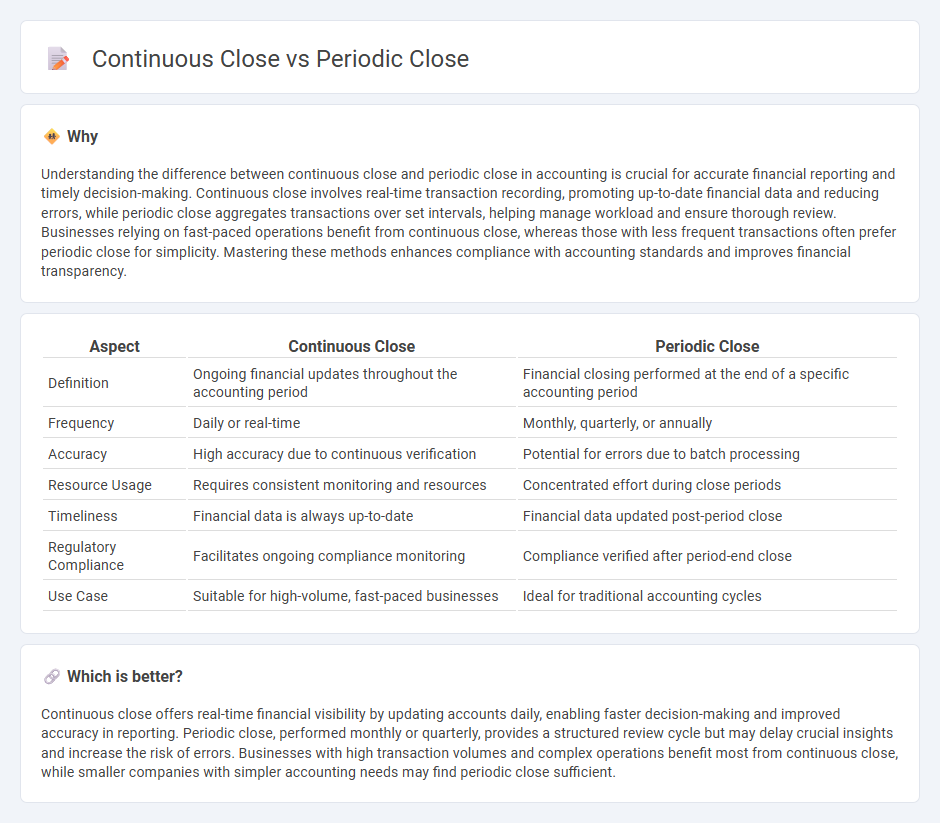

Understanding the difference between continuous close and periodic close in accounting is crucial for accurate financial reporting and timely decision-making. Continuous close involves real-time transaction recording, promoting up-to-date financial data and reducing errors, while periodic close aggregates transactions over set intervals, helping manage workload and ensure thorough review. Businesses relying on fast-paced operations benefit from continuous close, whereas those with less frequent transactions often prefer periodic close for simplicity. Mastering these methods enhances compliance with accounting standards and improves financial transparency.

Comparison Table

| Aspect | Continuous Close | Periodic Close |

|---|---|---|

| Definition | Ongoing financial updates throughout the accounting period | Financial closing performed at the end of a specific accounting period |

| Frequency | Daily or real-time | Monthly, quarterly, or annually |

| Accuracy | High accuracy due to continuous verification | Potential for errors due to batch processing |

| Resource Usage | Requires consistent monitoring and resources | Concentrated effort during close periods |

| Timeliness | Financial data is always up-to-date | Financial data updated post-period close |

| Regulatory Compliance | Facilitates ongoing compliance monitoring | Compliance verified after period-end close |

| Use Case | Suitable for high-volume, fast-paced businesses | Ideal for traditional accounting cycles |

Which is better?

Continuous close offers real-time financial visibility by updating accounts daily, enabling faster decision-making and improved accuracy in reporting. Periodic close, performed monthly or quarterly, provides a structured review cycle but may delay crucial insights and increase the risk of errors. Businesses with high transaction volumes and complex operations benefit most from continuous close, while smaller companies with simpler accounting needs may find periodic close sufficient.

Connection

Continuous close and periodic close are connected through their roles in ensuring accurate and timely financial reporting. Continuous close involves real-time data reconciliation and transaction recording throughout the accounting period, facilitating ongoing financial oversight. Periodic close consolidates this information at specific intervals, such as monthly or quarterly, to produce finalized financial statements and ensure compliance with regulatory standards.

Key Terms

Cut-off Date

The periodic close uses a cut-off date to record and summarize financial transactions within a defined accounting period, ensuring accurate reporting for specific intervals such as monthly or quarterly. Continuous close, however, updates transactions in real-time, reducing the dependency on a strict cut-off date by maintaining up-to-date financial statements. Explore detailed differences and benefits of periodic versus continuous close methods to optimize your financial closing process.

Real-time Reporting

Periodic close involves summarizing financial data at set intervals, such as monthly or quarterly, often leading to delayed insights. Continuous close leverages real-time reporting systems to update financial information instantaneously, ensuring up-to-date accuracy and enhanced decision-making agility. Explore how adopting continuous close can transform your financial reporting efficiency.

Batch Processing

Periodic close aggregates financial data at specific intervals, optimizing batch processing by consolidating transactions in bulk for efficient end-of-period reporting. Continuous close processes transactions in real-time, ensuring up-to-date financial statements and reducing the latency typically associated with batch systems. Explore how these approaches impact financial accuracy and operational efficiency in your organization.

Source and External Links

Understanding Periodic Closing and Reporting for Business Success - Periodic closing is the process of finalizing financial records at regular intervals such as monthly, quarterly, or yearly, ensuring all income, expenses, and adjustments are recorded to provide a clear and accurate financial picture for the business period.

Periodic Closing and Reporting | Financial Close Management - Periodic closing involves reconciling accounts, adjusting entries, and preparing financial statements to finalize financial activities within a specific period and ensure compliance, transparency, and effective decision-making.

Close Period Defined | NetSuite - The close period typically refers to the time between when a company finalizes its financial results and when those results are publicly released, during which companies stop issuing statements to avoid misinterpretation or speculation.

dowidth.com

dowidth.com