Fractional CFOs deliver strategic financial leadership on a scalable basis, providing expertise tailored to specific project needs or business phases. Part-time CFOs typically hold ongoing, recurring responsibilities with a fixed schedule, integrating closely with internal teams to manage daily financial operations. Explore the key differences and advantages to determine which CFO model best suits your company's growth and financial management goals.

Why it is important

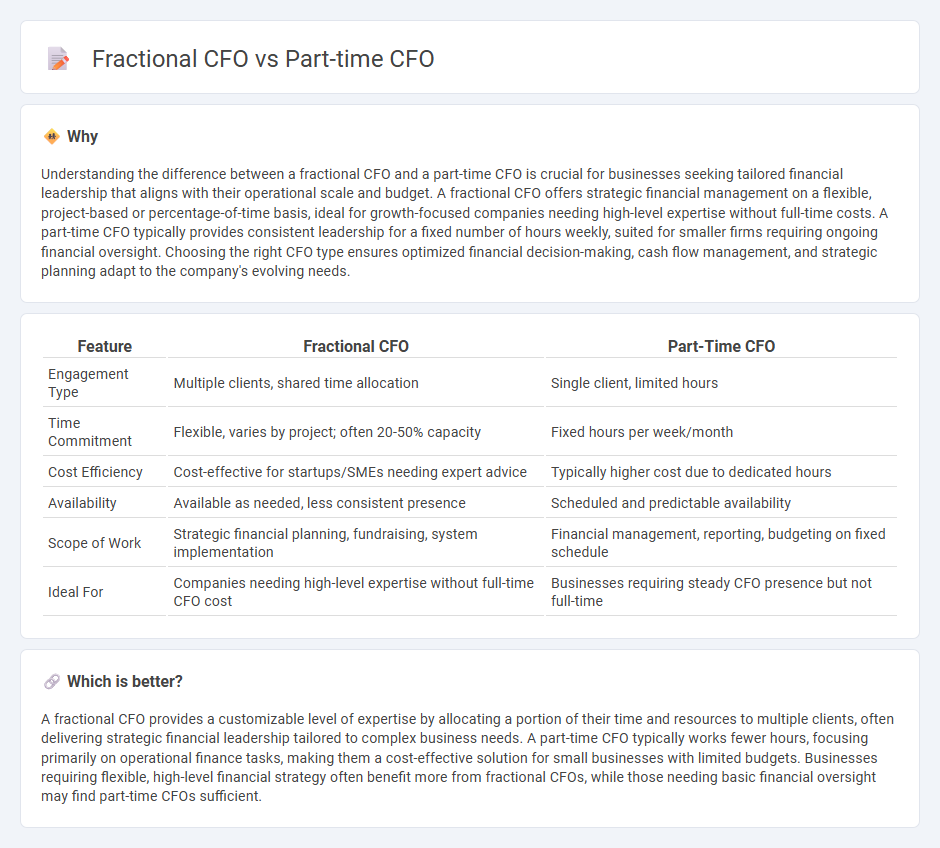

Understanding the difference between a fractional CFO and a part-time CFO is crucial for businesses seeking tailored financial leadership that aligns with their operational scale and budget. A fractional CFO offers strategic financial management on a flexible, project-based or percentage-of-time basis, ideal for growth-focused companies needing high-level expertise without full-time costs. A part-time CFO typically provides consistent leadership for a fixed number of hours weekly, suited for smaller firms requiring ongoing financial oversight. Choosing the right CFO type ensures optimized financial decision-making, cash flow management, and strategic planning adapt to the company's evolving needs.

Comparison Table

| Feature | Fractional CFO | Part-Time CFO |

|---|---|---|

| Engagement Type | Multiple clients, shared time allocation | Single client, limited hours |

| Time Commitment | Flexible, varies by project; often 20-50% capacity | Fixed hours per week/month |

| Cost Efficiency | Cost-effective for startups/SMEs needing expert advice | Typically higher cost due to dedicated hours |

| Availability | Available as needed, less consistent presence | Scheduled and predictable availability |

| Scope of Work | Strategic financial planning, fundraising, system implementation | Financial management, reporting, budgeting on fixed schedule |

| Ideal For | Companies needing high-level expertise without full-time CFO cost | Businesses requiring steady CFO presence but not full-time |

Which is better?

A fractional CFO provides a customizable level of expertise by allocating a portion of their time and resources to multiple clients, often delivering strategic financial leadership tailored to complex business needs. A part-time CFO typically works fewer hours, focusing primarily on operational finance tasks, making them a cost-effective solution for small businesses with limited budgets. Businesses requiring flexible, high-level financial strategy often benefit more from fractional CFOs, while those needing basic financial oversight may find part-time CFOs sufficient.

Connection

Fractional CFOs and part-time CFOs both provide specialized financial leadership on a non-permanent basis, offering businesses flexible access to expert accounting and strategic planning without the cost of a full-time executive. These roles involve overseeing financial reporting, budgeting, and cash flow management to improve business performance and compliance. Companies often opt for fractional or part-time CFOs to leverage high-level financial expertise tailored to their specific growth stages or project needs.

Key Terms

Engagement Model

Part-time CFOs typically engage with organizations on a predetermined, consistent schedule, often working a fixed number of hours per week or month, which allows for steady oversight of financial operations. Fractional CFOs offer a more flexible, project-based engagement model, adjusting their time and involvement based on specific business needs, often providing strategic financial leadership during critical growth or transition periods. Explore the differences further to determine the optimal CFO engagement model for your company's financial strategy.

Scope of Services

Part-time CFOs typically work on a limited schedule, handling specific financial tasks such as budgeting and cash flow management, whereas fractional CFOs provide comprehensive CFO services tailored to meet diverse business needs, including strategic planning, financial reporting, and risk management. Fractional CFOs often engage more deeply in long-term financial strategy and leadership, offering scalable support that adapts as the company grows. Explore more to understand which CFO solution aligns best with your business goals and operational demands.

Cost Structure

Part-time CFOs typically work fewer hours on a fixed schedule, leading to predictable but sometimes higher hourly costs, whereas fractional CFOs provide flexible, project-based services that optimize cost efficiency by aligning expenses with specific business needs. Fractional CFOs often leverage scalable resources and technology, reducing overall financial outlay while maintaining strategic financial leadership. Discover how choosing the right CFO model can transform your cost structure and drive business growth.

Source and External Links

What Is a Part-Time CFO, and Does My Business Need One? - Paro - This article discusses the role of a part-time CFO, also known as a fractional CFO, highlighting the benefits and responsibilities compared to a full-time CFO.

Do You Need a Part-time, Full-time, or Fractional CFO? - This webpage provides guidance on when to hire a part-time, full-time, or fractional CFO, focusing on the needs and benefits for small to mid-sized businesses.

Part Time CFO: What Is It? and How to Become One? - ZipRecruiter - This resource explains what a part-time CFO is, their responsibilities, and how to become one, including the necessary skills and qualifications.

dowidth.com

dowidth.com